Moneydance is a budgeting tool similar to Quicken but only charges a one time fee of $60, rather than expensive monthly charges (but that is an option).

With Moneydance you can monitor your banking and investment accounts all in one place – using your computer and phone. It’s also possible to handle multi-currency transactions and pay your bills directly from Moneydance.

This in-depth Moneydance review can help you decide if this is the best premium personal finance app for managing your money.

Table of Contents

- How Moneydance Works

- Moneydance Download Options

- Moneydance Key Features

- Online Banking

- Bill Pay

- Payment Reminders

- Moneydance Summary

- Categorizing Transactions

- Account Registers

- Graphing Tool

- Budget Reports

- Investment Tracking

- Foreign Currency Transactions

- Moneydance Pricing

- Moneydance vs Quicken

- Moneydance Pros and Cons

- Is Moneydance Worth It?

How Moneydance Works

Moneydance is free for the first 100 transactions. After that, you can purchase the software for a one-time fee of $60.

What makes Moneydance different than most apps is its open-source API. Developers can create customized extensions that add new financial tools without upgrading to a new software version every year.

Some of the core Moneydance capabilities include:

- Tracking bank, digital wallet, and credit card transactions

- Online bill pay

- Categorizing transactions and budgeting

- Monitoring investment account performance

- Multi-currency transactions

Moneydance is a robust platform. Your entire financial universe assembles in one place. Moneydance can automatically download financial transactions and sort them into their proper categories. You can also build a custom budgeting strategy including importing your existing budget spreadsheets.

Accessing all your accounts in one place makes tracking your money simple. Your Moneydance charts and graphs give you a visual picture of where your money’s going. The charting can be particularly beneficial for anyone with difficulty tracking spending.

Many budget-focused apps have mediocre investment tracking – at best. Moneydance can track your savings, mutual funds, stocks, bonds, and other investments. Not only does it keep track of your investments, but it also displays the performance of each.

You can also pay bills from the app, as well as receive alerts to remind you when payments are due. The last feature can save you money by helping you to avoid late fees.

Like any personal finance app, there is a small learning curve to efficiently navigate the software. Moneydance is not frustration-free. There can be programming bugs with importing data files and syncing your accounts. But you will find that with any software.

Moneydance Download Options

Moneydance remains a “desktop-first” budgeting app and is compatible with these operating systems:

- Windows (7+)

- macOS (10.11+)

- Linux

The Android or Apple mobile app is a good companion and syncs with your desktop using Dropbox. However, the Moneydance mobile app lacks many desktop features and other cloud-based apps are better.

Moneydance is available for Windows, Mac, and Linux, as well as iOS and Android mobile phones.

Moneydance Key Features

The many banking and investment features can make Moneydance the only personal finance app you use. Most apps specialize in either budgeting or tracking net worth and investments. It’s not often that you can do both with one program.

Online Banking

You probably have online banking through each individual bank but what if you have several accounts in two or more banks?

The Moneydance online banking can be a serious benefit when you have accounts at multiple banks. You can access each account from the same app.

Moneydance automatically downloads your transactions, then automatically categorizes them to help you track your spending. You can also make payments directly from the app.

Bill Pay

Some budgeting apps are excellent at tracking your finances and money goals. However, you must still use your bank app to schedule single or recurring online bill payments. Moneydance lets you pay bills from its platform using Direct Connect – the same program that Quicken and Quickbooks use.

Many national and regional banks support Moneydance for online bill payments and downloading transactions.

Payment Reminders

You can use this tool to schedule either individual payments or recurring transactions. Use it and you’ll never forget a payment again.

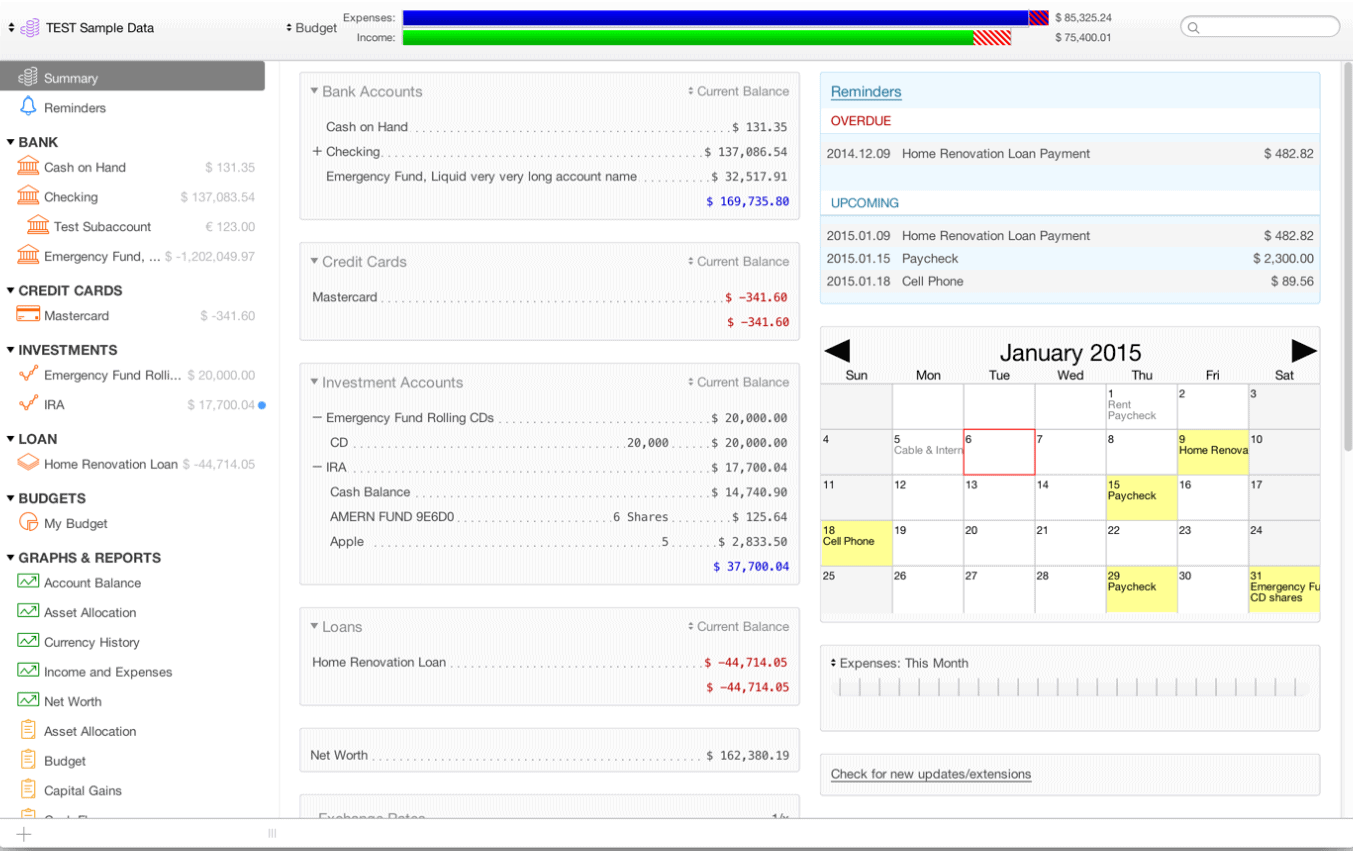

Moneydance Summary

This is your high altitude view – the big picture of your finances.

Some “all in one” finance apps excel at aggregating your account data but make it difficult to navigate your accounts.

The Moneydance summary dashboard provides these details:

- Account balances

- Upcoming and overdue transactions

- Payment reminders

- Foreign exchange rate information

While everything is summarized on one page, you can click on an account, or choose one from the drop-down list, to go directly to that account. There you can enter transactions, or reconcile your account.

Categorizing Transactions

Moneydance allows you to set budgets by category, for example, you may set a budget for restaurants. When a transaction comes into your checking account for a restaurant you can categorize that as such.

It’s also possible to assign “tags” to the transactions you categorize too. These tags can be handy when running budget reports and analyzing spending trends. For example, you might tag all of your expenses while on vacation as “travel”. You can then pull reports and see exactly how much your recent vacation was.

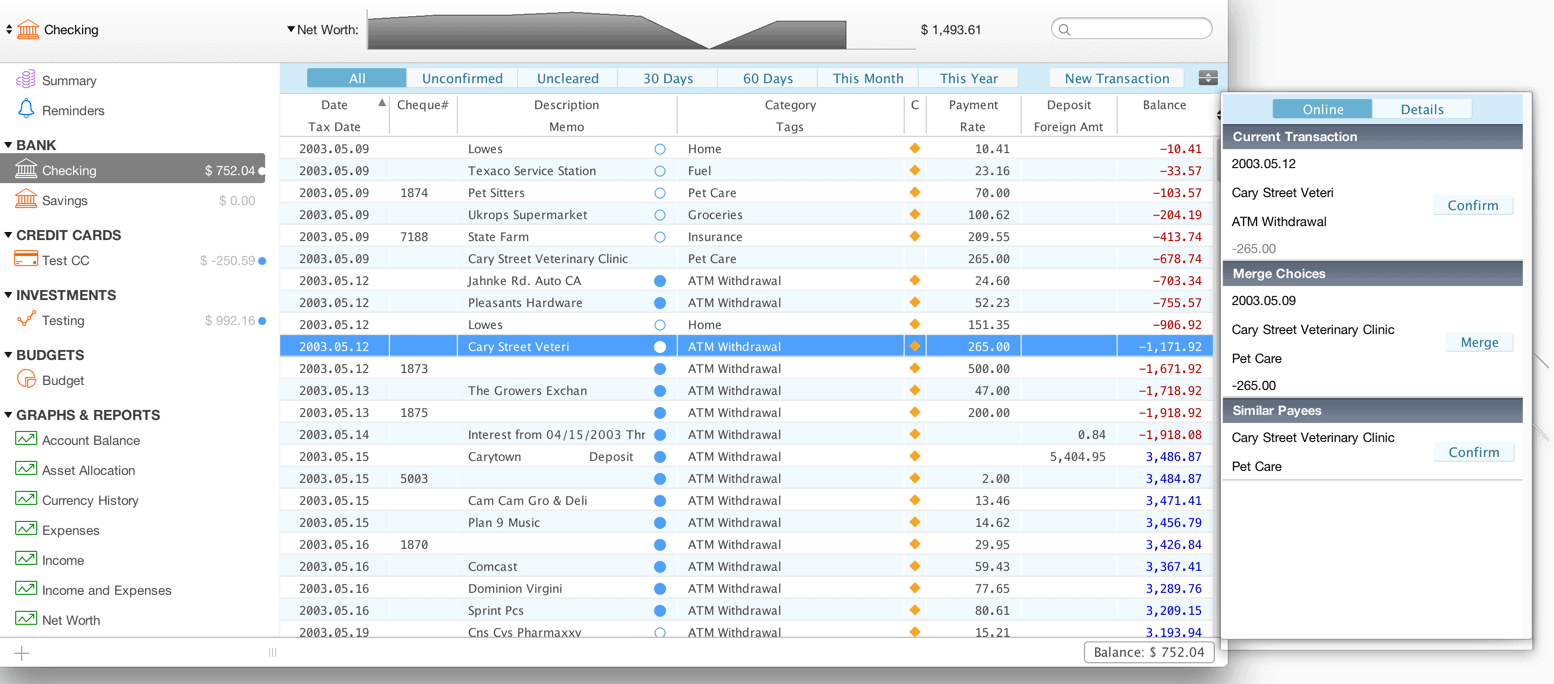

Account Registers

Here you can enter or delete transactions, or make any edits necessary. It’s set up like a traditional checkbook, but it automatically calculates your balances and sorts your transactions. It also has an auto-complete feature for recurring transactions to save time.

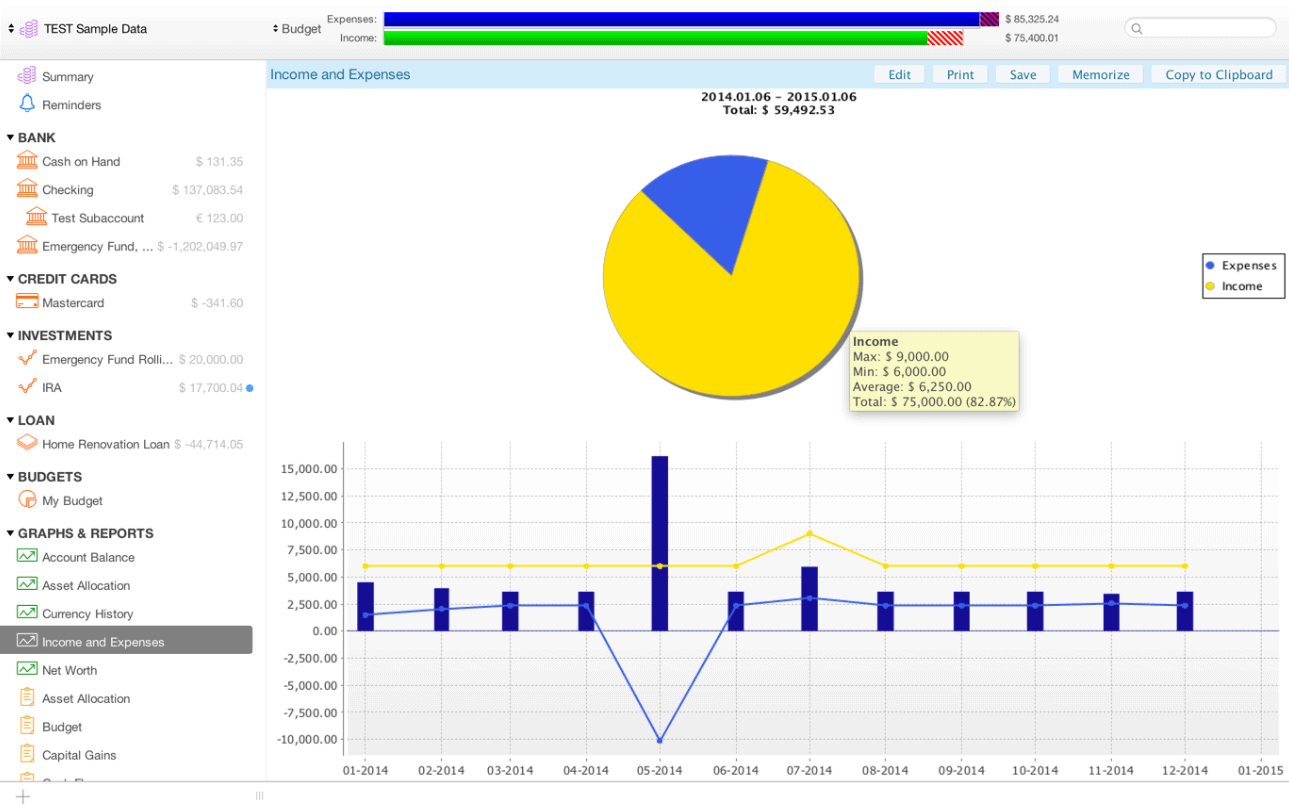

Graphing Tool

The graphing tools enable you to generate visual reports tracking both your income and expenses.

You can create any type of graph you’re comfortable with, and customize it with the desired date range and any other parameters you choose. Graphs can also be printed or saved on your computer.

Some of the available graphs include:

- Account balances

- Asset allocation for investments

- Income and expenses

- “Memorized graphs” (Customizable graphs that update continually)

- Net worth

Budget Reports

You may also appreciate the in-depth analysis that budget reports offer. These reports can make it easy to track your personal or business figures.

Some of the potential budget reports include:

- Account balances

- Budget performance

- Cash flow

- Income and expenses

- Missing checks

- Reconciling transactions

- Tag summary of categorized transactions

- Transfers

- VAT/GST applicable expenses and total tax paid

There are multiple investment performance reports you can run too. For instance, some of the investment-related reports let you track cost basis, capital gains, portfolio performance, and transactions.

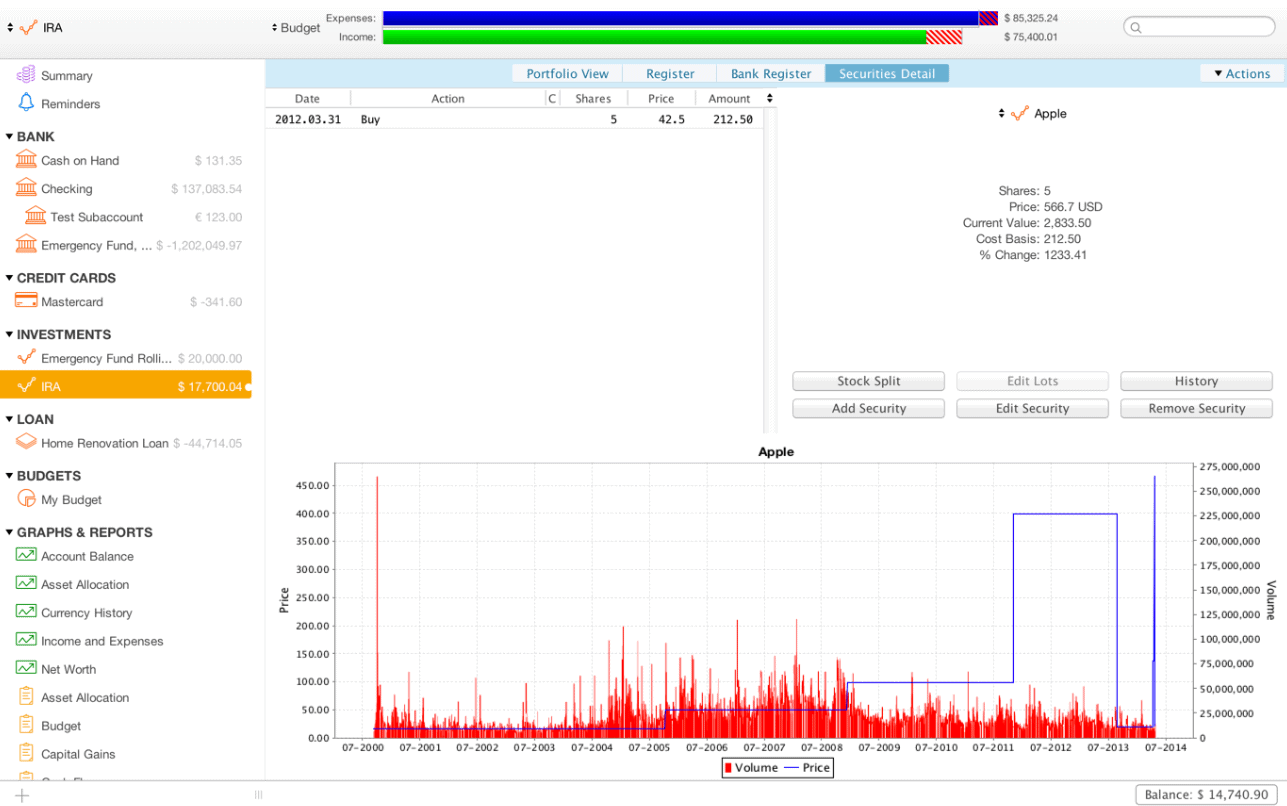

Investment Tracking

Tracking your investments is where Moneydance departs from many of the pure budgeting apps. It enables you to follow your investments not only by updating the total value of your portfolio but also by providing the performance of individual securities.

You can track stocks, bonds, certificates of deposit, mutual funds, and just about any other type of investment.

You can customize investment tracking by setting it to automatically download daily security prices. It can also help you to perform cost basis computations, as well as to account for stock splits.

Foreign Currency Transactions

If you do any foreign currency transactions or have a foreign-based bank account, you’ll really appreciate this feature.

Moneydance can handle multiple currencies and will make automatic conversions. It keeps a history of conversion rates too so your transaction from two years ago uses an accurate figure from that exact day.

There’s no need to get out your calculator and look up daily exchange rates. It all happens automatically.

Moneydance Pricing

Moneydance can be purchased for a flat fee of $60. This one-time fee is an advantage over competing platforms that have monthly fees or a recurring annual fee. (but that is an option if you want updates)

You can make your one-time fee upfront, then use the app forever. Payment can be made by Visa, MasterCard, American Express, Discover, PayPal, or Amazon gift cards.

Each personal license is good for every computer in your household with unlimited use.

For businesses, Moneydance requests one license per computer or data file (whichever is smaller). You can share data files between multiple computers and only buy one license.

Free Trial Period for Your First 100 Manual Transactions

Moneydance offers a free trial for your first 100 manually entered transactions. You have full access to the app during the trial period. Once you reach that threshold, you can make the one-time payment and continue using the app. Or not.

The Moneydance app comes with a 90-day money back guarantee. If you’re not happy for any reason, you can return the product for a full refund.

Upgrade Policy

After you purchase the software you get one free major release update. After your free update, you will receive subsequent updates at half price.

Quicken, and most other software packages, makes you pay full freight with each major upgrade.

Moneydance vs Quicken

Moneydance and Quicken are two of the most powerful personal finance programs on the market. Quicken offers a similar experience to Moneydance for PC and Mac. Both programs require a desktop download and their mobile apps syncs with your desktop file. Quicken dropped its cloud-only data storage a few years ago.

You might prefer Quicken as this program may sync with more banks and brokerages. And, Quicken offers chat and phone support while Moneydance only offers email support.

However, Quicken charges of yearly fee of either $34.99, $44.99 or $74.99 depending on your plan tier.

There are two great reasons to consider Moneydance instead of Quicken. First, personal households pay a one-time $60 for a lifetime license. The most similar Quicken plan tier costs $74.99 per year.

A second advantage of Moneydance is its customization potential. Developers can create extensions that don’t require you to upgrade to the latest version to enjoy. Quicken is more likely to require forced updates if you want to continue using their product.

One tidbit most long-time Quicken users may not know is that Intuit sold Quicken in 2016. A private equity firm now owns the platform but Intuit still owns the Quicken trademark. Intuit wants to focus their efforts on Quickbooks and TurboTax.

Here’s our full review of Quicken.

Moneydance Pros and Cons

Moneydance Pros:

- Reasonably priced: The one-time fee of $60 is quite reasonable for a personal finance app that does all that Moneydance can.

- One-time fee: If you’re looking for a budgeting software app, the last thing you need is another monthly expense for the app itself. Moneydance spares you the extra hit.

- Not cloud-based: If you are worried about your data being stored in the cloud, Moneydance doesn’t. It’s stored locally. The Moneydance mobile app syncs with your desktop file to update your financial accounts in real-time.

- License is for personal use and per household: You don’t need to pay per install, pay per person using it, or how many computers you use it on. It’s one license per household for as many computers as you want.

- Free Trial: You can “test drive” Moneydance for 100 transactions. If you like what you see, you can pay the fee, and continue using it. If you don’t, you can simply drop it and move on.

- The 90-day guarantee: This gives you the opportunity to back out with a full refund if you decide you’re not happy with the app, even after you complete the initial 100 transactions.

- Digital reconciliation: You can balance your accounts and reconcile transactions, as well as detect fraudulent activity in any of your accounts.

- Currency conversion: Not everyone regularly engages in foreign transactions, but if you do, Moneydance is the personal finance app for you.

Moneydance Cons:

- Feels cluttered: The dashboard tends to be a bit cluttered and could be especially confusing if you have a large number of accounts included and are still learning the system.

- Importing is tricky: This is not uncommon. To import data you need to make sure the data is exported into a QIF file, which is an ASCII text file generated by Quicken. QIF stands for Quicken

- Interchange Format.

- Limited customer service: Receiving a tech support response may take longer than with other budget software. The Moneydance knowledge base answers many FAQs and you have email support access.

Is Moneydance Worth It?

Moneydance offers a free trial for 100 transactions and a 90-day money-back guarantee, so you can give it a reasonable test drive to see if you like it.

There are so many different budgeting software apps out there and it often comes down to which you’ll be the most comfortable with. Some are fairly simple in nature, like EveryDollar, and others are slightly more complicated, like Quicken. Moneydance could be the app that works for you. If not, here’s our list of some great personal finance apps.

It goes beyond pure budgeting, by offering investment tracking and currency conversions. These will be more important to you if you have multiple investment accounts or regular foreign transactions.

If you’d like more information, visit the Moneydance website.

Martin says

I have been a Quicken Deluxe user for close to 20 years. Every three years I of course had to update to the latest iteration. That wasn’t too much of price to pay to keep track of my accounts. But it did seem the every upgrade or even update would cause minor issues that required me to call tech-support to try and fix the issue. I soon learned to shut off (disable) the automatic update feature so as to keep the software working. The last update I purchased was 2016 and when I was forced to upgrade to 2019 and saw it was a yearly license fee of close to $60, I said enough is enough and started searching for an alternative. That was when I came across Money Dance and decided to try the trial version. It took me about an hour to get used to it and I liked it. The only issue I have is that my bank does not accept direct connect and so I must use the “download QIF” feature to update my registries. Now I know with my Quicken 2016 being unable to download transactions automatically, I could go through the same steps as with MD. But WTF, I have decided to support Money Dance and say bye-bye to Quicken. The way I feel is I don’t use all the features that Quicken says it has added to its program. All I want is all my transactions resting in a database on my little ol’laptop and not floating out there in a fricken cloud for all to possibly hack or access. For a one time fee of $50 Money Dance is hands above Quicken.

Shanitta says

The Money Dance Android app hasn’t been updated since 2017 and when you download it, you get a message “this app was built for an older version of Android and may not work properly”. I’ll pass.

Volkstoy says

Like you, I have used Quicken for a very long time (since DOS days for ME!) I’ve also been frustrated with the “forced” upgrade every three years, but drew the line at an annual subscription model. One of the few things that was holding me up from doing most of my home computing needs on Linux was a lack of a decent personal finance program that I could continue to download my statements with. Moneydance finally filled that gap. Rather than using the QIF format from your bank (mine isn’t supported in Direct Connect either), most banks now support the Open Financial Exchange (.ofx) format, and Moneydance handles that quite nicely! I looked at the Moneydance app for my Android tablet, but it still seems to require a Dropbox link, which I won’t do. 🙁 I have a shared data file on my local network rather than on Dropbox that I *could* set up in a personal cloud, but I prefer my data at least within my control and within my walls.

Jack says

Dividends?

Is it easy to track stock dividends with Money Dance?

greatnorthwest says

Yes, it’s easy to track stock dividends with MoneyDance. You also have the option to track dividends that are automatically reinvested.

Hugh McLeod says

Can I import any data from my MS Money sunset software to MoneyDance?

I’m not sure but they have a 90-day money back guarantee you can use to find out. I imagine MS Money can export in the Quicken format and you can use that to import.

Volkstoy says

I’ve only briefly looked at MS Money sunset software when I was looking for a Quicken replacement, so I’m not absolutely sure, but I *think* MS Money could export to a QIF file (most personal finance programs can, since Quicken Interchange Format is about the de facto format for moving from one personal finance program to another).

SanDance says

Here is the procedure in the archive of MoneyDance Support:

https://infinitekind.zendesk.com/hc/en-us/articles/200684598-Moving-from-MS-Money-to-Moneydance

Here is this procedure in their current help support site:

https://infinitekind.tenderapp.com/kb/importing-data-from-other-programs/importing-from-microsoft-money

Norine says

I have a trial Money Dance. I want to enter an amount in a foreign currency and have MD convert to dollars. How do I do this?

Volkstoy says

I’d suggest you check out the excellent FAQ section on the Moneydance web site. This link seems to be what you’re after:

https://infinitekind.tenderapp.com/kb/currency-and-vatgst/cross-currency-transactions

Richard says

I am moving to Linux, Mint (likely) but maybe Ubuntu. Now using Quicken 2017, on Windows,

1. Can Quicken 2017 be imported.

2. Can Moneydance run on Windows first then convert onto Linux?

3. Charge is a one time event, not monthly or annually etc. Correct?.?

4. If 2 above, do you have to buy twice?

Thanks

Volkstoy says

Like you, I moved from Quicken2017 to Moneydance. The easiest way *I* found was to export from Quicken in QIF files (I did it all at once by marking all my accounts to include in the QIF file), then importing into Moneydance. At least in my case, everything imported just fine. Moneydance is a one-time purchase for as many computers in your household that you want to put it on. You do not need a separate license for each one. I also have a Linux Mint system that I run Moneydance on, and one of the features that I truly like is that I can share the data file over the network with my Windows 10 system(s). You can also copy the Windows datafile to a USB flash drive, then copy it over to the Linux system. I use a small, regional credit union that isn’t in the list for Direct Connect, but I’m able to download my files from the credit union in Open Financial Exchange format (.ofx) that is directly opened in Moneydance. Moneydance handles several file formats for on-line banking, including the .qfx for Quicken, or the more generic QIF (Quicken Interchange Format). Hopefully this answers your questions.

Joel Broida says

Question……is the total price ($49.99) for each computer running installed MoneyDance in the household “or” does it cover all computer residing in the household.

Are these one time payments forever or per year?

Thank you in advance for the information.

Joel Broida

The license is per household. You can install it on as many computers in your household that you want. It’s a one-time payment.

Dan says

Moneydance does a terrible job with tracking securities – it allows two entries for a security because the import file uses either the security name or the numeric ID. This becomes a real problem when importing 0FX, QIF or QFX. The security update feature uses IEX and/or Alphadvantage and both are pretty clunky but, in fairness, other financial software seem to have a similar problem with security updates. In short, the investment aspect of this software seems more like an afterthought than an integral part of this software.

Jeff Smith says

Requires 2 entries? I don’t get what you’re saying. I download my securities from Fidelity and Vanguard automatically… no need to know whether it’s QIF in the background or some other form of connection. It’s seamless. I had the same experience with Quicken years ago, but I’ve been with MoneyDance for 10 years now.

Michael O' says

I am a basic user. I want to have 1 system I can see my transactions and balances. I have created my own budget in excel that is very well done and I use it with my clients. I have also built an excel based debt reduction tool to help determine what method of payment structure to use to eliminate debt and start building wealth (Avalance vs Snowball).

My biggest concern is not the $50 but that Quicken requires an update every 2 years for another $70 give or take to keep downloading my transactions. And now is moving to an annual $50 subscription model to do this.

Is this something that will happen here? I am down to only a few businesses that I do business with so the benefit is starting to be so little that logging into 4 companies to see my life isnt that difficult. However, some of my clients are not as easy and they would benefit from the right tool, but many struggle monthly so it is hard to ask them to pay another $50 a year to help track their spending etc.

Volkstoy says

I don’t think you will have a problem with Moneydance, since it’s an open-source product. While it’s true you’re paying for the program, that’s more for support than it is for the product itself. I purchased an older version of Moneydance on Amazon (2017 version, with an approx $20 savings) and it has updated to the latest 2020 version without any problems.