Wire transfers are a convenient way to send money from one bank account to another – the only downside is that it’s often expensive to send and receive a wire transfer. If you are sending a wire transfer expect to pay between $15 – $30.

But there are some cheaper ways to send money electronically. I tend to use Zelle or Venmo, which are both free and easy.

If you don’t need the transfer to be “instant,” then an ACH transfer is free and takes just a few days to arrive in the recipient’s bank account.

Table of Contents

How Wire Transfer Fees Work

When one bank sends a wire transfer to another, either bank may charge a fee to the sender and recipient. There are also intermediary banks that process the transfer and they may also charge a fee. As you’ve probably come to expect when it comes to money, every middleman wants a piece of the action.

When we list the fees below, we are only listing the fee charged by that bank. If there are intermediary banks involved, those fees are separate and not included in the table.

Wire Transfer Fees by Financial Institution

Banks will charge you a different fee depending on whether you are receiving or sending a domestic or international wire transfer. With international wire transfers, the fee may be higher if you send it with U.S. dollars because they have to convert it to a foreign currency.

In the table below, we break out domestic vs. international (int’l) wires as well as sending international wires as foreign currency or USD, if the bank differentiates.

N/A means the bank does not do that type of transfer. For example, Capital One 360 doesn’t handle international wire transfers.

Finally, fees are for the basic account. A bank may have lower fees for their higher-tier accounts.

| Bank | Incoming domestic wire | Outgoing domestic wire | Incoming int’l wire | Outgoing int’l wire |

|---|---|---|---|---|

| Ally Bank | $0 | $20 | $0 | N/A |

| Bank of America | $15 | $30 | $16 | $35 sent as foreign currency, $45 USD |

| Capital One 360 | $0 | $30 | N/A | N/A |

| Chase Bank | $15 | $25 | $15 | $5 sent as foreign currency, $40 USD |

| CIT Bank | $0 | $0-$10* | N/A | N/A |

| Citi® | $15 | $25 | $15 | $5 sent as foreign currency, $35 USD |

| Discover Bank | $0 | $30 | $0** | $30 |

| HSBC Bank | $15 | $35 | $15 | $35 |

| PNC Bank | $15 | $30 | $15 | $45 |

| SunTrust Bank | $15 | $25 | $30 | $50 |

| TD Bank | $15 | $30 | $15 | $50 |

| US Bank | $20 | $30 | $25 | $50 |

| Wells Fargo | $15 | $30 | $16 | $35 sent as foreign currency, $45 USD |

* CIT Bank offers free outgoing wire transfers with a current balance of $25,000 or more. It’s $10 if your current balance is below $25,000.

** Discover warns their designated intermediate bank may apply a $20 currency exchange fee.

Best Bank Accounts for Wire Transfers

I don’t send a lot of wire transfers so I never looked to “optimize” my banking to achieve this. But it turns out I did it completely by accident.

Ally Bank is my primary bank and it also happens to allow free incoming domestic or international wire transfers. If I need to receive a wire transfer, which has never actually hasn’t yet happened yet, I would get it sent to my Ally Bank account.

As for outgoing wire transfers, which I have done a few times to make investments, I use my CIT Bank account. If you have a balance above $25,000 then the wire transfers are free. It’s a pretty high bar but they only charge you $10 for the wire transfer if you don’t meet that balance amount. $10 is cheaper than everyone else on the list.

How to Get a Discount on Wire Transfer Fees

There aren’t too many ways to get a discount on the wire transfer fee but sometimes you can get a small discount if you conduct the entire wire transfer process online.

The fee they list on their disclosures is often the one for wire transfers initiated at a bank branch. If you are able to do it online, you can save a few dollars ($5 – $10). Some banks, like Ally Bank, are entirely online so what you see is what you pay.

Alternatives to Wire Transfers

A wire transfer is convenient but expensive – there are alternatives.

If you need to transfer money and are not in a hurry, it’s usually easier to do an ACH transfer. ACH stands for Automated Clearing House and whenever there’s an electronic payment of some kind, it’s probably via ACH. Direct deposit, for example, is done through ACH. Most ACH takes a few days but there’s something known as Same Day ACH, which has a limit of $100,000 (increased earlier this year from $25,000), and functionally feels similar to a wire transfer but is far cheaper. There’s also 1-Day ACH, etc.

99.9% of the time, ACH is fine. So if someone is requesting a wire transfer, see if they will take a plain old electronic transfer.

You can also consider using a money transmitter like Western Union or MoneyGram. With those services, you usually transfer funds pretty quickly as well and you pay a fee that is lower than what banks charge. For MoneyGram, you can send up to $10,000 to someone else in the United States for just $1.99 ($11.99 if you fund the transaction with a credit card) if they accept the money on a debit card.

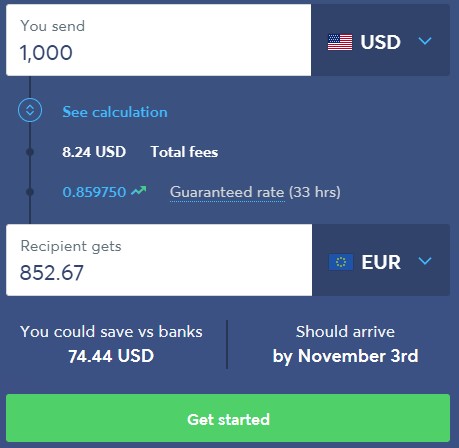

If you are transferring internationally, the cost of the wire transfer goes up considerably. If that’s the case, consider using a third-party service such as Wise. The fees are much lower, you get the real exchange rate (and not some inflated figure that pads the bottom line), and the money gets there quickly. You can send your money to your Wise account via ACH so it limits your fees significantly.

Check out our full review of Wise here.

In the screenshot to the right, the cost of sending $1,000 in USD to someone in the EU in euros is just $8.24.

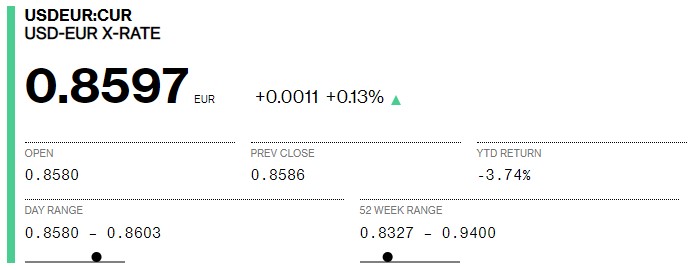

This is the exchange rate as shown on Bloomberg moments later (it fluctuates throughout the day but this is pretty close):

MoneyGram can also send money internationally and there is no “fee” but their exchange rates may not be as high as Wise so the “fee” is built into the exchange. It may be more convenient if you already have MoneyGram all set up.

If you are sending money inside the US, here is a list of several ways to send money to friends.

Wire Transfer Scams

When sending money via wire transfer know that you have almost no protection against fraud. Think of it as giving someone cash. Once the money is sent, it’s nearly impossible to get it back if something goes wrong.

A general rule is to never send a wire transfer to someone you don’t know.

Here are some specific things to watch for:

- A relative calls with an emergency that they don’t want you to tell anyone about

- They change the wire transfer details at the last minute

- You are sent a check for more than what was owed and the sender asks for their change via wire transfer

- A potential landlord wants a wire transfer of fees or security deposit before you’ve seen the rental

- If you are buying something online and the seller only accepts wire transfer

- If you’ve won a prize, or will get a loan, but need to wire transfer some sort of fee first

Here is information from the FTC if you want to know more about this kind of scam.

Summary

Wire transfers are a fast way to send money to someone, but they can be expensive. If you are sending money in the US, look for cheaper alternatives such as Venmo or Zelle. If you are sending money internationally consider a service such as MoneyGram, or Wise.

Also, beware that scammers love wire transfers because once the money is sent it’s very difficult to get it back. So make sure you know who you are sending the money to, always double-check the details with someone you trust.