Writing a paper check or using paper money to pay a bill or give money to a friend is becoming less common.

Instead, digital wallet apps are becoming the preferred way to transfer money. As one of the oldest digital wallet apps, PayPal has a high trust factor and an extensive suite of options for sending money to almost anyone.

To send money you simply search for the email address or phone number of the person you want to pay. Select the recipient, enter the payment amount, and send. If you use the “sending to a friend” feature and use your PayPal balance or linked bank account neither you nor the recipient will pay a fee (if sending in the US).

Table of Contents

- Who Can Send Money on PayPal?

- PayPal Fees for Sending Money

- How Do I Send Money on PayPal?

- Step 1: Create a PayPal Account or Log In

- Step 2: Click “Send Money”

- Step 3: Enter the Recipient’s Email or Phone Number

- Step 4: Enter Transfer Amount

- Step 5: Choose Funding Source

- Step 6: Choose “Sending to a friend”

- How to Send Money on PayPal Without a Fee

- How to Send Money on PayPal Internationally

- Can You Send Money on PayPal Without an Account?

- Is Sending Money with PayPal Safe?

- Other PayPal Features

- Summary

Who Can Send Money on PayPal?

Almost any adult in the world can open a PayPal account to send or receive money. United States residents must be at least 18 years old – or the age of majority for their state.

You might be using PayPal to lend money to friends, cover a surprise bill, or pay for last night’s dinner. PayPal doesn’t require it, but you can leave a note telling your friend why you’re sending money.

PayPal Fees for Sending Money

Having a PayPal account is free but several factors determine if there are any fees for sending money.

PayPal might charge three different fees when sending money:

- Funding fee

- Transaction fee

- Currency conversion fee

You might only pay a funding fee when sending money to others within the United States. Each international transaction has a transaction fee and may also have a funding fee and a currency conversion fee.

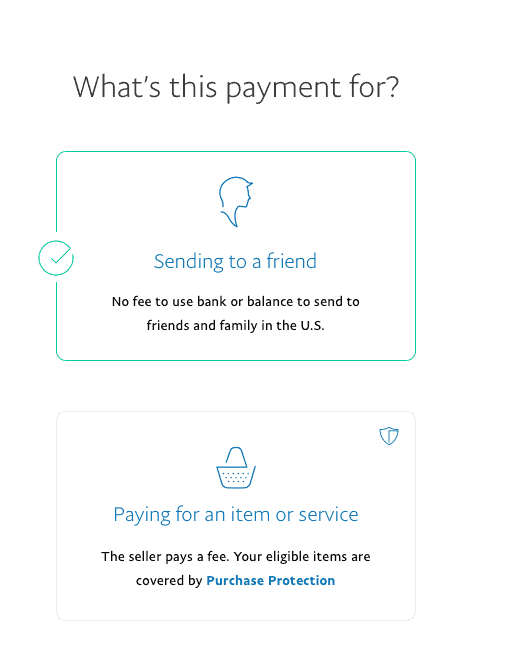

Sending to a Friend vs. Paying for an Item or Service

Whether you or the recipient pays any fees when you send money on PayPal depends on which payment setting you choose.

Below are the two different PayPal types of payment and who pays the fee:

- Paying for an item or service: Recipient pays a fee but the sender doesn’t

- Sending to a friend: The recipient doesn’t pay a fee but the sender will unless they using their PayPal balance or a linked checking account.

You can select the payment setting when you’re setting up your transfer.

“Paying for an item or service” is the default payment setting for PayPal transfers as many businesses use PayPal to sell goods and services. The sender gets purchase protections and pays no fees. However, the recipient pays a merchant fee for US and international payments.

Here are the current merchant fees that the recipient might pay:

- Sales within the US: 9% plus $0.30

- International sales: 4% plus a fixed fee for the currency received

So your friend or family member doesn’t have to pay a fee, you will need to switch the payment setting to “Sending to a friend.” The recipient doesn’t pay a fee but the sender might depend on how they fund the transfer and which country the recipient lives.

Sending Money to a Friend Fees

When sending money within the United States, PayPal only charges a funding fee. The good news is that you can avoid this fee by using your PayPal balance or a linked bank account to fund the transaction.

Below are the funding fees for domestic PayPal transfers:

- PayPal balance or a linked bank account: Free

- Credit card, debit card, or PayPal Credit: 2.9%

For instance, you pay a $1.50 funding fee to send $50 by funding your transfer with a credit card. But you pay no fees by using your current PayPal balance or a bank account.

Sending money overseas will incur a transaction fee and you may also pay a funding fee and a currency conversion fee. The recipient won’t pay any fees.

PayPal charges the sender these fees on international transfers:

- Transaction fee: 5% of the send amount

- Minimum of $0.99 and up to $4.99

- Funding fee: 2.9% for credit card, debit card and PayPal credit

- $0 if using a PayPal balance or a linked bank account

- Currency conversion fee: Varies by currency

Sending $50 US dollars to someone overseas using your checking account means you pay at least 99 cents in fees. If PayPal doesn’t meet your needs there are other money sending apps you can check out.

Here is the PayPal Fee Schedule for the current foreign currency charges.

How Do I Send Money on PayPal?

PayPal makes it easy to send money using their online website or mobile app. Here is a step-by-step guide to sending money on PayPal to friends and family.

Step 1: Create a PayPal Account or Log In

First, you will need to create a PayPal account – if you don’t have one already. Making one is free and only takes a few minutes.

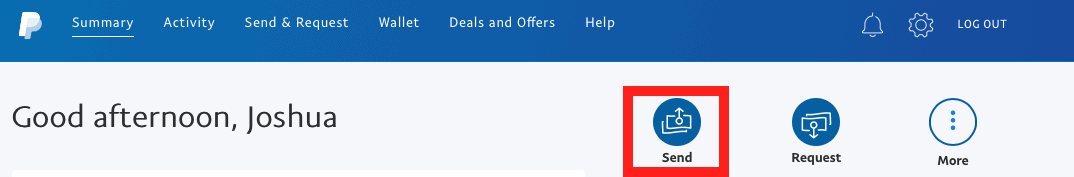

Step 2: Click “Send Money”

After logging in, tap the “Send” button or head to the Send & Request menu.

Step 3: Enter the Recipient’s Email or Phone Number

PayPal only requires the email address or phone number of the person receiving the cash. You can also search the PayPal database to find your recipient’s account as well.

If the person you’re sending money to doesn’t have a PayPal account, they can create one to receive their funds. PayPal will send them a notification after you initiate the transfer.

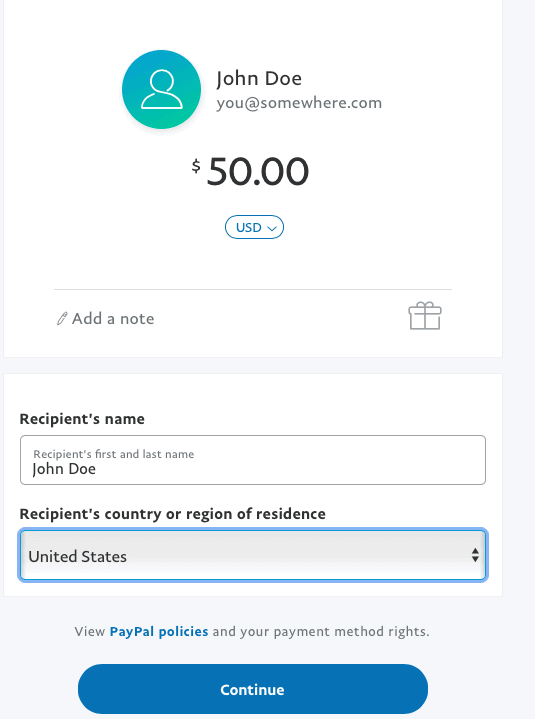

Step 4: Enter Transfer Amount

The next step is telling PayPal how much money you want to send. If the person doesn’t have a PayPal account, you will need to enter their name and country of residence.

Step 5: Choose Funding Source

PayPal will ask how you want to fund your transfer. Your options include any current PayPal and your linked bank account or payment cards. PayPal displays any sending money fees you will pay for either funding option.

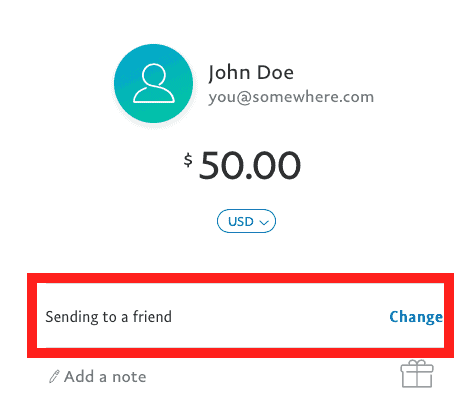

Step 6: Choose “Sending to a friend”

The final step is confirming that your payment setting is “Sending to a friend.” If the payment setting says “Paying for an item or service,” click the Change link to switch the setting.

PayPal will update the fees you pay as you change the setting. Once everything looks correct, you can tap the “Send Payment Now” button and your friend gets their cash.

How to Send Money on PayPal Without a Fee

The only way for the sender and recipient to avoid paying a PayPal fee is by choosing a “Sending to a friend” payment. The sender will need to fund the transfer from their PayPal balance or a linked bank account.

If the recipient starts a Money Pool to a split a purchase, you only encounter a fee if you pay your share with a credit card, debit card, or PayPal credit.

Regardless of how you fund your transfer, you won’t pay a fee to send money if the payment setting is “Paying for an item or service.” However, your friend will pay a transaction fee.

How to Send Money on PayPal Internationally

PayPal offers a couple of ways to send money overseas using your PayPal account.

Sending to a Friend

The easiest option can be sending money to the phone number or email address of a friend. Select the “Sending to a friend” option to help your friend avoid transaction fees.

You can choose the currency and destination country to calculate your fees and the exchange rate to see how much money your friend will receive.

Xoom

PayPal also owns Xoom, an international money transfer app that you can access directly from PayPal. It’s possible to send money to over 130 countries and your friend doesn’t need a PayPal account.

It’s possible to send money directly to a bank account in over 90 countries. You can also arrange a cash pick up in more than 110 countries.

The fees vary by destination, funding source, and delivery option. These fees for the sender will cost more than sending money on PayPal as a family and friends transfer.

Can You Send Money on PayPal Without an Account?

In most cases, you need a PayPal account to send money on PayPal. The recipient will need to create a PayPal account to receive their funds and transfer to a bank account.

Of course, there is one exception to this policy. The recipient can send an invoice or money request to you to pay by sending you a payment link. You don’t need to open a PayPal account to pay but you will need to use a credit card or debit card.

The invoicing option is different than a PayPal.Me link that requires a PayPal account. If your friend shares their PayPal.Me link, you can send money directly to them.

Is Sending Money with PayPal Safe?

Yes, sending money using PayPal can be as safe as using another digital wallet.

To protect your privacy, only send money to people and email addresses that you know and trust. The person receiving your money can see your name and email address.

If making a purchase, be sure to choose the “Paying for an item or service” payment setting to get buyer protection benefits. If you have a purchase problem, you can dispute the transaction and potentially get a refund.

PayPal offers fraud protection benefits as well. If someone hacks into your PayPal account and goes on a spending spree, PayPal can reimburse the stolen funds.

Other PayPal Features

Here are several PayPal features that you might be interested in.

Money Pools

PayPal makes it easy to split large purchases between friends and family. The person creating the pool can share the link using email, text, and social media.

There are no fees when you contribute to a money pool using a PayPal balance or bank account. Credit card, debit card, and PayPal Credit payments incur a 2.9% funding fee.

Check Cashing

The PayPal mobile app lets you cash preprinted payroll and government checks between $5 and $5,000. There are no fees if you’re willing to wait ten days to receive your funds. You pay a 1% fee to access your funds within minutes.

You can also cash handwritten checks, money orders, and other printed checks but you pay a 5% instant cash fee ($5 minimum charge). Waiting ten days to receive your funds lets you avoid the check-cashing fee.

Online Shopping

You might see a PayPal payment option for many online stores. But you can also earn cash rewards by visiting the “Deals and Offers” section in your PayPal account. The offers are not as plentiful as most cashback rebate sites, but you might find a deal you can’t refuse.

PayPal QR Codes

One of PayPal’s newest features are QR Codes. You can scan a merchant’s QR code for local purchases using your phone to pay with PayPal.

Rewards Credit Card

PayPal offers two rewards credit cards through Synchrony Bank.

The PayPal Cashback Mastercard is a cash rewards credit card that earns 2% back on all purchases and doesn’t have a foreign transaction fee. But this may or may not be the best card for you – here is a list of the best cash back credit cards.

If you prefer flexible redemption options, consider the PayPal Extras Mastercard. You earn up to three points per $1 on purchases. You can redeem your points for gift cards, award travel or cash deposits into your PayPal account.

Summary

It’s effortless to send money on PayPal to friends in the US and across the world. It’s possible to not pay any fees by using the “sending to a friend” feature and you use a PayPal balance or a linked bank account.