If you want to get ahead financially, you need to know where you stand.

And for that reason, there are several money metrics you should track such as your personal savings rate, how much you spend on fixed costs, how much you save towards retirement, your asset allocation, etc.

Today, I want to focus on some money metrics that feel important but are not. Or that you might be tracking incorrectly or for the wrong reasons.

Many of these metrics are numbers that you've been told are important but there are nuances to that importance.

I'm going to stop writing about these numbers and get into them:

1. How Much You Earn

Much of us live in a world of unlimited calories and so there's never a need to restrict your physical activity because you can fuel it with as much energy as you need. If you didn't have access to that, you'd change what you did. You wouldn't work out or run or do anything physically frivolous. You would only do things that mattered to you.

But sometimes we act as though we have unlimited money, usually because of access to credit cards and loans.

How much you earn matters – it informs how much you can spend.

When I say we “care” about this but shouldn't – it's because we assign value to you. Someone who makes more money is “better” than someone who doesn't. Perhaps their “smarter” or “harder working” or other positive attributes, all because they've amassed more “money.”

But there's a dude out there who put his family's life savings and a large slug of home equity into Ethereum, ate a whole lot of stress and came out on the other side with $13 million. Is he better, smarter, or harder working than someone who didn't do that? (before you get too excited, read this New York Times' article about people who were crushed after the last bitcoin bubble burst)

How much you earn is just how much you earn. It's not an indictment on you as a person.

It is important but it doesn't matter.

2. Your Net Worth

Your assets minus your liabilities equals your net worth.

It's a number that I track each month… but also a number that “doesn't matter.”

Knowing your net worth is like knowing your weight. It's good to have a snapshot of your financial health but that single number is not enough information. It can also be quite deceptive if you only track that figure and don't dig any deeper.

A prime example is that guy who put his family's life savings and home equity into Ethereum. If he tracked his net worth and only looked at that number, he'd be thrilled all day and all night. But would you rather have $13 million in a cryptocurrency or $13 million in cash? Or $13 million in VOO?

Tracking your net worth is valuable for many reasons but the actual number is the least of them. It's a monthly check-in on your finances. It gives you a sense of how you are performing compared to last month, last year, the last five years, etc.

And lastly, through diligent saving and investing, you will reach a point where you escape financial gravity and your investments start moving your net worth figure more than anything else.

That's what is important about tracking your net worth – not the number.

3. The Value of Your House

Our county is going through a redistricting of our schools. We live near a massive neighborhood of hundreds of homes (perhaps even a thousand, it's that big) and their Facebook group is up in arms about the redistricting plan because various versions slice up the neighborhood into different groups going to different schools.

Where your children, or more accurately the children of the people living in a home, go to school has an impact on home prices. A real estate agent commented that homeowners should expect a drop in the value of 7-9% of their homes if it is redistricted to another high school. The same agent also mentioned that a handful of sales have fallen through ever since the redistricting plans were released.

I understand why people are upset.

But I also understand that the value of your home doesn't matter in the short term.

If you plan on living in your home for many years, you want the value to be as low as possible. The lower the value, the less it is taxed by the state and county for real estate taxes. You may not be able to get as much home equity but that's hardly a good reason to pay more taxes!

Having more home equity is like having more paper gains in the stock market. It's nice to see, it creates the wealth effect (not a good thing), but it doesn't impact your finances at all (outside of tapping the home equity). To access it, you have to pay a price. At least for stocks, you just pay capital gains tax. With a home, you have to sell it (pay a real estate agent, pay state and county fees, taxes on any gains above the threshold, and then move).

4. Your Credit Score

The strategies for establishing a credit score and increasing a credit score are simple. And your credit score is important because it plays a role in so many things outside of getting a credit card or a loan.

But what ends up happening, like everything we try to optimize, is that you end up falling down the rabbit hole and giving it far more attention than it deserves. Once you have a good credit score, there's no point obsessing over getting a “perfect” score.

Once your FICO is over 760, you don't get much of a benefit because you are getting the best rates for home and auto loans. But some folks obsess over it because higher is better. 20% of people have over 800% but they're in the same boat as the folks who are in the 760-799 FICO score range!

Remember, the FICO score is just a measure of how likely you are to default. This means it's only valuable in situations where someone is lending you something, like a loan.

If you don't foresee a situation where you will need that shortly, you don't need to be checking. What you do need to do is check your credit reports once a year for errors, since those take time to fix, but you don't need to check your score.

(I should mention that there are a ton of ways to check your credit score for free so checking these days doesn't cost as much as it used to)

5. Annual Investment Returns

I struggled to title this section because I wanted to capture an idea that we all know but can't put into a handful of words.

Are you ever at a social gathering and someone talks about how some investment of theirs is up big? Maybe they have some shares of Apple (up 77% YTD as of 11/12/19) that went up big this year or a few Bitcoins. I get it – it's fun to talk about when your bets pay off.

But it's also completely meaningless outside of having a little bit of fun.

Investing isn't about home runs, it's about getting a series of base hits year after year. Base hits aren't as exciting unless you're Ichiro Suzuki and you enjoy a 19 season major league career with over three thousand hits. Oh, this was after nine years in Japan where he had over 1,200 hits.

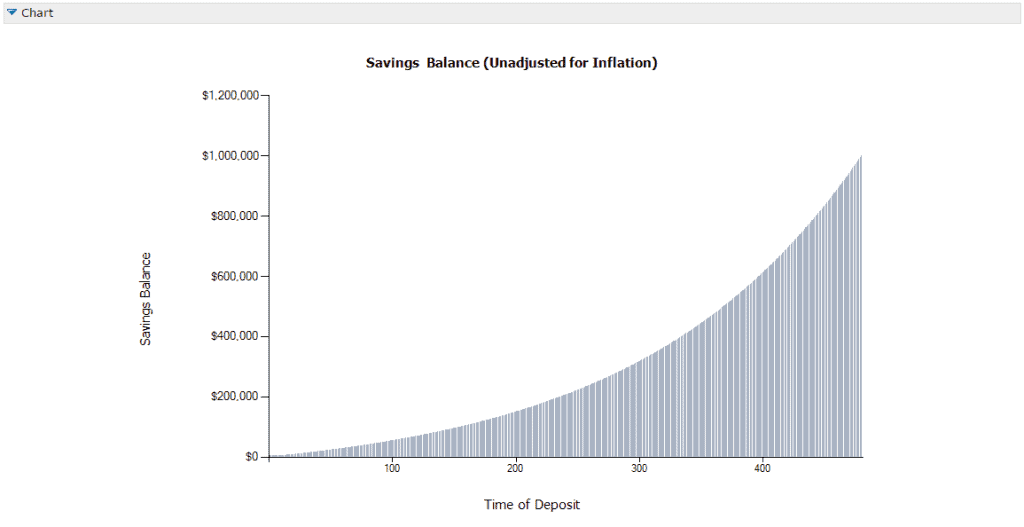

With investing, you want longevity. If you have forty years of 10% returns, you'll retire wealthy if you save diligently. If you start saving at 20 and retire at 65, with just a 7% return, then you can reach $1 million in savings by putting in just $4830 a year. It's the power of compounding.

It's fun to talk about the mammoth home runs, it's not like they hold a Base Hit Derby each year, but the real number to focus on is your total returns over a long period.

Which vanity money metrics do you think people talk too much about? Leave your thoughts in the comments!

Educator FI says

As someone who works in schools – the redistricting process is a crazy one! It’s amazing how many factors get considered in the process, and there is never an easy way to balance them out. The impact on home values can be massive – though you’re right that the value doesn’t matter until/unless you’re intending to sell.

The only one of these I track regularly is net worth (though that does capture home value and investment returns secondarily) but just as you said – a measure of progress to financial independence. I try hard to avoid vanity metrics…especially with my money.

Oh man we just went through that locally and you could really see people get emotional (rightfully so) about the redistricting process, where they’d be moved, etc. In many cases, it was because they had kids. They didn’t want to move schools, split up friendships, split up neighborhoods, and I totally understood that.

Then you had the folks without kids who only cared about their property values. Again, I understand the frustration and being upset but I felt like it was a little less “personal” when you don’t have school-aged kids involved.

Jason says

Great read as usual! The primary reason we track net worth is to make sure, on a periodic basis, that we are making progress towards accumulating assets and not living beyond our means. The few times I’ve stopped tracking net worth I’ve noticed our debt levels has gone up, and I’ve become less devoted to savings funds for the future. Nothing bugs me more then working hard at my job only to check in after 3 months and realize our financial picture is stagnant or I “rewarded” myself with too many credit purchases. To each their own, that process just works for our household. Wallethacks gets prime positioning in my inbox, thank you for the articles!

I think the delta, and the underlying reasons why, are the crucial pieces to tracking net worth.

It becomes a little harder as you age and your investments have a bigger impact… but it’s still important to look at!

Mighty Investor says

Hmm. Jim, do you really think a liquid net worth of zero (or even negative) vs $5 million “doesn’t actually matter?” I love your writing, but this post didn’t convince me–except for the point about how a credit score being above 760 isn’t that important. Cheers!

I didn’t say a smaller number was the same as a bigger number. Nor did I say a smaller number is better or worse – it’s not. It’s important to track but it’s a snapshot in time.

The important part about tracking your net worth is in the delta from month to month, or quarter to quarter, because it shows you how you are progressing.

The makeup of your net worth is important too. The actual number is the least important.