In our recent post, What is a Self-Directed IRA?, we provided a basic understanding of how self-directed IRAs (SDIRAs) work. In this article, we will present what we believe to be the seven best self-directed IRAs. Or better put, the seven best self-directed IRA custodians.

Much like investment brokers and robo-advisors that act as custodians for regular IRAs, self-directed IRA custodians are there to accommodate this particular type of IRA.

An SDIRA is an IRA in which you can hold alternative assets, particularly physical assets, like gold bullion and real estate. But you can also store other types of assets not permitted in regular IRA accounts. These include tax liens, private equity, oil and gas leases, peer-to-peer loans, and even raw land, among other asset types.

An SDIRA custodian provides a place to park these assets. They neither sell them nor choose which assets you’ll hold. Instead, you – the plan holder – decide where to invest. The custodian will purchase the assets for your plan and keep them until it’s time to sell.

DISCLAIMER: Self-directed IRAs are for experienced investors with knowledge about the asset classes they are investing in. SDIRA custodians don’t provide specific investment advice other than the mechanics of how to hold each asset class in your SDIRA. These are specialized IRAs that have a lot more moving parts and much higher fees than regular IRAs. As such, we are not recommending any of the custodians listed in this guide. Instead, we’re presenting these institutions only as those known to provide such services. Be sure you understand the intricacies of investing through a self-directed IRA, including consulting with an attorney and an investment professional with experience in SDIRAs.

Now, onto the list of the seven best self-directed IRAs.

Table of Contents

The Entrust Group

The Entrust Group is one of the better established SDIRA providers in the industry. Based in Oakland, California, the company began operations in 1982 and currently has $4 billion in assets in custody for 22,000 investors.

The company stands out for the sheer number of asset classes in which you can invest. In addition to real estate, precious metals, and private equity, the platform also supports the following: arcades, art galleries, bowling alleys, cryptocurrency, crowdfunding, improved or unimproved land, life settlements, renewable energy, retirement homes, storage spaces, show horses, and even vineyards.

You can also invest in alternative energy sources, like solar, wind, and water power, as well as biofuels.

However, what the company specializes in are real estate IRAs. You can hold single-family homes, office buildings, and mortgage notes, among other real estate-related investments.

The Entrust Group – Account Features:

- Minimum Investment: No account minimums

- IRAs Supported: Traditional, Roth, SIMPLE and SEP IRAs

- Other Account Types Supported: Coverdell Education Savings Accounts (ESA), Health Savings Accounts (HSAs), and Solo 401(k)s

- Asset Classes Supported: Real estate, precious metals, private equity, other alternative investments.

- Fees: Account establishment fee, $50; transaction fees, from $10; purchase and sale fees, from $95 ($175 for real estate, or $250 for property with non-recourse loans; no transaction fee for precious metals for crowdfunding); annual account recordkeeping fees, $199 per year for a single asset OR $299 per year for 2+ assets AND .15% of your total asset value (up to a maximum of $2,299); account termination processing fee, $250.

- For example, if you have three assets with a total account value of $60,800, your annual recordkeeping fee after the 1st year would be $315 ($299 + .15% of $10,800. The first $50,000 in your account is not charged a .15% fee).

- Checkbook Control: Yes

- Customer Service: Monday through Friday, 8:30 AM to 5:00 PM, plus 24/7 account access through the Entrust Client Portal

- Better Business Bureau Rating: A+

👉 Learn more about The Entrust Group SDIRAs

IRA Financial Group

Starting in 2010 and based in Miami, Florida, IRA Financial Group has expanded to all 50 states. They currently have more than 28,000 clients with over $4.6 billion in alternative asset investments. The company has 67 employees in five states and describes itself as the fastest-growing provider of SDIRAs in the country. They also describe themselves as the only SDIRA custodian that doesn’t charge transaction fees for making investments.

The company offers various services by partnering with third-party providers. For example, Capital One provides banking services. All cash is held with Capital One, which provides FDIC insurance of $250,000 per depositor (though this insurance does not extend to investments made in your plan). And cryptocurrency investing is offered through a partnership with Gemini.

IRA Financial Group – Account Features:

- Minimum Investment: $0 (but must have a credit card on file)

- IRAs Supported: Traditional, Roth, SIMPLE and SEP IRAs

- Other Account Types Supported: Solo 401(k), employer 401(k), Keogh, profit-sharing plan, rollover 403(b), 457(b), or other defined-benefit/cash balance plan, rollover business startup (ROBS) plans.

- Asset Classes Supported: Real estate, cryptocurrency, hedge funds and private equity funds, tax liens and deeds, precious metals, private businesses, and hard money loans.

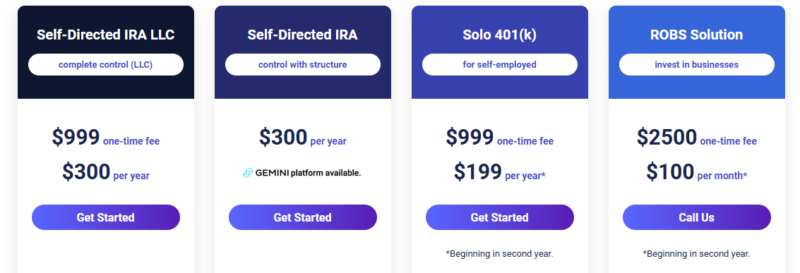

- Fees: No transaction or account management fees; flat fee pricing: see screenshot below.

- Checkbook Control: Yes

- Customer Service: Monday through Friday, 9:00 AM to 7:00 PM, Eastern time

- Better Business Bureau Rating: A+

IRA Financial Group Flat Fee Pricing plans:

Pacific Premier Trust Company

Formerly known as PENSCO, Pacific Premier Trust boasts one of the industry’s most extensive lineups of alternative assets – nearly 42,000 in total. The company claims to be the first alternative asset custodian on the Internet, which it started in 1994. Based in San Francisco, the company opened its doors in 1989. It’s been a wholly-owned subsidiary of the $20 billion Pacific Premier Bank since 2020.

In addition to alternative assets, Pacific Premier Trust Company provides brokerage services for stocks, bonds, mutual funds, certificates of deposit, and other traditional retirement plan assets.

Pacific Premier Trust Company – Account Features:

- Minimum Investment: $1,000, but $5,000 for accounts holding real estate

- IRAs Supported: Traditional, Roth, SIMPLE, SEP, custodial, inherited, and beneficiary IRAs

- Other Account Types Supported: Solo 401(k) and Coverdell Education Savings Accounts (ESAs),

- Asset Classes Supported: Real estate, private equity, promissory notes, offshore funds, precious metals, marketable securities, tax liens, wind farms, peer-to-peer lending, and land and mineral rights

- Fees: Annual fee: $750; administrative fee: 0.30% on the first $1 million, 0.15% on the next $4 million, and 0.10% on balances in excess of $5 million; asset processing services: $175; asset registration fee: $75; account closure fee, $225 plus asset registration

- Checkbook Control: Not indicated, but likely

- Customer Service: Monday through Friday, 7:00 AM to 5:00 PM, Mountain time

- Better Business Bureau Rating: A+

Equity Trust Company

Based in Westlake, Ohio, and founded in 1974, Equity Trust Company is the oldest SDIRA provider on this list. The company claims to be the number one custodian for real estate investors, with over 200,000 properties bought, sold, and funded. It’s also a privately owned company, operating as a regulated South Dakota trust company. An independent third party audits and subjects them to strict account protection policies.

In addition to the usual lineup of real estate, private equity, precious metals, and cryptocurrency, Equity Trust Company also offers oil and gas investments, livestock, agriculture and farmland, mineral rights, show horses, billboard signage, theatrical and movie productions, food trucks, equipment leasing, accounts receivable, royalty interests, and structured settlements, among others.

Equity Trust Company – Account Features:

- Minimum Investment: $500

- IRAs Supported: Traditional, Roth, SIMPLE and SEP IRAs

- Other Account Types Supported: Coverdell education savings accounts (ESAs) and health savings accounts (HSAs), solo 401(k)s

- Asset Classes Supported: Real estate, mortgage notes, promissory notes, peer-to-peer lending, private equity and entities, precious metals, real estate investment trusts (REITs), cryptocurrency, foreign currency, mutual funds, stocks, exchange-traded funds (ETFs), and 100 other possibilities.

- Fees: Application set up fee: $50; annual fee: see table below;

- Checkbook Control: Yes

- Customer Service: Monday through Friday, 9:00 AM to 6:00 PM, Eastern time

- Better Business Bureau Rating: A+

| Portfolio Value | Standard Fee |

|---|---|

| $1 – $14,999 | $205 |

| $15,000 – $24,999 | $290 |

| $25,000 – $49,999 | $330 |

| $50,000 – $99,999 | $400 |

| $100,000 – $199,999 | $480 |

| $200,000 – $299,999 | $660 |

| $300,000 – $399,999 | $470 |

| $400,000 – $499,999 | $1,025 |

| $500,000 – $599,999 | $1,680 |

| $600,000 – $699,999 | $1,785 |

| $700,000 – $799,999 | $1,890 |

| $800,000 – $899,999 | $1,945 |

| $900,000 – $999,999 | $1,995 |

| $1,000,000 – $1,999,999 | $2,050 |

| Over $2,000,000 | $2,150 |

uDirect

uDirect is based in Irvine, California, and has been in business since 2009. They offer broad investment choices without specializing in any specific type. The company emphasizes “learn and earn,” offering webinars so you can best learn how to manage your self-directed IRA. They provide knowledge, tools, and information needed to help you succeed with self-directed investing but do not promote any specific investments.

Kaaren Hall founded the firm – a single mom with more than 20 years in mortgage banking, real estate, and property management experience, including stints at Bank of America and Indymac Bank.

Compared to other SDIRA custodians, uDirect offers lower fees. There is a $50 set-up fee and a $50 annual fee. But beyond that, you’ll be charged only storage fees that run a very reasonable $8 to $18 per month.

uDirect – Account Features:

- Minimum Investment: $325, plus $50 for the set-up fee

- IRAs Supported: Traditional, Roth and SEP IRAs

- Other Account Types Supported: Solo 401(k)s, health savings accounts (HSAs)

- Asset Classes Supported: Commercial real estate, undeveloped land, managed futures, REITs, real estate notes, promissory notes; private limited partnerships, limited liability companies, and C corporations; tax liens, oil and gas, private stock offerings in placements, judgments and structured settlements, gold bullion, car paper, factoring, accounts receivable, and equipment leasing.

- Fees: Annual fee: $50; initial set-up fee: $50; storage fees: see screenshot below

- Checkbook Control: Yes

- Customer Service: Monday through Friday, 8:00 AM to 5:00 PM, Pacific time

- Better Business Bureau Rating: A+

uDirect Storage Fees:

| Asset Value | Gold Only | Silver Only | Both Metals | Currency |

|---|---|---|---|---|

| < $25,000 | $8 / mo | $10 / mo | $10 / mo | $8 / mo |

| ≤ $25,000 | $12 / mo | $18 / mo | $18 / mo | $8 / mo |

Rocket Dollar

Founded in Austin, Texas, in 2018, Rocket Dollar is a relative newcomer to the SDIRA field of custodians. The company offers 24/7 email support, in addition to phone support during regular business hours, something unique in the SDIRA custodial field.

They offer two plans, Core and Gold. The Core plan establishes a limited liability company (LLC) to hold your investments and provide online document storage, checkbook control, email support, and no transfer or rollover fees. There’s no minimum deposit to open this plan.

The Gold plan comes with all the features of the Core plan but also adds expedited service and transfers, four free yearly wire transfers, an account debit card, a custom named LLC, priority support, tax filing for the 1099-R and IRS Form 5500, and Roth IRA conversion assistance if needed. The fees for each plan are listed below.

Rocket Dollar – Account Features:

- Minimum Investment: $0

- IRAs Supported: Traditional and Roth IRAs

- Other Account Types Supported: Solo 401(k)s

- Asset Classes Supported: International investments, precious metals, loans, promissory notes, digital assets and cryptocurrency, real estate, startups, crowdfunding, and stocks and bonds.

- Fees: Core plan: $360 one-time set-up fee, then $15 per month; Gold plan: $600 one time setup fee, then $30 per month

- Checkbook Control: Yes

- Customer Service: 24/7 email support and phone contact, Monday through Friday, 9:00 AM to 4:30 PM, Central time

- Better Business Bureau Rating: Not Rated

AltoIRA

Nashville, Tennessee-based AltoIRA provides alternative investments for your IRA, with a specialization in cryptocurrencies. They make more than 80 cryptocurrencies available through their partnership with Coinbase.

AltoIRA offers two plans, AltoIRA – which comes in Pro and Starter versions – and AltoCryptoIRA.

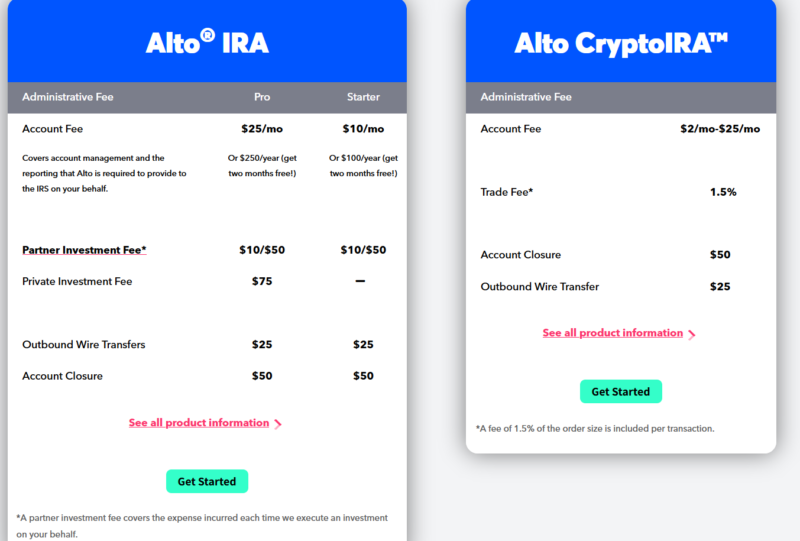

Both AltoIRA versions come with account set-up, account funding, tax reporting, e-statement delivery, and Roth conversion free of charge. Apart from that, the main difference between the two versions is the fee structure. For the Starter version, there’s a monthly account fee of $10, or $100 if you pay a full year in advance.

The monthly account fee is $25, or $250 if you pay the Pro version a full year in advance.

Both plans have a private investment fee of $10 or $50 each time you execute a trade (the price is $10 if investments are bought and sold through preferred partners and $50 with other partners). Otherwise, there’s a $75 private investment fee with the Pro plan.

Alto CryptoIRA comes with the same services offered by AltoIRA. You’ll pay a monthly fee ranging from $2 to $25 and a trade fee of 1.5%.

AltoIRA – Account Features:

- Minimum Investment: $0

- IRAs Supported: Traditional, Roth and SEP IRAs

- Other Account Types Supported: Not indicated

- Asset Classes Supported: Cryptocurrency, and any other asset class not prohibited by the IRS

- Fees: See screenshot below

- Checkbook Control: No

- Customer Service: Email only; phone contact is not indicated

- Better Business Bureau Rating: Not Rated

AltoIRA Fee Schedule:

Is a Self-Directed IRA Right for Me?

If you’re shopping for a self-directed IRA, you’ll need to be very careful in choosing the proper custodian. SDIRA custodians are small companies and hardly household names. And while there are certain practices standard across the industry, they can vary from one company to another, and they’re entirely unfamiliar to an investor who has never worked with one.

We highlighted the companies in this guide because they are among the largest and best established SDIRA custodians in existence. Five of the seven have a rating of A+ from the Better Business Bureau. That provides a good barometer of the customer experience with each.

Even so, do a deeper investigation of any of these companies or any others you are considering. You can start the process by doing a FINRA broker check. When you do, determine if there are any complaints filed against the company or disciplinary actions past or pending.

You should also check with the Secretary of State where you live and where the custodian is domiciled.

You can do this online, and it will indicate if the company is in good standing with the Secretary of State or any disciplinary actions against the company.

But beyond the custodian, make sure you’re entirely comfortable with the process of self-directed investing in alternative assets. It’s much more complicated than investing through a regular retirement plan.