You Need a Budget

$98.99 / yearSurprisingly, 78% of Americans live paycheck-to-paycheck. If you’re one of them, there’s no point agonizing over it – do something about it instead.

You Need a Budget, more commonly known simply as YNAB, can help you get there. Not only will it help you master the fine art of budgeting, but it will also enable you to get ahead of your finances and, finally, break the paycheck-to-paycheck cycle that has so many trapped.

Table of Contents

What is YNAB?

Launched in 2004 – making it one of the longer running budgeting apps – YNAB was created by CPA Jesse Mecham as a tool to help, himself and his wife, get better control over their finances. When he saw how it worked well for them, he decided to make it available to the general public.

The app was built around four principles:

- Decide what you want your money to do before spending it.

- Convert infrequent, large bills into more manageable monthly bills, to even out your cash flow.

- Change your budget as necessary.

- And most important, spending only money that was at least 30 days old.

Number four is the main pillar YNAB is built on because it, essentially, takes you from being behind your budget to being ahead of it. We’ll discuss this concept more as we move on in this review.

YNAB uses a four-step process to enable you to master your money through budgeting. The company boasts the average user saves $600 by the second month, and more than $6,000 during their first year of using the app. Not surprising, YNAB has become one of the most popular budgeting apps available (even though it’s a premium service in a large field of free providers).

YNAB has received 4.1 stars out of 5 from nearly 6,000 Android users on Google Play, and 4.8 out of 5 stars from nearly 21,000 iOS users on The App Store.

How YNAB Works

The YNAB budgeting is built around four “Rules:”

Rule One – Give Every Dollar a Job

Simply put, you’ll prioritize how you use every dollar in your budget. The idea is to commit each dollar to a specific need, which will prevent you from spending it on an unrelated want. You’ll decide in advance how money is going to be spent.

For example, let’s say you receive $2,000 on payday. Before YNAB you might get carried away with the good feeling new money brings. But with YNAB you’ve built a budget. You know exactly where that money needs to go. Perhaps $500 is set aside for rent, $200 for groceries, $150 for a car payment, etc.

You’ll know exactly how much you have for free-spending and you’ll be able to confidently move forward knowing all your goals are covered.

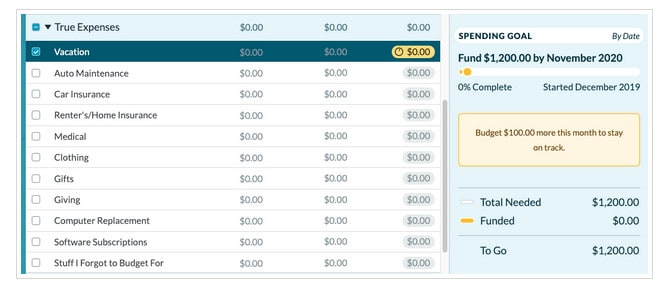

Rule Two – Embrace Your True Expenses

This rule is all about evening out your budget so that those large, but infrequent, expenses don’t bust your budget. You identify the big, infrequent expenses in your budget, then set up a goal to fund them on a monthly basis.

For example, it might be something like putting away $100 per month so that you have $1,200 available when Christmas arrives. That will avoid the need to disturb your budget when it does come, or worse, to turn to a credit card.

Rule Three – Roll With The Punches

This rule is about building flexibility into your budget. Let’s face it, you can set up a budget, but there will be times when certain expense categories will be higher. You can address that by simply moving money from other categories into the unexpectedly higher expense category. It’s another rule to smooth out your expenses and keep you from abandoning your budgeting efforts completely.

For example, an old friend comes to town unexpectedly and invites you out for drinks putting you over budget in your “entertainment” category. To balance out this new budget-buster you move some money out of your grocery budget and decide to eat out of the pantry and freezer next week to get you through.

Rule Four – Age Your Money

Remember at the beginning when we discussed how YNAB founder Jesse’s fourth principle was spending money that’s at least 30 days old? That principle manifested itself in Rule Four. The basic idea is that you are always living on last month’s income.

This is the hardest rule to get your head around. Imagine that in January you don’t cash any of your paychecks. Instead, you save them up and on February 1st you deposit them all at once into your checking account. Now, you will live on January’s income during February–meanwhile, you are saving up all your paychecks again so you can deposit Feburary’s income on March 1st.

Doing this means your income will always be at least 30 days ahead of your expenses. That will buy you an automatic cash cushion and reduce the stress that comes with budgeting.

You won’t accomplish Rule Four overnight. You’ll need to follow the first three Rules and build the extra cushion into your budget. It’s the perfect strategy for getting out of the paycheck-to-paycheck trap that so many are locked in.

Now imagine that you successfully implemented all four rules and you’re now a full month ahead of your expenses in your budget? From that point all your other financial goals will be possible.

YNAB Features

YNAB has dozens of features, and far more than we can adequately cover in this review. Below are some of the more important ones:

YNAB Referral Program: YNAB will give you one month of service free for each person you refer who signs up for the app. In theory at least, if you refer 12 people who sign up, you’ll get a full year of the budgeting app free. They also promise that the offer comes with plenty of free stuff.

YNAB Accessibility: YNAB has a website you can access and you can even connect it to your Amazon Echo. It’s also available in mobile apps, including iOS 12.0 and higher, and watchOS 2.1 and later. It’s compatible with iPhone, iPad, iPod touch, and available at The App Store. Additionally, it’s available on Google Play for Android devices, 6.0 and up.

Customer Support: Available by email and live chat only, Monday through Friday, noon to 9 pm, Eastern time. There is no direct phone support.

Available Currencies: You can set YNAB to be based on either US dollars or foreign currencies. However, the app cannot accommodate multiple currencies in use at the same time.

Schedule transactions: If you have recurring transactions you can set them up to hit your budget automatically. Saving you from having to enter them manually each month.

Split transactions: There may be certain transactions that will involve multiple spending categories or goals. A frequent example is when you go to a big-box retailer like Walmart. Your order may include clothing, food, and gifts. Though you are making a single payment, you can split the transaction and the three separate categories.

YNAB Pricing and Fees

YNAB is completely free for 34 days, you don’t even need to give them a credit card to start your free trial. After that, the service costs $14.99 per month, or $98.99 per year as an annual subscription.

If you’re a student you’ll get an additional 12 months – plus the 34-day free trial. You’ll need to provide proof of enrollment, like a transcript, tuition statements or a student ID card that proves you’re enrolled. At the end of the student trial period, you can sign up for the premium version with a 10% discount.

YNAB moneyback guarantee. If at any time during your subscription you don’t feel like the service is working for you, you’ll be refunded 100% with no questions asked.

Start your free trial with YNAB

How to Sign Up with YNAB

Signing up with YNAB is incredibly easy. You can sign up from the website, either by entering your email and creating a password or connecting with Google. During your 34-day free trial, you won’t even be required to put a credit card on file.

Once you’re signed up, you’ll begin by importing your transactions from your bank account. This can be done by hitting the Import Button from the app. If you prefer not to link your bank account to the app, you can choose to enter your transactions manually.

Whether you import your transactions or enter them manually, you’ll then spend some time assigning categories to each expense.

You can sync or manually enter transactions from multiple bank accounts and even credit cards. In the case of credit cards, the app will track your transactions separately from those run through your bank account. This will give you an opportunity to determine how much spending you’re doing, either, through your bank account or your credit cards, and that can be a valuable way to help you get control of your credit card spending.

From here, reference our guide to help you create a simple YNAB budget.

YNAB Advantages & Disadvantages

Advantages:

- YNAB will help you break the paycheck-to-paycheck cycle that is so difficult to get out of.

- It aggregates all your various financial accounts, including bank accounts, loans, and credit cards on one platform to give you a complete picture of your entire financial life.

- You have a choice to, either, import your transactions from your various accounts or enter them manually.

- YNAB implements a system that forces you to be more deliberate about how you manage your money and ultimately moves you to a point where you’re paying this month’s bills out of last month’s income.

- The YNAB Referral Program will enable you to get a free month of service for each friend you refer who signs up for the app. Refer at least one person per month, and you may never need to pay for the service.

Disadvantages:

- No live phone support.

- Even though YNAB can sync with your accounts and import transactions, you’ll still need to reconcile your accounts manually to make sure they’re accurate.

- There is no investment functionality, which is frequently available with other budgeting apps.

- YNAB doesn’t have some of the extra features offered by other budgeting apps, like free credit score monitoring.

- The app doesn’t offer a bill paying function, but then not many budgeting apps do.

- The app is free for college students for one year, then available for one more year at a 10% discount.

The biggest con is that YNAB isn’t free. If you don’t have room in your budget to pay for another service, here are the best free budgeting software tools.

✨Related: Best Budgeting Apps for Couples

Should You Sign Up with YNAB?

If you’ve never been able to master budgeting, and even if you’ve tried with other apps and failed, YNAB is a real opportunity to start again with a fresh perspective. They use an incredibly simple process that’s governed by four basic rules. It enables you to set a workable budget and build flexibility to handle life’s surprises.

It works with the primary goal of getting you to the point of paying this month’s expenses out of last month’s income. If you can reach that point, you’ve completely broken the paycheck-to-paycheck cycle.

Probably, the biggest drawback with YNAB is that it doesn’t offer any kind of investment support. That would seem like a natural extension of budgeting activity in getting you to the point of being able to invest. If you are looking for investment support you can pair YNAB with a free portfolio management software. Here’s a list of our favorites.

But maybe they don’t offer an investment capability because they want to stay strictly with budgeting. After all, until you master that, investing is just a pipe dream, and once you do, there are plenty of investment apps and robo-advisors available that can take it from there.

If you’d like more information or want to sign up, visit the YNAB website.

Get started with YNAB free!