In 2003, I graduated Carnegie Mellon University with about $35,000 in student loan debt. It was a mix of federal mostly subsidized and a small percentage of unsubsidized loans. If my memory is correct, it was mostly Stafford loans with a small Perkins loan mixed in.

The interest rate was low and servicing the debt wasn’t a problem because my expenses were low.

Back then, a year of Carnegie Mellon cost around $30,000. Graduating with just $35,000 in debt isn’t a testament to my ability, I had plenty of help from financial aid and my parents. Graduating with a loan of about 30% of my college costs seemed reasonable.

Today, a year at Carnegie Mellon is around $77,500.

That puts the four year bill at $310,000.

(that’s more than what we paid for our first townhome!)

And what if you graduated with 30% of that in student loans?

That’s $93,000!

I can’t even begin to wrap my head around a near six figure student loan debt but that’s what many students face. I was lucky to graduate with only $35,000 in debt.

My alma mater has an endowment of around $3 billion, according to their most recent financial report (page 20). Folks often point to endowments whenever they talk about the cost of college. Harvard’s endowment is over $50 billion and it costs approximately $76,000 per year to attend that hallowed institution.

While I don’t know the ins and outs of university finances, I do raise an eyebrow when I see an endowment of $3 billion (and certainly when you see one with over $50 billion) and the price of college. I wonder if there’s room to reduce the cost of tuition… but let’s put that aside for now.

What if you could snap your finger and make college free – would we want to?

Let’s have a fun thought experiment and run through some pros and cons. 🙂

Table of Contents

Before we get into Pros and Cons for this thought experiment, let’s make a few non-trivial assumptions:

- The only thing we’re changing about college is that it is now free. Everything else is being held the same – same quality of education, same number of schools, same number of students, etc.

- We won’t discuss how we make it free, that’s too big of a problem. We’re just going to look at whether it should be free. (for our purposes, let’s just say Warren Buffett decided to pay for it!)

- We’re expanding the idea of “college” to include any post-secondary education. This increase the trades, culinary school, certifications, etc.

Let’s get into it!

Pro: Reduces Student Loan Debt

This is the biggest and clearest reason for making college free – it would eliminate student loans.

I think this is an obvious result of making college free and not one anyone would dispute. 🤣

Pro: Increases Access to College

While you still have to get accepted into prestigious universities, it would increase access to college because many people don’t go (or even consider it) because of cost.

That said, it would also increase competition. The pool of applicants would go up and since schools can’t take more students, the competition would naturally go up too.

This would increase access to college for some and decrease it for others. It’s not always about academic fit or financial means though, colleges accept folks for a variety of reasons but the applicant pool would certainly increase.

Pro: Increases Focus in College

A lot of students have to take part-time jobs to help pay for college. As a result, you’re taking someone who is paying thousands of dollars to go to school and diverting their focus away from academics for many hours a week… just to work a job.

You want students to be focused on education and learning, not working to help pay for college.

Pro: Free to Pursue Any Major

The absence of student loans means you won’t have the classic situation of a liberal arts major with six figure debt. We need people in liberal arts, it’s what helps make our society better.

But liberal arts graduates don’t have the same career prospects as those with more lucrative degrees. This is only a problem because of the high cost of college. If college were free, students would be free to pursue any major – even the ones with lower paying jobs after graduation.

Sure, an engineer may graduate and make more but at least the art history major could earn their, likely, lower salary without carving out a huge junk for student loan payments.

Con: People Do Not Value Free

If you get something for free, you don’t value it as much as if you paid for it.

There are a variety of reasons for this but the main one is that when you pay for something, you have given up something tangible for it – your money. Free college will still cost you time but we don’t value our time as much as we value our money.

If school gets difficult, it’s easier to walk away when you aren’t saddled with the cost. If you pay $30,000 for something, anything, you’re going to value it more than if you paid zero. It’s human nature.

And college is difficult. The premier schools are extremely difficult.

People already quit school after they’ve paid. Imagine if it were free… quitting without any financial repercussions, would make that decision so much easier.

Con: It May Devalue Some College Degrees

If college were free, it could devalue some of them.

The prestigious schools will always be prestigious. They are competitive and people know it.

But what about lesser known schools? The smaller universities that don’t have name recognition outside of their alumni and their local region?

Right now, you can take some courses from Harvard for free. It’s one of many free learning resources online but how many people would give you credit for taking those classes. It’s unclear but I suspect the answer is not everyone.

Con: Those Unfit for College Would Attend

In this case, “unfit” doesn’t mean that they’re not smart enough or anything like that – I simply mean that going to college is not the best choice for them (fit goes both ways!).

Not everyone should go to college but our education system seems to elevate college above all other institutions. If someone wants to become a Master Electrician, there’s little reason they should spend four years at a private college. They should go to a trade school and/or begin an apprenticeship.

We still put college on a pedestal (though it’s a shorter one nowadays) and so a Con is that a kid who would rather be doing something else might be urged to college. At least with college being free, they wouldn’t be saddled with debt!

My Conclusion

I don’t think college should be free. Not exactly a hot take, since “free college” would be exceptionally difficult to implement.

I think that if you make college free, students won’t take it as seriously. They need to have some skin in the game. We all know that kid in college who took a few extra years to graduate… they (or someone close to them) was footing bill those extra years.

College should be cheaper though. Average student loan debt in 2021 was $37,338.

There isn’t a single reason why it’s that expensive… there are a lot of reasons. Inflation, increased amenities, less state funding, etc.

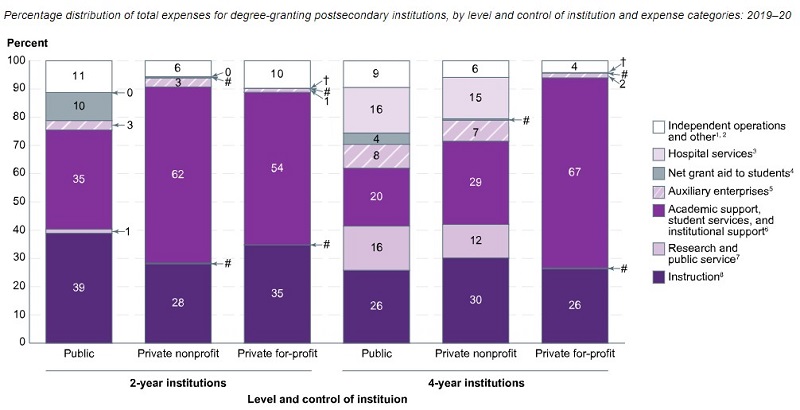

But this chart, from the National Center for Education Statistics, is eye-opening:

At private 4-year for-profit universities, 67% of total expenses goes towards “Academic support, student services, and institutional support.” Only 26% goes towards instruction. Even at private nonprofits, it’s 29% (instruction is 30%).

Maybe that’s an area to take a look at. 🙂

Do you think college should be free? Why or why not?

Robert L Hazelwood says

“Free” college tuition isn’t free. It’s paid for by all the people who work and pay taxes.

Most of the US offers 12+ years of “free” education. 90% of high school students graduate.

Approx 60% of high school graduates attend college.

Approx 60% of college students graduate.

So, 100% of tax payers would now be forced to pay for college for approx. 32% of the students who graduate.

You are correct that no one appreciates “free” stuff.

College is worth it for those who attend a university that they can afford and graduate from.

At some point, everyone needs to be self sufficient. The earlier the better.

Steve Rogers says

Think of it as an investment and not an expense. No modern economy can survive without an educated workforce (yes, including trade and vocational education). Pricing people out of training is economic suicide on a large scale.

We need to get out of this me, me, me attitude and recognize that subsidizing the education of people who will be keeping the economy afloat and providing vital services after we retire makes economic sense.

College graduates earn far more money and pay far more tax over their careers than non-graduates. They work longer before retirement. They are healthier. They raise healthier children that are more likely to achieve higher educational status. They are more likely to get married and less likely to get divorced. They are much less likely to be incarcerated or depend on public services. Purely from a cost-benefit perspective it makes perfect sense for government to make sure that everyone gets as much education as they can absorb. The benefits of an educated populace accrue to everyone, not just the people being educated.

I don’t think education should be free, but I do think expenses at state schools should be capped at the student’s ability to pay, as determined by FAFSA. Not free, but debt-free.

Pat Hill says

NOTHING IS FREE! Someone has to pay for it. It should be those reaping the benefits, not the gullable taxpayers who believe the tooth fairy pays for the free college. Stop providing college loans. College cost go down and student debt goes away.

Dennis says

No, college should not be free. As you said, students need some skin in the game in order to play. Still, it’s a good idea to make it less expensive. In Ga and 8 other states they can use “Hope” funds to help with their costs, if they stay eligible (see link below). When we used this in Georgia, eligibility was based on grades. my son attended college and kept Hope all 4 years to help with expenses. It paid half of his book costs and most of the cost for classes. We had to come up with the balance which also included room and board. This allowed us to get him through 4 years of college with zero loans.

https://www.cga.ct.gov/2000/rpt/2000-R-0945.htm

There are a few of these types of programs around the country. Another reader shared a program in a small town that was funded by a local oil company.

What your son used sounds like a great program!

Phillip says

College shouldn’t be free. Four years of “free” high school should be enough to figure out if college is a good fit. Students and parents must get more educated about college education ROI and whether it even makes sense for the student.

For those college bound high school students, they need to plan ahead and take AP classes and/or community college in high school classes (for free) that give them college course credit, saving them thousands. And when looking at schools, parents and students should then stop the nonsense of paying high tuition prices for mediocre/poor private colleges and seek state schools with much more reasonable tuitions with equal/better educational results and ROI. And if government would be more responsbile in lending for college, many of these “bad” schools would and should close (or get redesigned so that they are competitive and not just moneymakers that put graduates in ridiculous debt with no good career prospects).

I’m not adverse to more government college subsidies for those in need but students need skin in the game.

AP was great for me, I got enough credits to avoid early morning calculus (my crowning achievement) but also graduate a semester early, which saved a ton of money.

You make a good point about responsibility in lending. I think one of the reasons student loans can’t get discharged in bankruptcy is because otherwise banks would never give a loan to an 18yo with no credit!

Michael Hirsch says

Should be reasonably affordable, but absolutely not free. There are many ways to lower the cost of higher education.

Mary Ryan says

I don’t think college should be free, however, the for profit loans that the government has strapped on our youth is appalling. Once the Obama admin decided that the government would be in charge of the loans, tuition has gone up by 37% at most colleges. The colleges now have guaranteed payments and zero accountability. I have 3 children that went to graduate school (law and medical schools) and they have graduate student loans that are 6 figures and with the interest it will probably take them decades to pay off. The interest on the loans started accruing the day of 1st disbursement so that by the time they graduated they already owed at least $10K in interest alone. (Graduate school loan interest rates are around 7% ). Then there is the $2K origination fee slapped on each loan upfront. That’s another $12K-$16K. That $2K is taken from the amount that the student had allocated to get them through a semester, so they start a semester with $2k less than they needed but the privilege of paying interest on it.

These loans should be interest free! The government should not be making a profit off of our youth as they try to get ahead in life. It would seem that the government took over the student loans to help out the colleges and banks, not the students.

Lazy Man and Money says

Colleges should have a free tier. I envision it as a standardized online curriculum developed by the Department of Education. Because it would be a nationwide standard available to everyone, we don’t have to worry about the reputation or selectivity.

It may not be the best education, but that’s not the point. For some students, it would be a great value. The cost would be low compared to the scale of students it would serve.

I know this is a different answer than what you were asking, but it isn’t hard to imagine it being easy to implement – which overcomes the biggest obstacle.

Freemium college??? 🙂

Ron Mote says

Well written article Jim. . . as always. There will always be a cost of college. If not borne by the student then born by the taxpayer. Subsidized to some degree yes, completely free no.

There always is a cost!

Mrs. S says

College should never be free!

Sherry Schwartz says

I think college should be considerably less costly! I don’t think that the tuition fees are really supporting the colleges. Therefore, why burden students or their parents with high costs, resulting in huge unpaid student loans. In response to students not fit for college, free or moderate pricing does not mean that the colleges are bound to accept all students regardless of qualifications.