You Need a Budget (YNAB) is a zero-based budgeting approach which means every dollar has a job and needs to be budgeted for, including savings. It is a subscription-based website and phone app that gives you the freedom to prioritize your money the way you want. This is a guide about how to create a simple YNAB Budget from scratch, and allow you to start using it right away and be budgeting in less than an hour.

(if you aren't sure if YNAB is for you, our You Need a Budget review discusses the app's features, this is just a walkthrough of how to create a simple YNAB budget)

There are 4 rules that the company teaches its users about the system. I have bolded these rules throughout the post so you can become comfortable with them and learn what they mean.

- Give Every Dollar a Job – allocate your money upfront

- Embrace Your True Expenses – know where your money is going

- Roll With The Punches – you can make adjustments at anytime

- Age Your Money – keep your money longer

Even if you don't use YNAB, and say prefer to use a budgeting spreadsheet, these powerful ideas can be used by anyone and implemented in almost any type of budget system, including pen and paper. YNAB is super flexible and quick which is why I love it.

How to Build a Simple YNAB budget

Starting a YNAB budget is super simple!

First, you'll need a YNAB account. You can sign up here. There's a 34-day free trial so you can test drive it before you commit to it.

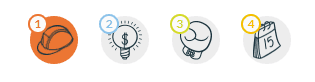

Once you create an account, log in and you'll see that YNAB has automatically created common categories for your expenses. You can change these later.

Adding Bank Accounts

What you want to find is “Add Account” on the left (it's below the list of accounts).

Here you have two options. You can have linked or unlinked accounts:

- Linked means you can directly link with your bank to download your transactions. YNAB keeps improving this service so that you can link most U.S. and even some non-US bank accounts. More details on the status of direct import and issues can be found here at the YNAB status page.

- Unlinked means you need to manually enter the transactions. I did this for several years and it is extra work but it makes you mindful of what you are spending. The less you spend, the fewer transactions you have to enter. This is also good if you're concerned about security.

If you are trying to spend less, entering each transaction by hand can be a powerful deterrent!

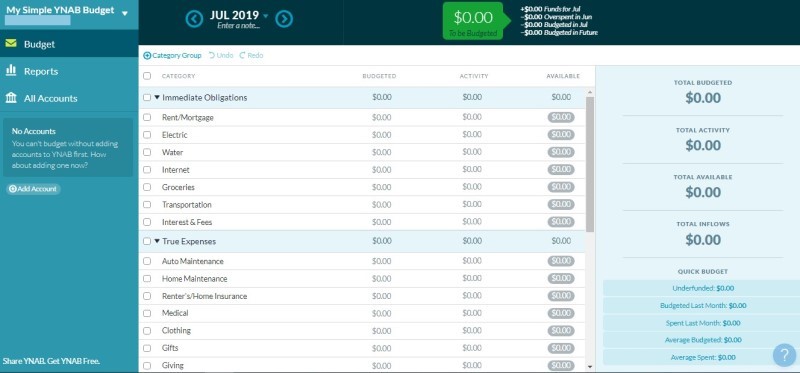

Adding Credit Cards

Credit cards are debt usually for a short period, YNAB understands this well and wants you to pay it off in full each month. Unlike some other systems, YNAB is OK with users using credit cards so they can earn cash back and travel miles.

My favorite part is YNAB doesn't treat a transfer of money from a checking account to pay the credit card as another expense. It is smarter than that; it already tracked your expenses once. Some systems get confused and can treat payments as another expense so they are counted twice.

When you set up a credit card for the first time in YNAB it will ask you some key questions.

- Create a goal to pay off the balance over time. This is an option for those that need time to pay it off. This can be done based on dollar amounts or by a certain date.

- Budget for the entire balance.

- Or you can skip this for now.

Paying it off over time – If you are paying your credit card off slowly, you will need to follow YNAB goals. YNAB will guide you and remind you about reaching those goals. Each month you will budget directly in the credit card category for your payment.

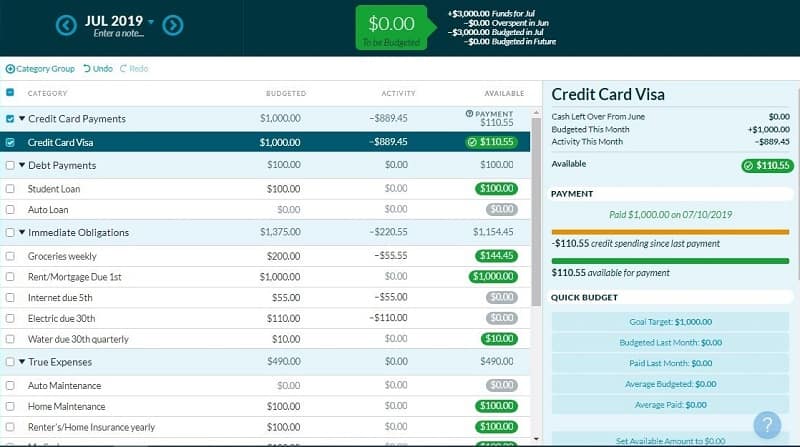

Paying off the credit card each month – If you select this option, the current month is the ONLY month you will need to budget in the credit card category. After transactions start appearing in YNAB, the credit card category will start to grow and be ready for you to pay off in full each month.

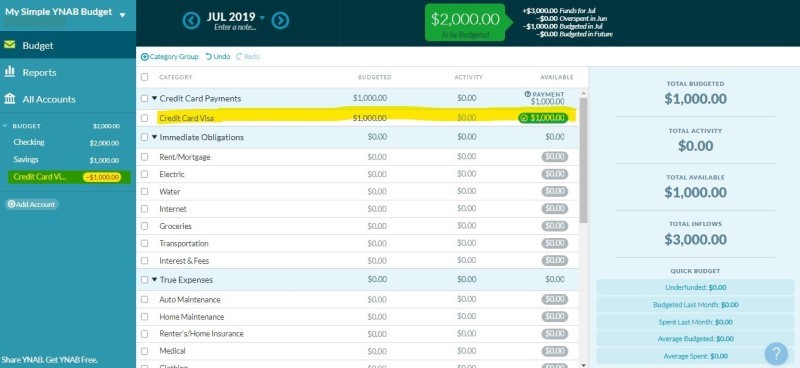

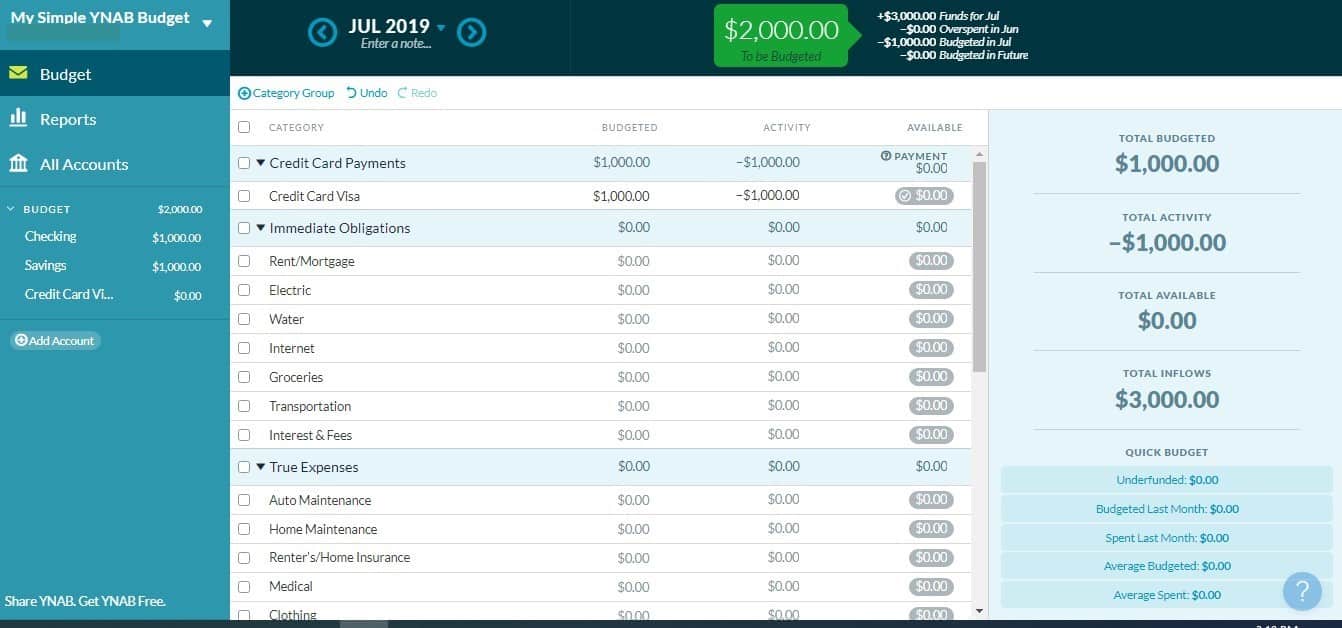

In the budget view below, I set the amount at $1,000 since I paid off my credit card full that month.

Check Your Starting Balances

You can start using YNAB at any time and the best part is YNAB doesn't care if you are starting at the beginning of the month or the end of the month. It wants you to start today!

I hear it often, “Oh, since it is August 24, I'll wait until the first of September.”

There's no need, you can start right now!

So check your checking account(s), savings account(s), and credit card account(s) for the CURRENT balance as of today.

Important Note: This starting balance should not include any pending transactions. Those will appear soon and they should be entered manually. The reason you don't want to have them in the starting balance is that they haven't cleared. You don't want to accidentally double-count some transactions.

Here's an example of a pending transaction:

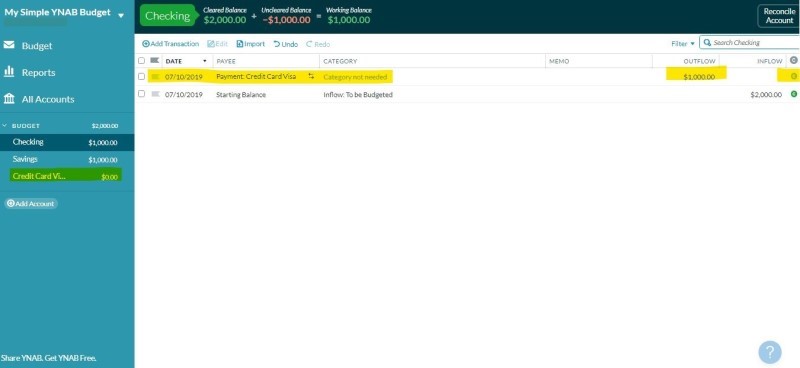

Let's say I just paid $1000 for your credit card. Neither my checking and credit card reflect that in my current balance from the bank. I will need to manually enter that as a transfer from checking to the credit card.

- Checking: $2000 (actual balance)

- Credit Card: -$1000 (actual balance)

I will go into checking and create a transfer of $1000 to the credit card.

Note: Now the credit card balance should be $0.00. The transaction isn't cleared yet (the green C is not clicked). When the transaction does clear, with direct import YNAB will match this transaction. Right now I have $1000 left to budget from my checking account.

Here's what it looks like in YNAB:

Only Budget Money You Have Now

You will want to budget for everything but don't! The first rule of YNAB is “Give Every Dollar a Job.” Now that you have added your accounts, account balances, and any pending transactions, you need to handle what remains in “To Be Budgeted”.

To Be Budgeted is the pot of money you have right now to spend or save.

In this example, I have a total of $2,000 in both checking and savings accounts.

Caution: YNAB doesn't care where the money is but you need to know!

What are the most important expenses you need to spend or save towards RIGHT now before your next paycheck? This is why zero-based budgeting is so important. You start to realize what you need the money for right now. It also helps you think about the present and how it fits with the future.

I suggest sorting them by the due date and to put any savings and debt categories at the top of your list. Pay yourself first and pay down debt are excellent goals.

Let's look at my budget example – where should I put these dollars?:

- Student loan? Yes! I'll budget for that first.

- Is it groceries? Just purchased those but will need to next week so I'll allocate some to that.

- The mortgage? No, already paid that for July. But I do have the August payment to think about.

- Home maintenance? Yeah, I need to work on the shower caulk.

- Car Insurance? Yeah, that is due in November and again in May.

- “Things I forgot about” category? Yes, I'm bound to forget something.

- Savings? Yes, I need to work on my emergency fund.

- Continue to go down the list and add the things that you can think of.

As you put money in the budgeted column, you will be putting money into the available column too. That money is available until you spend it. It will also carry over into the next month, YNAB calls this aging your money. As this happens on a month to month basis, you start to develop positive cash flow. As this cash position grows, eventually you will live on last month's income and save the current month's income. You will be amazed at how much you can save!

At this point, you've “set up” the budget – now it's time to use it.

How to Use Your YNAB Budget

The next step is to create some transactions.

The best way is to use YNAB with your bill payment process. This is why it is such a good system for real-time budgeting vs. “after the fact” budgeting where you track expenses after they happen. You will know today how much you have left to spend on groceries. This is easy to see in the app.

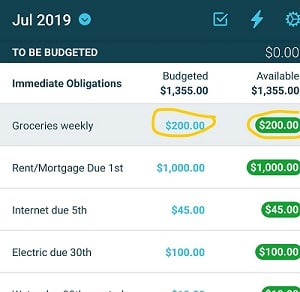

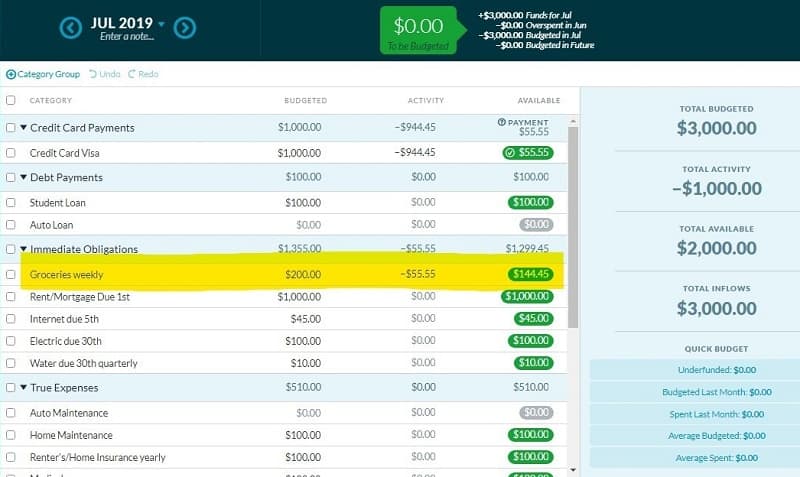

Here is an example in my budget:

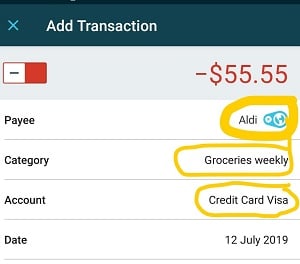

On my phone, I open the app when I go grocery shopping at Aldi. I look and see that I budgeted $200 for groceries for the rest of the month.

I know I should spend less than that. I go to Aldi and do my shopping. I buy milk, eggs, veggies, fruit, and some dinner fixings. I spend $55.55. I'm rocking it!

Next, I go into my YNAB budget app and click on record transaction and enter in -$55.55.

Easy! Now, you can see there is only $144.45 left to spend for that category.

Here it is in the website view:

What If You Bust Your Budget

If budgeting was just about giving every dollar a job and tracking, then we'd all have fully funded emergency funds and be saving all day long. But things pop up, we overspend, and now we have to deal with orange and red available balances.

This is where Rule 3: Rolling the Punches shows up. Sometimes our estimates are off. Maybe you underbudgeted for groceries this month. Maybe you underbudgeted… a LOT. We made this rookie mistake when we started using YNAB and it's even acute now with my kids getting bigger and eating more!

When you see red and orange numbers, this is what it means:

- Red: When you see the available balance turn red it means you have overspent directly out of a checking or savings account.

- Orange: If you see the Orange sign with the credit card next to it, it means you overspent using your credit card.

YNAB wants you to fix the overspending. You should want to fix the overspending!

Fortunately, you can adjust the budgeted categories by editing the amounts budgeted. You'll shift it from other places similar to envelope budgeting.

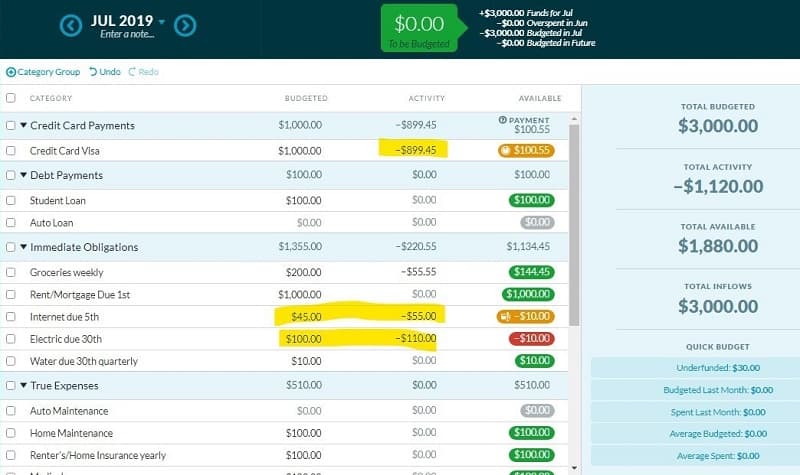

Here is an example in my budget:

I budgeted $100 for our electric bill but it showed up and it was actually $110. I used our checking account to pay for it. I overspent by $10 and now it is red.

Also this month, the Internet bill came in and it was $55, not $45. This time, it is orange because it's a credit card and not a bank account.

This looks ominous but I didn't fail. I just didn't estimate it correctly but we can fix that.

To fix this, I moved money from the category “Items I Forgot to Budget For.” I took $10 to the Internet and Electric categories. Everything is green again and happy!

I could've pulled money from any category. But we created that “Forgot” category just for this, so you don't have to pull from an important category. It's like building in a little wiggle room for those expenses that aren't exactly the same each month.

Summary

That's it! Isn't it simple to create a YNAB budget?

There is a lot more that I could go over like reconciling, goals, and shortcuts. Don't get overwhelmed with that yet. Just get started with a basic budget. The best day to enjoy YNAB is on payday since that is when your “To Be Budgeted” money is full again ready to be given a job. I highly recommend it. Enjoy!