Benzinga Pro

Strengths

- News and information about the market, industry sectors, and individual stocks provided in real time

- The platform is customizable to fit your own needs and preferences

- Benzinga Pro is provided by one of the top information sources in the investment industry

- Chat feature gives you access to other investors

Weaknesses

- You cannot initiate trades from the Benzinga Pro platform

- Limited charting capability

- No mobile app specifically available for Benzinga Pro

- Tools and features don’t extend to mutual funds and exchange traded funds

If you’re looking for an information service and suite of investment tools to help you earn higher returns from your investing activities, take a close look at Benzinga Pro. It provides real-time information, as well as tools to help you identify upcoming investment opportunities.

It is a subscription-based service, but the increase in investment returns you may experience can easily justify that cost. It’s designed primarily for active traders, including day traders.

Table of Contents

Benzinga is offering a big 25% off discount on their Benzinga Pro subscription.

It’s normally $49 a month but for a limited time they’re dropping it to just $37 a month.

What is Benzinga Pro?

Benzinga Pro is a real-time investment news service designed specifically for active traders. But it goes beyond investment news alone. The platform provides various tools to enable you to track and analyze stocks, including getting detailed information about current and upcoming events as soon as they’re announced.

But just as important, Benzinga Pro also helps you to identify future investment opportunities, whether they represent short-term trades or long-term holds. They do this with a combination of tools that enable you to track the market based on activity with stocks that are in the news.

Benzinga Pro is offered by Benzinga, which has become one of the most active and respected financial news sources in the industry. In fact, the company accurately describes itself as a content ecosystem. The main website, Benzinga.com, was launched in 2010, and already has 25 million monthly readers.

Benzinga rolled out Benzinga Pro specifically to help active investors improve their results.

How Does Benzinga Pro Work?

Benzinga Pro is a subscription-based service, with three different plan levels. You can select the plan that will work best for your investment style and preferences.

Each plan level comes with a specific number of features. You’ll need to choose the plan that best fits your own investment style and future direction.

If you’re a new- or intermediate-level trader, you may want to begin with the Basic plan and work with it until you’re comfortable with it and realize the need for more advanced services. You can then trade up to one of the next two plan levels as the need arises.

Benzinga Pro customer service is available by live chat and email as well as by phone, at 1(877)440-9464.

Benzinga Pro doesn’t have a mobile app but you can access the website with any device, including your mobile phone.

Benzinga Pro Features

Alerts

Alerts provide customizable real-time market news alerts to keep you up-to-date on the latest news and information as it happens. You can set up browser notifications, sound alerts, or email notifications, whichever works best for you.

Calendar

This tool gives you access to more than a dozen calendars, so you can track events in one place. Calendars are available for analysts’ ratings, dividends and earnings announcements, guidance, mergers and acquisitions, retail sales, stock splits, and more.

Chat

Learn to become a better trader by chatting with other members of the Benzinga Pro community. In the Chatroom, you’ll be able to ask questions, share news and information, and learn trading strategies from other investors. It’s open to traders at any level.

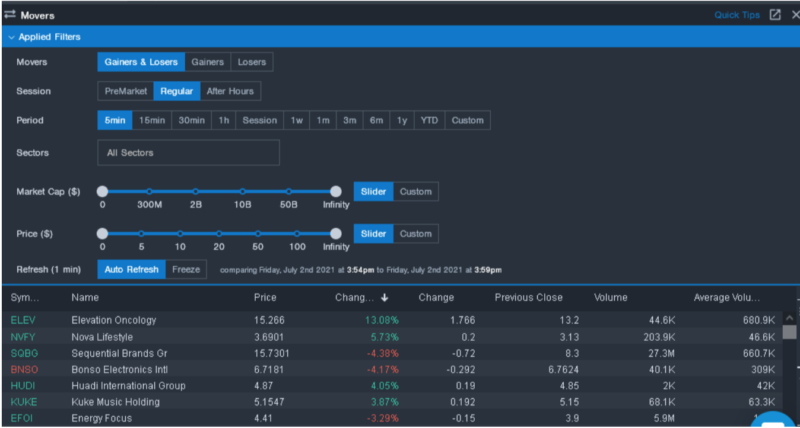

Movers

This tool provides you with an up-to-the-minute list of the biggest winners and losers in the stock market at any time. That will help you to focus news and information surrounding some of the most promising stocks available.

As is typical with all Benzinga Pro tools, you have the option to customize the screen. With Movers, you can set the criteria for gainers and losers, or each individually. You can even set the market capitalization of the stocks you’re interested in, as well as the stock prices, in addition to other variables.

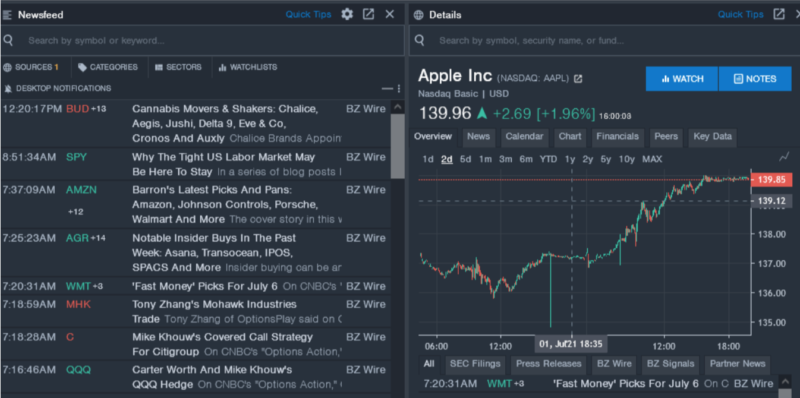

Newsfeed

Get up-to-the-minute news and information to help you become a better trader. This feature also includes Benzinga Pro’s patented price sentiment engine that tells you how likely news is to move a stock up or down.

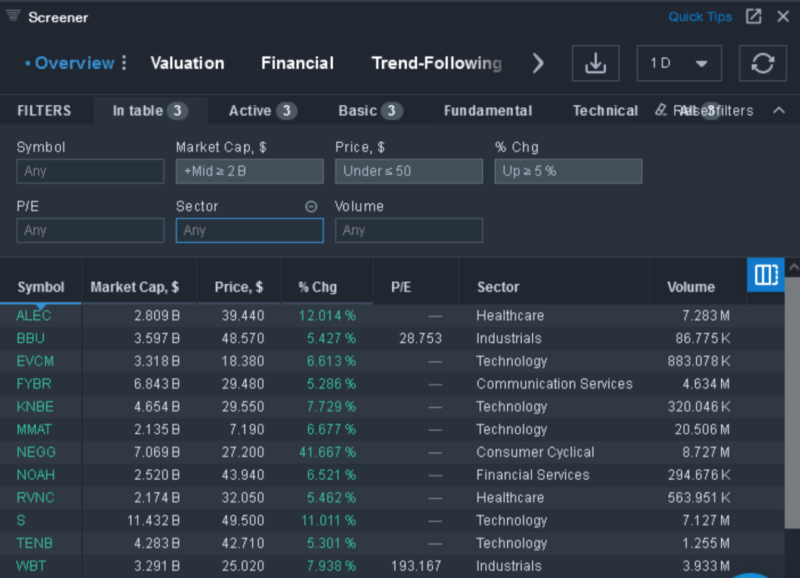

Screener

Search for stocks using a wide variety of criteria to isolate the list of companies you want to invest in. Includes filters like float, margins, simple moving averages, and many more.

As an example of how you can customize Benzinga Pro tools and screens, I set the following criteria to produce the above list of potential stocks to invest in:

- Market Cap: +Mid > $2 billion

- Price: Under $50

- % Change: Up > 5%

For the rest of the filters, I left “Any”, which wasn’t an arbitrary decision. As you might expect, the more filters you add, the fewer results you’ll get. It’s even possible to get no results with too many filters.

I also limited the display criteria so that the screenshot would fit on this page. But you can add dozens of categories, including high and low price and simple moving averages over various intervals, relative strength, dividend yield, and many others.

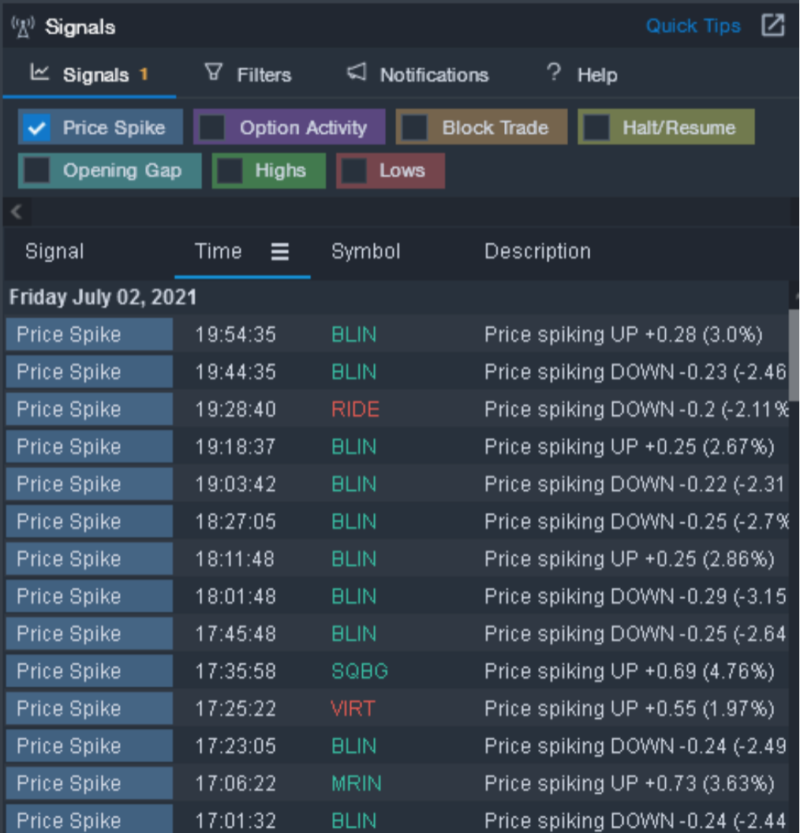

Signals

This tool is designed to spot unusual activity in the market. Available signals include price spikes, stock halt and resume notifications, option activity, opening gap (when a stock opens with a big price change from the previous day), block trades, and highs and lows (you can choose a session, day, or 52-week highs and lows).

Notice that the top bar offers the choice to track activity based on price spikes, option activity, block trades, and other criteria. You can use whichever works best for you, or experiment with several until you can make a clear choice.

Audio Squawk

These are fast audio news broadcasts, providing you with most important stock market news from Benzinga’s news desk monitors.

Watchlist

Keep track of the stocks you choose. You’ll have the ability to track stocks in your own portfolio, as well as monitor potential trades or even entire industries. Watchlist comes with a quick snapshot of how selected stocks are performing. Information is available in real time, including current price and percentage changes, daily high and low, and stock volume.

By clicking on the ticker, you can open the “Details” window, and get even more information about the stocks on your list.

Options

More specifically, this feature is to monitor unusual options activity. It’s available for an additional fee, over and above the subscription fee for your Benzinga Pro plan.

It’s formally known as the Benzinga Pro Unusual Options Activity Signal, and it alerts you to large block trades traded at or near the bid, or option sweeps executed at or near the bid. This information can alert you to the kinds of trades that can indicate an investor is taking a large bullish or bearish bet on a security.

Benzinga Pro Pricing

Benzinga Pro offers three plans, Basic, Essential and Annual Options Mentorship. Each comes with its own features and pricing.

Basic

Basic is Benzinga Pro’s baseline plan. It costs $99 per month, or $79 per month if you pay annually, and comes with the following features:

- NASDAQ basic delayed quotes

- Watchlist Alerts

- Details Tool with key stock stats

- Movers

- Newsfeed access (including Benzinga headlines and articles, press releases, SEC filings and partner content)

- Calendar suite

Essential

For $177 per month, or $117 per month if you pay annually, Essential includes all the features of the Basic plan, but adds the following:

- NASDAQ Basic Real-time Quotes

- Audio Squawk

- Newsdesk Chat

- Sentiment Indicators

- Signals (options activity available for an additional fee)

Annual Options Mentorship

Annual Options Mentorship is designed primarily for options investors. It costs $347 per month, or $281 a month if you pay annually, and it includes all the features of Basic and Essential, plus:

- Trading mentorship and education from leading trader, Nic Chahine

- Access to the Options Inner Circle Chat Room, led by Nic Chahaine

- 6 High-conviction options trades per month, including entry and stop information along with fundamental and technical analysis

- Access to exclusive webinar sessions for ongoing options education

- Regular Market Overview to match Nic Chahaine’s Winning Trading Strategy

Each subscription plan starts with a two-week free trial.

Benzinga Pro Promotion Codes

From time to time, Benzinga will offer a discount off their membership fees. The latest offer was for 50% off your first month, quarter, or year (works for any plan but only for the first billing cycle!) after a two week trial. To get the discount, you had to use the promotion code JULY50 by 7/31/2021.

The discount was pretty substantial (I previously hadn’t seen one nearly that high) so keep an eye out for discounts if you’re considering it.

How to Sign Up with Benzinga Pro

You can sign up for Benzinga Pro directly from the website. You’ll be asked to provide your name, phone number, and email address, then create a password.

You’ll choose which plan you want to sign up for, Basic, Essentials or Annual Options Mentorship. Each comes with a 14-day free trial to give you a chance to test drive the product and see if it works for you.

You will need to put a credit card on file, even though there’s a 14-day free trial. You can cancel anytime within the free trial, but if you choose to continue your credit card information will already be on file, avoiding any disruption in service.

Who Should – and Shouldn’t – Invest with Benzinga Pro

Because of the type of information and tools provided by Benzinga Pro, it’s best used by active traders. This can include day traders and swing traders who are looking for up-to-the-minute news information that can create investment opportunities to generate quick profits.

This service may be best by larger investors as the subscription costs between $948 and $4,164. Newer investors or those with smaller balances may find the subscription costs to be too high.

For example, on a portfolio of $100,000 and below, and subscription cost of $948 is close to 1% of your portfolio. If your portfolio is significantly smaller, the cost of the service may not justify the subscription.

If you aren’t ready to pay nearly $1,000 for stock picking information check out these alternatives, most of which are under $200 per year.

Benzinga Pro may not provide much of an advantage for long-term, buy-and-hold investors. If that describes you, you’re more interested in the longer-term prospects of a company than in the day-to-day news and information that can drive stock prices in the near term.

Benzinga Pro Pros and Cons

Pros

- News and information about the market, industry sectors, and individual stocks provided in real time.

- The platform is customizable to fit your own needs and preferences.

- Three different plan levels are offered to accommodate the largest number of investors.

- The Chat feature will give you the increasingly important social aspect of investing, enabling you to swap information and trading strategies with other investors.

- Benzinga Pro is provided by one of the top information sources in the investment industry.

- Customer service is available by phone, live chat and email.

Cons

- You cannot initiate trades from the Benzinga Pro platform.

- Limited charting capability.

- Though Benzinga has mobile accessibility, there’s no mobile app specifically available for Benzinga Pro.

- Tools and features don’t extend to mutual funds and exchange traded funds. It’s designed primarily for equities.

FAQs

The cost is based on the plan you select. The Basic plan is available for as low as $79 per month if you pay on an annual basis. At the opposite end of the cost scale, Annual Options Mentorship is available at a monthly subscription rate of $347. However, this will be reduced by 19% if you pay the entire cost upfront for a full year.

Essentially, anything you need it to do as an active investor, other than trading directly from the platform. It will provide you with real-time information, as well as the tools necessary to identify new investment opportunities. You can also track stocks, both those in your current portfolio and any you may want to add in the near future.

The most basic capability of the service is providing investment information and news in real time. But you can also set active alerts, based on the criteria you consider to be most important.

From a trading standpoint, the most important features include the Watchlist, Movers, Signal, and Screener tools. Those are the ones you’ll use to track and identify new investment opportunities that can give you a jump on other investors.

Bottom Line

Benzinga Pro is well worth the investment if you are a serious active trader, with a decently sized portfolio that can afford the subscription fee.

The tools and features it provides can provide a competitive advantage, enabling you to execute trades based on up-to-the-minute information and analysis that would take you a significant amount of time to compile yourself.