Kraken

Strengths

- Kraken has one of the lowest cryptocurrency fee structures in the industry

- You can invest in more than 50 cryptocurrencies

- Margin and futures investing are available

- You can participate in staking in both cryptocurrency and US dollars and euros

- Kraken is one of the older and better-established cryptocurrency exchanges

Weaknesses

- Unlike many cryptocurrency exchanges, Kraken does not offer a digital wallet to store your digital assets

- Because of the ID verification process, investing in cryptos through Kraken won’t be as private as investors have come to expect

- No IRA account is available

- Confusing fee structure

- Customer service is limited to live chat

Maybe like millions of others, you’ve been bitten by the cryptocurrency bug. It’s not hard, given the dramatic price performance of cryptos in the past year alone.

The advances have been so pronounced – and the interest so intense – that mainstream financial websites now routinely list Bitcoin prices, right up there with the oil, gold, the 10-year Treasury note, and various foreign currencies.

That’s how far cryptocurrencies have come in just the decade or so they’ve been in existence.

But just as there’s much interest around cryptocurrencies, there’s at least an equal amount of confusion. While it’s easy to buy stocks, bonds, funds, and even options through online brokers, the industry hasn’t exactly embraced cryptocurrency investing.

Not to worry, however. A host of cryptocurrency exchanges have sprung up, enabling investors to buy, sell and even store their cryptocurrency.

One of the top names in the cryptocurrency exchange industry is Kraken. It’s available to investors throughout the US and most countries around the world. And not only do they provide basic trading in cryptocurrency, but they also offer margin, futures, and staking to enhance crypto investing and profitability.

If you’re looking to invest in cryptocurrency, Kraken needs to be on your short list of cryptocurrency exchanges.

Table of Contents

What is Kraken?

Kraken is a cryptocurrency exchange and bank. It’s based in San Francisco, California, and was founded in 2011. That, somewhat ironically, makes it one of the “oldest” crypto exchanges, given that the industry itself only came into existence in 2009.

The platform offers their services in 48 US states, as well as 176 countries around the world. (New York and Washington state are the only US state exclusions.)

Kraken’s mission is to “… accelerate the adoption of cryptocurrency so that you and the rest of the world can achieve financial freedom and inclusion.”

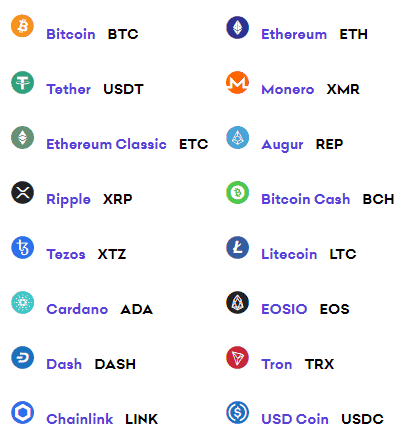

The platform did start out as an exchange exclusively for Bitcoin. But as the cryptocurrency universe has expanded, Kraken has grown to accommodate dozens of the most popular Bitcoin competitors. You can now trade in more than 50 cryptocurrencies, in addition to Bitcoin.

How Kraken Works

Kraken is a cryptocurrency exchange where you can buy and sell well over 50 cryptocurrencies, including the largest and most popular ones. But in addition to basic buying and selling, Kraken also allows you to invest on margin, and even to participate in cryptocurrency futures.

Note: Kraken does not offer a digital wallet service, so you will not have a secure way to store your cryptocurrency on the exchange. They recommend the use of hardware wallets for this purpose, suggesting Ledger and Trezor as two of the most popular. Other than adding an extra step to the Kraken investing experience, this shouldn’t be a problem. Hardware wallets are the most secure form of storage, and they make it easy to transfer your cryptocurrency from one device to another.

The more important features of investing through Kraken include the following:

Kraken Staking

Similar to mining cryptocurrency, staking is about participating in transaction validation on a proof of stake (PoS) blockchain. If you have the minimum amount of a specific cryptocurrency, you can validate transactions and earn staking rewards.

Kraken makes staking available on both cryptocurrency, and even on fiat currencies, like the US dollar. You simply need to buy assets or fund your Kraken account with an eligible asset, then choose the ones you want to stake. You’ll earn rewards twice each week from your staked assets.

You can earn staking rewards on the following currencies, though this list is partial for demonstration purposes:

- Bitcoin, 0.25% yearly rewards.

- Ethereum, 5% to 7% yearly rewards.

- Tezos, 5.5% yearly rewards.

- US dollars, 2% yearly rewards.

- Euros, 1.5% yearly rewards.

Trading on Margin

Kraken makes margin trading available to enable you to use leverage with your cryptocurrency investing. However, margin trading is designed for more advanced traders since it involves a greater degree of risk.

You can use Kraken margin on both long and short positions, with leverage up to 5X. That means you’ll have five times as much earning potential compared with regular spot trades. For example, you’ll be able to use $10,000 to invest in $50,000 in cryptocurrency.

Eligible investors can access up to $500,000 in margin. Rollover fees apply that will never be more than 0.02% per four hours of leverage.

Margin trading is available only on the following cryptos:

Kraken Futures

Futures involves using contracts in which you agree to buy or sell an asset or security at a later date for an agreed-upon price. They can be used to make profits directly or to lock in profits on long-term positions.

Margin is commonly used with futures trading, and Kraken allows margin on futures to be as high as 50X, compared with 5X for other trades.

Kraken Futures are not available for residents of the US, Japan, Singapore, Ukraine, the United Kingdom, or residents of the province of Ontario, Canada.

Futures trades involved pairs that include Ethereum, Litecoin, Bitcoin Cash, Ripple and Bitcoin futures, which can be paired with either US dollars or euros.

Kraken Fees & Pricing

Kraken has five separate fee schedules, for Instant Buy, Kraken Pro, Stablecoin & FX Pairs, Margin and Futures.

For the benefit of the most typical cryptocurrency investor, below is the fee schedule for Kraken Pro:

| 30- Day Volume (USD) | Maker | Taker |

|---|---|---|

| $0 – $50,000 | 0.16% | 0.26% |

| $50,001 – $100,000 | 0.14% | 0.24% |

| $100,001 – $250,000 | 0.12% | 0.22% |

| $250,001 – $500,000 | 0.10% | 0.20% |

| $500,001 – $1,000,000 | 0.08% | 0.18% |

| $1,000,001 – $2,500,000 | 0.06% | 0.16% |

| $2,500,001 – $5,000,000 | 0.04% | 0.14% |

| $5,000,001 – $10,000,000 | 0.02% | 0.12% |

| $10,000,000+ | 0.00% | 0.10% |

Kraken Features & Benefits

Minimum initial investment: For cryptocurrency transactions, deposit, trade and withdrawal minimums are denominated by the particular crypto. For example, for Bitcoin, the minimum is 0.0001 for deposits and trades, and 0.0005 for withdrawals. You’ll need to check the minimums for each crypto you’ll be investing with.

Available accounts: Taxable trading accounts only (no IRAs).

Available investments: More than 50 cryptocurrencies, including Bitcoin, Bitcoin Cash, Dogecoin, Ethereum (Ether), Ethereum Classic, Litecoin, Ripple and Zcash.

Customer service: Available 24/7 by live chat; no direct phone contact is available.

Mobile app: Kraken is available on The App Store for iOS devices, 11.0 or later, including iPhone and iPod touch. It’s also available on Google Play for Android devices, 7.0 and up.

Kraken security: When you sign up for your account you can set up two factor authentication (2FA) to make account access more secure. You can also set up PGP (pretty good privacy), which is a public key encryption program to secure your email communications. You can also establish a global settings lock (GSL) to prevent changes to your account settings and withdrawal addresses, even if an attacker gains access to your account.

How to Sign Up with Kraken

You can sign up with Kraken on the company’s website. You can do this by clicking “Create Account” in the upper right corner of the site.

You’ll then enter your email address and create a username and password. You’ll be required to read the Kraken Terms of Service and Privacy Policy, and checking if you agree.

Next, you’ll click the “Sign Up” button. Once you do, you should receive an activation email that will contain an activation key. You’ll enter the activation key on the account activation form or by simply clicking on the link in the email.

From there, you’ll confirm your password, complete the captcha box, then click “Activate Account”.

You’ll then need to set up any necessary security options, as listed under “Kraken security” above.

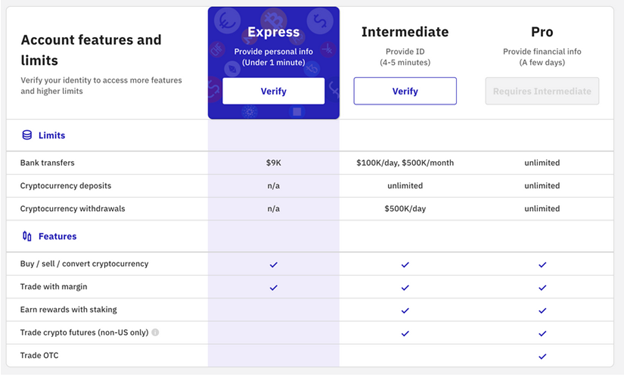

The next step will be to get verified on Kraken. You’ll do this by signing into your Kraken account, clicking on your name, and then clicking “Get Verified”. This is where you’ll choose the type of account you want, Express, Intermediate or Pro.

The specific capabilities of each of the three account types are as follows:

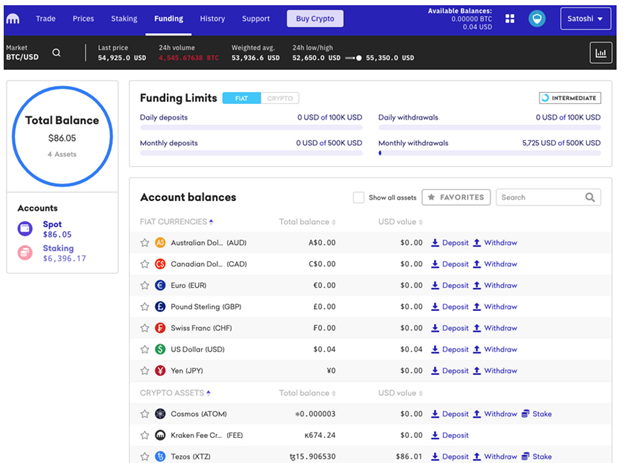

The next step will be to fund your account. By selecting the “Funding” tab, you can review the funding options available:

You’ll be able to fund your account using fiat currency (US, Canadian or Australian dollars, Euros, Pounds, Yen, or Swiss Francs) or digital assets/cryptocurrencies.

If you fund that your account using fiat currencies, you can do so with debit or credit cards, or directly from your bank account. As a security measure, deposits will have a temporary (72 hour) withdrawal hold.

Deposit limits are based on your plan level, Express, Intermediate or Pro, and are as follows:

| Limit Window | Action | Starter | Express* | Intermediate | Pro |

|---|---|---|---|---|---|

| Daily Limits | Deposit | 0 | $9,000** | $100,000 | $10 MM+ |

| Daily Limits | Withdraw | 0 | $9,000 | $100,000 | $10 MM+ |

| Monthly Limits | Deposit | 0 | $9,000** | $500,000 | $100 MM+ |

| Monthly Limits | Withdraw | 0 | $9,000 | $500,000 | $100 MM+ |

Kraken Pros & Cons

Pros:

- Kraken has one of the lowest cryptocurrency fee structures in the industry.

- You can invest in more than 50 cryptocurrencies.

- Margin and futures investing are available.

- Kraken is available in most US states, and most countries around the world.

- You can participate in staking in both cryptocurrency and US dollars and euros, to increase your holdings of both.

- Kraken is one of the older and better-established cryptocurrency exchanges, having been launched more than a decade ago.

Cons:

- Unlike many cryptocurrency exchanges, Kraken does not offer a digital wallet to store your digital assets.

- Because of the ID verification process, investing in cryptos through Kraken won’t be as private as investors have come to expect.

- No IRA account is available.

- The fee structure, while one of the lowest in the industry, can be confusing because it varies by activity and by currency.

- Customer service is limited to live chat; no direct phone contact is available.

Kraken Alternatives

If you’re not ready to take on a cryptocurrency exchange, there are alternatives that may be more user-friendly, especially for more casual crypto investors.

eToro

For intermediate crypto investors, take a close look at eToro. Like Kraken, it’s a cryptocurrency exchange. But for less experienced investors, it offers a digital wallet, a virtual trading account, and copy trading. The latter is a capability that enables you to match the trading activity of more experienced cryptocurrency investors.

Here’s our full review of eToro.

Robinhood

Robinhood is an investing app where you can trade stocks, exchange traded funds, and options commission-free. But they also can accommodate trading in cryptocurrencies. It’ll be a real opportunity to hold your cryptos with the same platform where you hold other investments.

Here’s our full review of Robinhood.

Webull

Similar to Robinhood is Webull. They also offer commission-free trading in stocks, options, and exchange traded funds. They’re especially strong on options since they don’t charge a per contract fee on your trades. But if you also want to dabble in cryptocurrencies, Webull is an excellent choice.

Here’s our full review of Webull.

SoFi Active Invest

SoFi Active Invest similarly provides commission-free trading in stocks and exchange traded funds. And they can also accommodate trading in cryptocurrencies. But where SoFi stands out is in the sheer volume of financial services they offer.

Best-known for student loan refinances, they also offer financing and insurance. And on the investing front, you can also take advantage of SoFi Automated Investing if you prefer a low-cost, professionally managed investment portfolio.

Should You invest through Kraken?

Kraken is designed primarily for intermediate or advanced cryptocurrency traders. Not only does it offer advanced trading capabilities, like margin and futures, but the fee structure is lower for high-volume trading, particularly over $50,000 per month. To take advantage of all those features, you need to be both experienced and active in trading cryptos.

The platform is less oriented toward new or casual cryptocurrency investors. Customer service is extremely limited, and the platform does not provide a digital wallet to store your cryptocurrency.

More casual investors, who simply want to take a flyer on cryptocurrency, may want to consider investment brokers that offer cryptos. Examples include SoFi Active Invest, Robinhood and Webull, all of which were covered briefly above.

Otherwise, Kraken is an excellent choice for cryptocurrency investing if you have some experience, and you’re looking for the more advanced trading features it offers.