Investment research websites are essential for anyone who wants to trade individual stocks. But while many investing apps offer bullish/bearish analyst consensus, you usually can’t see the individual ratings or compare a specific analyst’s rating history to the stock’s performance.

TipRanks offers a unique set of tools that can help you view professional analyst ratings and gauge investor sentiment. These research features can be a welcome addition to your preferred fundamental and technical indicators.This TipRanks review looks at the free and premium tools available.

Table of Contents

- What is TipRanks?

- Pricing & Offer

- How Does TipRanks Work?

- Stock Screener

- Smart Scores

- Analyst Ratings

- Top Experts

- Stock Alerts

- Charting Tools

- Insider Trading

- News Sentiment

- Crowd Wisdom

- Website Traffic

- Calendars

- Smart Portfolio

- Education Center

- Mobile App

- TipRanks Pros and Cons

- Is TipRanks Legit?

- Alternatives to TipRanks

- FAQs

- The Bottom Line on TipRanks

What is TipRanks?

TipRanks compiles and ranks the buy, hold, and sell ratings from over 4,600 stock analysts for just about every publicly-traded stock on the US stock market. In addition, you can view the rating history by analysts.

Some tools can help you gauge investor sentiment, perform basic financial research, and track your portfolio performance in a single platform.

The platform can help you quickly see what the “smart money” (analysts) and “dumb money” (traders) think about stocks. This information can also be more reliable than browsing websites like StockTwits, Twitter, or waiting for the weekly AAII Investor Sentiment Survey. TipRanks offers a free tier as well as a premium plans for deeper analysis and data.

Who Should Use TipRanks?

You can benefit from this service if you regularly use third-party analyst ratings when researching stocks. The service can also be helpful for trend investing as you can see which stocks that financial bloggers and the most popular company websites that consumers are visiting.

Pricing & Offer

TipRanks has a free plan and two paid plans for data-hungry investors. A 30-day moneyback guarantee applies to both paid versions.

Let’s take a closer look at the key features of each one:

TipRanks Basic

The free Basic plan offers these limited stock research tools:

- Stock screener

- Charting tools

- Follow one analyst

- Insider transactions

- Website traffic

- Portfolio analyzer

- Email alerts for up to five stocks

This plan is best if you’re a casual investor that may only make a handful of trades a year or quarter. It can also help you try the platform for free and decide if upgrading to a premium plan is worth it.

TipRanks Premium

TipRanks Premium plan costs $29.95 monthly when billed annually ($360 upfront) and lets you use most features without limitation.

Some of the best benefits include:

- Follow up to five analysts

- Analyst ratings and price targets

- Hedge fund activity

- Similar stocks

- Stock scores (i.e., Outperform, neutral, or underperform)

- Email alerts for up to 30 stocks

- Export data by PDF

A paid membership lets you spot trends and get an in-depth look at the analyst ratings.

TipRanks Ultimate

The top-tier Ultimate plan costs $49.95 monthly with an annual membership of $600.

You get full access to this stock research website and unlock these features:

- Track unlimited analysts

- See expert rankings

- View stock risk factors

- Manage multiple portfolios

- Unlimited email alerts

- Export data by PDF or CSV

Consider this plan if you want the most help looking for investment ideas with the screening and research tools.

How Does TipRanks Work?

Here are the core features (with screenshots) that TipRanks offers its users.

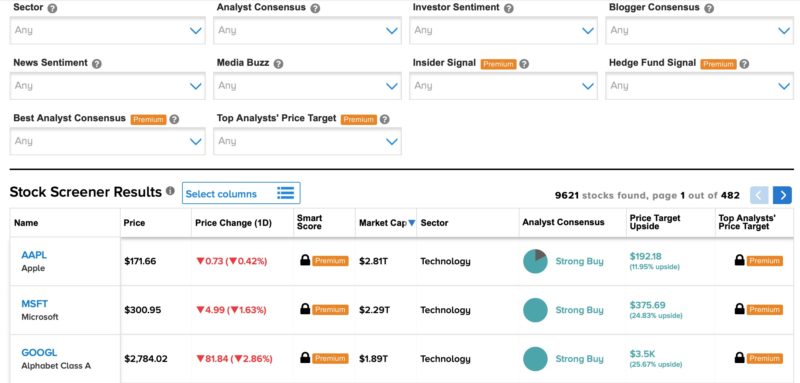

Stock Screener

The stock screener offers a different set of filters than most competitors. For example, instead of emphasizing specific fundamental and financial metrics, you can search for stocks by analyst rating.

Some of the filters include:

- Analyst consensus

- Blogger consensus

- Investor sentiment

- News and media sentiment

- Price target

Once you narrow down your list of potential investments, you can compare multiple stocks in one screen for their analyst rating, price target, smart score, and other indicators.

Smart Scores

Many research platforms and full-service online brokerages have an in-house scoring system to rank stocks and funds. The TipRanks Smart Score judges stocks on eight criteria:

- Wall Street analyst ratings

- Corporate insider transactions

- Financial blogger opinions

- Individual investor sentiment

- Hedge fund manager activity

- News sentiment

- Technicals

- Fundamentals

The 10-point scoring system determines the potential for a stock to outperform the S&P 500. This feature is exclusive to paid members.

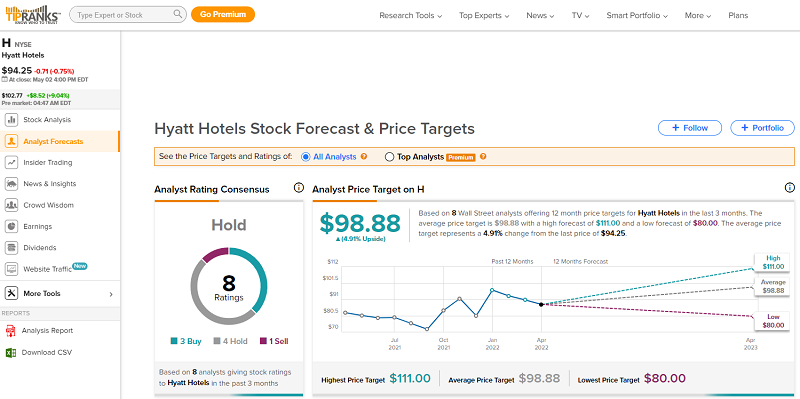

Analyst Ratings

The detailed analyst ratings help distinguish TipRanks from other stock research websites. You can see the research from over 5,550 analysts.

It’s possible to read the accompanying research reports and follow your favorite analysts.

In addition to TipRank’s hands-on guidance, you can see the overall consensus and price target range. However, if you’re an experienced researcher, you know how difficult it can be to find trustworthy analysis and not blindly follow the recommendation from a research firm. This tool can help you avoid the noise and see the opinions of the most knowledgeable ones first.

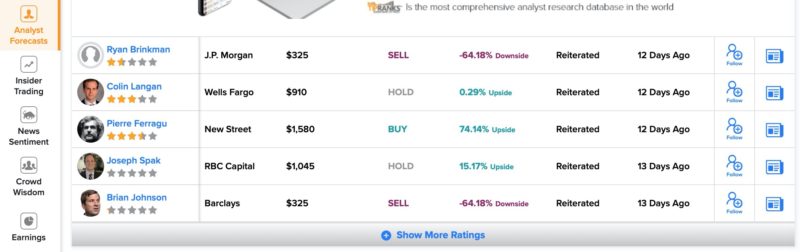

Top Experts

You can see opinions and recent trades from a variety of investment research outlets:

- Wall Street analysts

- Hedge funds

- Financial bloggers

- Individual investors

To help you avoid lousy investment guidance, TipRanks assigns a Star Ranking for each contributor. The three ranking factors are:

- Success rate: How often a rating or transaction outperforms the S&P 500 or a respective sector ETF over one year.

- Average investment return: The average return of ratings and transactions to its benchmark.

- Analysis frequency: Analysts making more recommendations are more likely to get a higher star rating as there is more data to compare.

You may choose this feature when looking for investment ideas before diving deeper into a single stock.

Stock Alerts

Depending on your membership plan, you can receive email alerts for five, 30, or unlimited stocks. In addition, you can expect up to three email alerts per day for the stocks on your watchlist as TipRanks publishes new analyst ratings and the company reports financial news.

Charting Tools

The charting tools are sufficient for most investors. The default chart when analyzing a stock is the historical price performance.

However, the free advanced charts integrate TradingView for upper and lower technical indicators. You can also use the platform’s drawing tools and compare multiple stocks on the same chart.

Insider Trading

Seeing whether executive leadership is buying or selling can also help you decide if the company has an optimistic or pessimistic near-term future.

Paid members can view the five most recent trades and unlock tools that can make it easier to calculate insider sentiment.

News Sentiment

Being able to quickly see what the media is saying about a particular stock and whether it’s bullish or bearish is unique.

You can compare the current weekly ratings to the stock sector for your research company. It’s also possible to compare the historical share price to the news sentiment.

You can also read the latest bullish and bearish articles from the leading investment sites. Specialty investors can also find focused content for dividend stocks and penny stocks.

Crowd Wisdom

It’s also possible to see what retail investors are saying about stocks. The service tracks the success rate and average return on prior recommendations of its contributors so you can decide which projections are more likely to come to fruition.

While following the “dumb money” (i.e., non-professional investors) might be today’s equivalent of taking stock tips from a shoeshine boy, this feature can help you decide if a stock has a cult following and may rise. Or if it’s falling out of favor and will potentially plummet.

Website Traffic

Viewing the website traffic metrics can help you spot trends between ascending or descending page visits and share price. A notable change in traffic patterns and scanning the latest market news can help you identify a potential trade.

In addition to looking at the traffic for a specific stock, the platform lets you view the companies with the fastest rates of ascending or descending page visits.

Calendars

You can see these calendars for pivotal stock market events:

- Earnings

- Dividend

- IPO

- Stock market holidays

Viewing all of this information in one place is handy as your brokerage may not offer these planning features that can benefit short-term traders.

Dividend-focused investors may also appreciate that the dividend calculator can also estimate your dividend income over time.

The platform also offers a daily dividend digest to send daily email updates about new dividend announcements and ex-dividend dates.

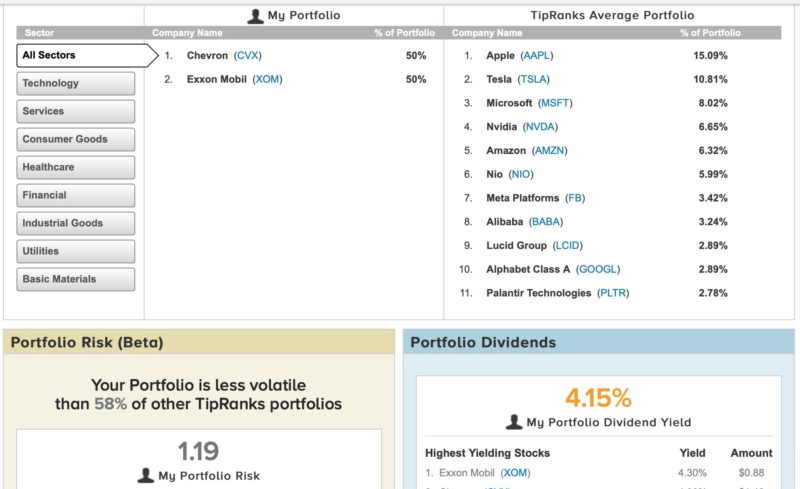

Smart Portfolio

The Smart Portfolio feature lets you track your current investments. You can import your portfolio from most brokerages or manually input positions.

You can see the overall analyst consensus for each holding.

Paid plans can unlock these features:

- Analyze your asset allocation, volatility, dividends, and P/E ratio

- View fund management fees

- Compare portfolio performance to other TipRanks investors

These portfolio tracking tools are similar to Empower Personal Dashboard. However, it can be easier to keep up with the latest company-specific news and analyst ratings.

The “community investing” approach is also unique as you can see how your investment selection compares to the average user. For example, you can see the average allocation for a stock by industry or a fund.

Education Center

With so many research tools that you won’t find on other platforms, the education center helps you learn how to leverage the features. This service is easy to use, but reading these guides can show you everything TipRanks offers.

Mobile App

An Android and Apple mobile app is available and user-friendly when you research stocks from your phone or tablet.

This service provides a lot of data, and you may appreciate using the desktop website for a larger screen. However, the layout is clean and better than most stock screeners and brokerage investing tools, no matter how you access the platform.

TipRanks Pros and Cons

Here is a closer look at the strengths and weaknesses of TipRanks.

Pros

- Many data-driven research tools

- Smart Scores makes screening stocks quicker

- Easily track professional analysts

- Can receive daily alerts for stocks and analysts

- Easy to use platform

Cons

- The free plan has limited features

- No monthly payment options

- Fundamental and technical analysis tools are secondary features

Is TipRanks Legit?

Yes, TipRanks is a credible stock research app that provides abundant data for most individual stocks. As a result, the company has a 4.5 out of 5 Trustpilot score, and it also has positive customer ratings on Google Play and the Apple App Store.

The Smart Scores and Star Rankings systems can help you find the best research. The alternative is sifting through many opinions and hoping you pick the correct one.

This service is one of the easiest ways for individual investors to see what the Wall Street professionals are thinking. Like any service, it’s essential to perform your due diligence and visit the company’s homepage and explore some of the analyst claims and news reports in-depth to decide if you fall in the bullish or bearish camp.

Alternatives to TipRanks

TipRanks has a lot to offer, but depending upon what you’re looking for in an investment research website, you may prefer one of the following TipRanks alternatives.

Seeking Alpha

Seeking Alpha has many similar research features but can be better if you prefer reading bullish and bearish stock reports. The research articles also cover funds and the general stock market. Most of this research comes from the 7,000 contributors, but you can also see Wall Street ratings.

This service also has an impressive stock screener for long-term and short-term investment ideas. Its Quant Ratings and Factor Grades can help you score stocks and funds by metrics like momentum, profitability, and growth to assign a buy or sell rating. These ratings can emphasize fundamentals instead of analyst research like the TipRanks Smart Score.

While you can get limited access for free, a paid plan is necessary to research more than one or two stocks a month. However, monthly plans are available if you only want to upgrade temporarily.

Read our Seeking Alpha review to compare its research tools.

💵 Seeking Alpha Premium Spring Sale – 25% Off

Seeking Alpha offers a 7-day free trial for Seeking Alpha Premium so you can see whether it’s right for you. If it is, the regular price is $239 for an entire year and now you can get 25% off – making it just $179 for the year.

If you don’t like it, you can always downgrade to the Basic plan and still use all the portfolios, screeners, and research you’ve done without paying the premium fee.

The trial is a great way to test-drive Seeking Alpha Premium.

👉 Get the Seeking Alpha Premium 7-Day Free Trial

(Offer expires April 3rd, 2024)

Motley Fool

Motley Fool offers free and premium research content for US stocks and ETFs. They publish several free articles daily about specific companies and investment themes.

The free content is a good starting point; however, you will need to upgrade to Motley Fool Stock Advisor ($99 for the first year and then $199/year) to receive hands-on investment ideas. This service provides two stock picks each month with a detailed write-up. You also receive weekly updates about the best active recommendations to buy now from the model portfolio.

*Billed annually. Introductory price for the first year for new members only. First year bills at $99 and renews at $199.

Unfortunately, this service doesn’t offer an in-depth stock screener or charting tools for stocks excluded from the model portfolio.

Read our Motley Fool Stock Advisor review to learn more.

Morningstar

Morningstar is a well-known research service for mutual funds and ETFs. There are also Morningstar ratings for individual stocks, research reports, and stock market commentary.

This service is best for researching stocks and funds from a fundamental perspective. You’re also less likely to be overwhelmed with commentary from individual investors as you only receive research from the Morningstar team.

Read our Morningstar Investor review to find out more.

Zacks

Zacks Investment Research offers free and paid tools.

One of the best features is the free Zacks Rank scoring system. This score estimates how likely a stock can outperform the S&P 500 in the near term.

Long-term investors can also access the Focus List, which has 50 recommendations.

You can also read analyst research reports and use the stock screener to find investment ideas with a paid subscription.

Frequent traders may also be interested in the Zacks Trade platform, which provides a trading platform and robust research tools.

FAQs

Yes, the web and mobile platforms are easy to use. However, despite providing a lot of information, the layout is organized and highly navigable.

Yes. All paid plans have a 30-day satisfaction guarantee.

Sending an email can be the quickest way to resolve most issues. You can also call the toll-free number or access their education library.

The Bottom Line on TipRanks

If you rely on analyst reports and consumer sentiment trends in your stock research process, TipRanks can be worth it. This platform aggregates many different data streams that you may currently use several websites to view.

However, other screening tools may be better if you prefer fundamental and technical analysis. While you will need a paid plan to get the most value from this service, the free research tools can be more satisfying than other software.