Most of the articles on this site are geared towards folks around the start or mid-point of their working years – partly because that’s my perspective.

Occasionally, I have folks near or in retirement ask me questions about Social Security.

Right now, I want to admit that I’m not experienced with it. I can (hopefully) do math, but Social Security is not my strength, so if you want to join me on a little adventure… please come along. 😂

That being said, my parents just went through this decision process, and I felt like I was at a loss (at the time) because I knew so little about it.

That said, it can’t be that hard to decipher, right? It’s just math!

So, should you be delaying when you collect Social Security?

🦉 While I am not an expert, I did ask two of my older and wiser friends on the internet, Rob Berger and Fritz Gilbert, to look at this post and point out any potential problems. Rob runs a fantastic Youtube channel @Rob Berger about financial freedom and hosts a weekly live stream, “Ask Me Anything,” that is very informative. Fritz is the founder of The Retirement Manifesto, the type of blog you’d want to read if you were interested in this type of thing!

Table of Contents

How Do Social Security Benefits Work?

To understand this, we need to look (briefly) into how Social Security works.

When your employer pays you, a portion is taken out to pay FICA – Federal Insurance Contributions Act. It’s a tax that is taken out to pay for Social Security (6.2% of your salary, on up to $160,200 of earnings for 2023) and Medicare (1.45% of your paycheck, with no cap).

That’s how money gets into the Social Security system; how does it come out?

There are two benefits – the Worker’s benefit and the Worker’s Spouse’s benefit. We will assume you are the worker and that you have a spouse.

You can start receiving Social Security at the age of 62, but you don’t get “full benefits” unless you wait until your “Full Retirement age.”

The same is true for your spouse. The spousal benefit can be as much as 50% of the worker’s benefit, depending on the spouse’s age at retirement. The benefit is reduced if the spouse starts taking payments before their Full Retirement Age. (it is reduced 25/36 of 1% for each month before normal retirement age).

🚩 If you haven’t registered for an account on the Social Security website, do it as soon as possible. Scammers will try registering your account and claiming your benefits, so you want to register immediately.

What is your Full Retirement Age?

Your Full Retirement Age depends on when you were born (sometimes referred to as Normal Retirement Age):

| Year of Birth | Full (Normal) Retirement Age |

|---|---|

| 1943 – 1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 or later | 67 |

If you take Social Security at Full Retirement Age, you get the full benefits of what’s listed in your Social Security Statement.

What happens if you take Social Security early?

For simplicity, let’s consider someone who was born in 1960.

It’s 2023, so that person is now 63 years old. That person could’ve started taking benefits last year (in any month in which they were at least 62 years old for the entire month) and a $1,000 retirement benefit would’ve been reduced to just $700 – a 30% reduction.

🚩 This assumes you are not earning a salary. If you earn a salary and take Social Security early, your benefit is reduced by 50% of what you earn over the annual limit ($21,240 in 2023). You can use this Retirement Earnings Test Calculator to help estimate your benefits. You will, however, get that reduction back when you reach full retirement age.

Assuming the spouse is of the same age, the spousal benefit would be $500 at Full Retirement Age. If taken at 62, it would be reduced to $325 – a reduction of 35%.

The benefit is reduced if you take Social Security before your Full Retirement Age. Significantly.

💡 If you begin taking Social Security early and change your mind within the first 12 months of getting the benefits, you can pay them back and restart later. This could be because you decided to return to work or came into some money – you can only do this once.

You can also voluntarily stop payments

If you’ve reached Full Retirement Age and are not yet 70, you can choose to stop benefits to earn “delayed retirement credits” that will increase your benefit. More on that shortly as we discuss why someone might wait until 70 to start taking Social Security benefits.

Why Do Retirees Delay Getting Social Security?

There are many situational reasons – you’re still working and don’t need the benefits, you are healthy and expect to live longer than the average life expectancy, etc.

But the primary consideration, independent of other factors, is that you can increase your monthly benefit by waiting.

🔥These increases are on top of any Cost of Living Adjustments (COLA). COLAs are added to your primary insurance amount whether you’ve started receiving benefits or not. So you don’t miss out on inflation adjustments if you delay.

If you have reached Full Retirement Age and delay getting Social Security, your monthly benefit will increase by a set amount (until age 70, at which point there is no increase):

| Birth Year | 12-Month Rate of Increase | Monthly Rate of Increase |

|---|---|---|

| 1933 – 1934 | 5.5% | 11/24 of 1% |

| 1935 – 1936 | 6.0% | ½ of 1% |

| 1937 – 1938 | 6.5% | 13/24 of 1% |

| 1939 – 1940 | 7.0% | 7/12 of 1% |

| 1941 – 1942 | 7.5% | ⅝ of 1% |

| 1943 or later | 8.0% | 2/3 of 1% |

Whether or not you should wait will depend on your specific situation. By waiting, you get a higher benefit. By taking it at Full Retirement Age, you get more, but slightly smaller, payments.

There is no financial reason to wait once you turn 70 though. (You could wait as long as 70 years and six months because Social Security will pay you up to six months of retroactive benefits)

There’s also a slight concern about the solvency of the Social Security Trust Funds. According to the Center on Budget and Policy Priorities, the funds would not be depleted until 2034, assuming policymakers do nothing. And even if they were to be depleted, the program could still pay about 80% of promised benefits.

Should You Wait?

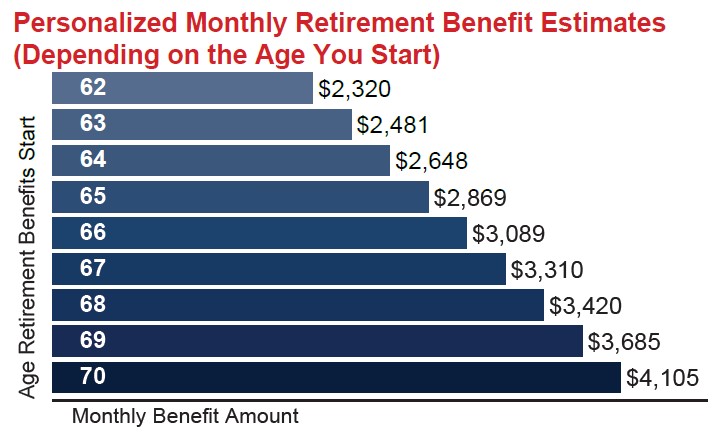

Here’s where a little bit of math helps, and fortunately, the Social Security Administration has done some of the work for you – download your Social Security Statement, and it will show you a “Personalized Monthly Retirement Benefit Estimates.”

This amount assumes that my Full Retirement Age is 67 and I continue to earn $108,999 per year until I start my benefits.

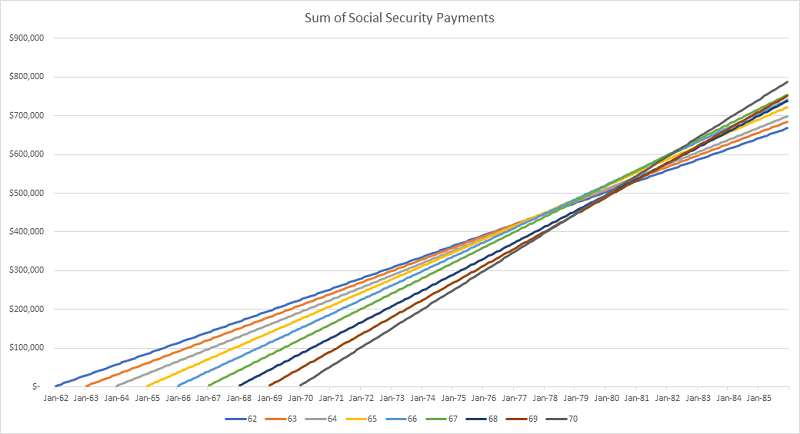

Deciding how long to wait depends on the various crossover points, right? If you sum up how much you’ve collected from Social Security, where does each group cross each other?

Here’s what that chart looks like:

The crossover point between taking at 62 and waiting for full retirement at 67 is the 8th month of the 78th year. That’s 16 years into collecting Social Security (if you started at 62).

If you wait until 70, how long until your total amount collected beats what you would’ve collected had you started at 67? It’s not until the 4th month of your 82nd year. That’s just 12 years from Full Retirement Age.

If you make it to 85, how much would you have collected from Social Security?

- Starting at 62 – $668,160

- Starting at 67 – $754,680 (+$86,520)

- Starting at 70 – $788,160 (+$33,480)

My takeaway from this is that the differences are relatively slight, so it’s unlikely you will make a catastrophic decision that will affect your quality of life. If you still aren’t sure, Fritz has an easy-to-understand guide on when to take Social Security benefits that should help you answer that question in about fifteen minutes (for those who are more number crunchy, this Open Social Security Calculator may be useful).

✨Related: What is the Average Retirement Income?

Delaying Social Security as “Longevity Insurance” – You may have heard this approach and it was one that Rob Berger mentioned when I asked him. It’s where you may opt to delay getting it so that it’s insurance if you live a long time – you get more cash just in case your nest egg runs out. (he also mentioned the other strategy of a lower earning spouse claiming it earlier and then takes spousal benefits when the higher earn starts taking SS).

It seems like this is a case of doing what feels right for you given your current financial situation, which will likely be the biggest motivator for taking it early or delaying it past Full Retirement Age.

For that, I recommend talking to a financial advisor to discuss your specific situation to know which choice is right for you and not relying strictly on my math!

Also, if you don’t want to work with an advisor, retirement planning tools like NewRetirement have features built in to help you decide when to take Social Security. NewRetirement has a Social Security Explorer feature that walks you through your options and will show you how each one maps out to your situation.

There are plenty of tools out there to help you make this decision; find one that works for you.

Robert Sweeney says

I believe the other factor to consider is how much your wife’s Social Security will be and the age difference between you. I waited until 70 because I wanted my Social Security to be as large as possible so she could ride on it after I passed.

Marisette L van Linden says

Great article as always!

One thing I think is missing is managing the experience of living on a fixed income. For some people it’s not about the total collected as much as being able to cobble together a livable monthly cash flow without running out of savings.

Some of us, especially women, have had serious breaks in building up savings (long layoffs, breaks to raise children, forced retirement due to life events, financial disasters, unexpected spousal death or divorce) and have to calculate how much we must tighten the belt to make it all last as long as we *think* we will be alive, considering potential extra costs for health care and loss of ability to live independently.

My stepmom’s constant worry about this is hard to witness. While Dad was alive they did fine on his company pension and social security, but on his passing the pension stopped paying out and somehow her survivors benefits dropped significantly (timing is everything at SSA and apparently her window of opportunity to challenge this has closed). For her, it’s emotionally difficult to see her accounts dwindling and fear unexpected expenses that could drain her savings before she dies. Even the thought of having to adjust to a 20% drop in SS benefits is mind boggling. Her house is practically paid off but that just means she has nearly 1/2 million in equity to which she has little or no access, while she continues to pay taxes, insurance, utilities, and maintenance on it. Selling, moving, and how to find an affordable alternative are constant subjects of conversation. It’s not just math… it’s also facing your mortality mixed with fear of losing independence as a worse alternative to dying. And just the change from being an earner and saver to a spender.

These are all very difficult challenges to manage and overcome, you are right though about how this is part of the struggle of living on a fixed income. I wanted to take a closer look at just the taking of Social Security without getting into the bigger issues because it’s multifaceted and difficult to “distill” into an article (at least one that I’m qualified to write).