I was fortunate to grow up with a relatively privileged upbringing in the 1980s.

We were what I still consider solidly middle class. My parents owned a single-family home in the suburbs on Long Island, my dad had a stable white-collar job, my mom also worked part-time while we weren’t in school, we never worried about food or our heating bill, and every few years we took a month-long trip back to Taiwan.

We didn’t enjoy a lavish lifestyle, by any means. We turned down the heat at night, went to sleep with fans blowing on our faces rather than air conditioning, and we went to public school like everyone else. But we ate regular meals together and while it would’ve been nice to get a few more toys, we had a good life.

Not everyone has that.

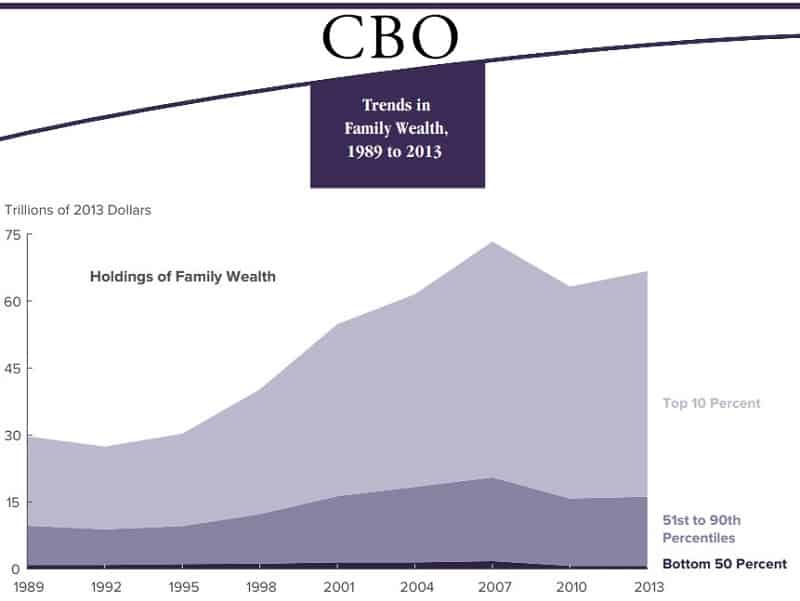

There’s a huge wealth gap in America and wealth inequality is growing.

One of the ways we, as a society can help, is by helping lift the poorest among us. Where you end up is based quite a bit on where you start. I’m financially independent in part because of what my parents were able to accomplish. I didn’t have to get a job right after school to help pay the bills, I could study, go to college, and graduate to a better paying job.

This why so many government programs, subsidies, and tax rules are based on the idea of poverty.

What constitutes poverty in America?

Table of Contents

Federal Poverty Level Guidelines Chart (2024)

Every year, the Department of Health and Human Services issues new poverty guidelines under the authority of 42 U.S.C. 9902(2).

It has to be adjusted each year because of inflation.

These figures below are in effect as of January 17, 2024.

The poverty level is based on where you live as well as how many people are in your household. It’s also sometimes called a poverty line, meaning you are either above or below it based on your income.

| # People in Household | Lower 48 & DC | Alaska | Hawai’i |

|---|---|---|---|

| One | $15,060 | $18,810 | $17,310 |

| Two | $20,440 | $25,540 | $23,500 |

| Three | $25,820 | $32,270 | $29,690 |

| Four | $31,200 | $39,000 | $35,880 |

| Five | $36,580 | $45,730 | $42,070 |

| Six | $41,960 | $52,460 | $48,260 |

| Seven | $47,340 | $59,190 | $54,450 |

| Eight | $52,720 | $65,920 | $60,640 |

| Each Additional | +$5,380 | +$6,730 | +$6,190 |

If you live in the lower 48-states and have five people in your family, you are considered under the line if you earn less than $36,580. You are over the line if you earn more than that. You can see that the level changes for Alaska and Hawai’i.

If you have more than eight family members, you simply add the number in that row by the excess number of people and add it to the figure in the Eight box. So if you were in Hawaii and had 9 family members, the poverty level is $72,650 ($65,920 + $6,730).

This figure is always interesting when you compare it with average net worth, which tends to be much lower than you expect.

100%/150%/200% Poverty Level

Some programs are based on the poverty level, others are based on a percentage above or below the poverty level. Some have sliding scales where the benefit is reduced based on the percentages. There are quite a few programs that use this percentage like Head Start, the Supplemental Nutrition Assistance Program (SNAP), Children’s Health Insurance Program (CHIP), and the Low-Income Home Energy Assistance Program.

Calculating the percentages is simple – it’s based on the level for your family.

If you live in the lower 48-states and have five people in your family, the line is at $36,580. 150% of that is $54,870.

It’s as simple as that.

Programs based on Poverty Levels

One prime example of a program based on poverty levels is the Supplemental Nutrition Assistance Program (SNAP).

With SNAP, eligibility is based on the family’s gross monthly income. A family’s gross monthly income must be at or below 130% of the poverty line. Net income, which is the household’s income minus deductions, must be at or below the poverty line (100%).

There is also an asset rule but that’s not related to the poverty level.

This is just one of several programs tied to the poverty level.

Taxes based on Poverty Levels

One of the biggest, and most publicized, use of the poverty level in taxes is the Premium Tax Credit. It is a tax break for families who get health insurance under the Affordable Care Act. If your household income is between 100% and 400% of the poverty level, you can qualify for this credit. (for 2022, the American Rescue Plan of 2021 removed the 400% cap for eligibility)

In Maryland, there is a Poverty Level Credit that is based on the poverty level:

If your earned income and federal adjusted gross income plus additions are below the poverty level income for the number of exemptions on your federal tax return, you may be eligible for the poverty level credit. You are not eligible for this credit if you checked filing status 6 (dependent taxpayer) on your Maryland income tax return.

Generally, if your Maryland state tax exceeds 50% of your federal earned income credit and your earned income and federal adjusted gross income are below the poverty income guidelines from the worksheet, you may claim a credit of 5% of your earned income. This is not a refundable credit.

Mahatma Gandhi once said, “A nation’s greatness is measured by how it treats its weakest members.”

I hope we measure up.