When Microsoft Money was shut down in 2009, it left a lot of people in a lurch.

A tool you may have been using was now no longer going to be supported, online functionality would be gone (no more automatic updates), and it's only a matter of time before banks stop exporting into Microsoft Money formats (none of my bank accounts supports Microsoft Money now).

But eventually I grew out of both and found one that I think I'll be using for a while.

It's called Personal Capital. (and it's free)

Why Personal Capital

Personal Capital offers all the budgeting and income projecting features of Microsoft Money, Quicken, and Mint – plus powerful investing tools.

When I was first working, budgeting was my primary focus. What am I spending my money on, what am I wasting my money on, and how do I adjust it so I can save more for my future and my retirement.

Eventually, my budget became relatively set. I liked the notifications when I got near my targets each month for my spending categories… but honestly, I knew I was close already.

As I spent less time wondering where I was spending, the more I focused on where I was investing.

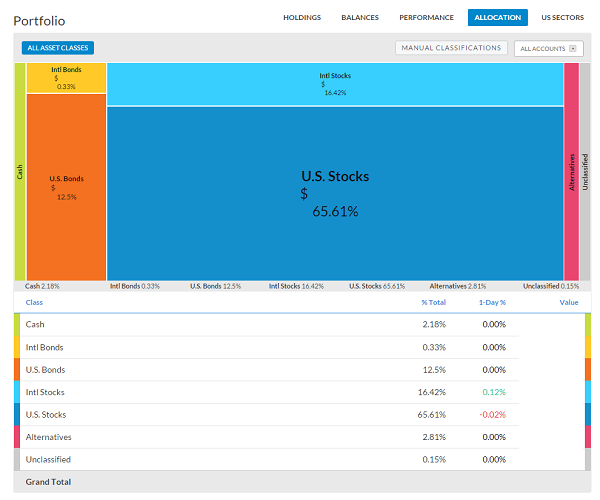

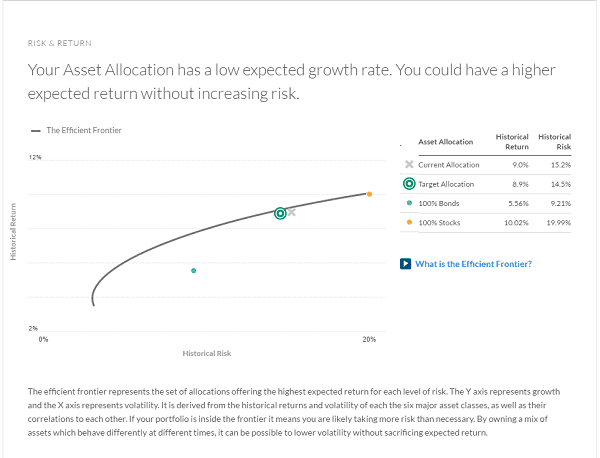

That's when a tool like Personal Capital entered the picture. Personal Capital has the budgeting and expense tracking tools but the primary strength is the investing tools. Being able to pull data from a few brokerages (in my case TradeKing and Vanguard) meant I could see all of my investments on a single screen and updated regularly.

It's hard to see your asset allocation across brokerage accounts. But at a glance I know I'm 65.61% in U.S. stocks and 12.5% in U.S. bonds.

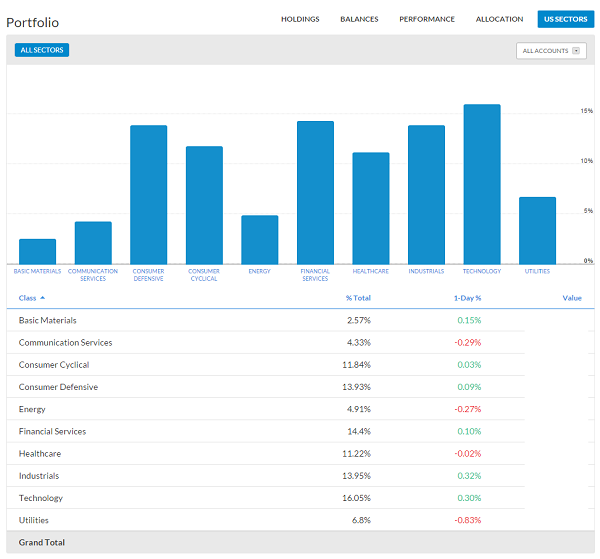

Curious to know what sector's you're in? Yep, you can see that too… in seconds.

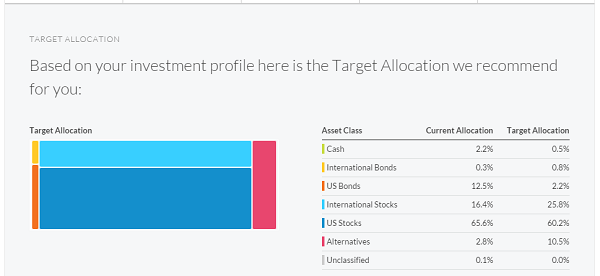

Finally, looking at your investments is great and all but what about some advice? You can get all that – plus expert personalized (one on one phone calls) advice if you really want it.

Why Not Quicken?

Quicken is usually the first tool that comes to mind but it's expensive, has its own support and sync issues, and has no free trial. I switched away from Quicken years ago because the syncing issues just weren't worth the hassle.

If you want to find an alternative to Microsoft Money, and you believe me when I say that Quicken and Mint just don't have the investing chops for growing into the future, you should give Personal Capital a look. It's 100% free.

If you want a more in-depth look at Personal Capital, check out my review.