MySavingsDirect

Strengths

- Available to depositors nationwide

- Competitive rates on high-interest savings account

- No minimum account balance for savings

- No monthly maintenance fees

Weaknesses

- Only offers a savings account and CDs

- CD rates less competitive than top online banks

- No mobile app

- No debit card or ATM access

- No physical branches

If you’ve been searching for a better return for your savings, you may have noticed that online banks are paying significantly more than traditional brick-and-mortar banks.

This includes MySavingsDirect, which is currently paying 4.35% APY on their high interest savings account, which is comparable to rates you’ll find elsewhere but does not lead the pack in any one category.

MySavingsDirect is an online bank, but they’re owned by a regular bank from New York City, and deposits are covered by FDIC insurance.

In this MySavingsDirect Review, I’ll explain why it could be the right place for you to park your savings, while maintaining a relationship with your primary bank.

Table of Contents

What Is MySavingsDirect?

MySavingsDirect is the online banking platform for Emigrant Bank, based in New York City. Emigrant Bank is a full-service bank offering personal and business bank accounts, with a heavy emphasis on mortgage lending. The bank was founded in 1850 and has assets of $5.75 billion as of 2021.

MySavingsDirect specializes in deposit accounts, offering high-interest savings accounts and Certificates of Deposit (CDs) to customers nationwide. Apart from those two account offerings, MySavingsDirect offers limited services. For example, it does not provide a checking account, loan products, a debit card, ATM access, or mobile banking capability.

There are also no physical bank branches, but online banking is offered 24/7 through the MySavingsDirect website. The account can accept direct deposits, but the lack of a mobile banking app means you cannot take advantage of mobile check deposits.

To access your funds, you’ll need to first transfer funds to a linked outside checking account. Transfers made by automated clearinghouse (ACH) can be expected to take between two and four business days.

What the bank does offer is high interest rates with no monthly fees. That can make MySavingsDirect a good choice for consumers looking only for limited-access savings.

MySavingsDirect Features

- Available account types: High-interest savings accounts, certificates of deposit (CDs), and personal mortgages.

- Account ownership: Individual or joint, with the option to add a beneficiary.

- Interest compounding: Daily and credited monthly.

- Mobile banking: Not offered.

- Customer service: MySavingsDirect can be reached by phone or email from 8:00 AM to 11:30 PM, Eastern time, seven days per week.

- Account security: The bank uses encryption to protect your information, including your user ID and password. This reduces the likelihood of information being accessed by unauthorized parties. You can also choose to establish a two-step verification for login purposes for an extra layer of security. Account balances are covered by FDIC insurance for $250,000 per account per depositor.

Precious Metals Storage

MySavingsDirect provides account holders with the ability to store precious metals with the bank. However, the capability extends only to existing customers with precious metals on deposit with the bank. The ability to store precious metals is no longer available to new customers.

High-Interest Savings Account

MySavingsDirect’s flagship product is their high-interest savings account. As of this writing, it’s paying an annual percentage yield of 4.35% APY. There are no fees and no minimum account balance requirement.

MySavingsDirect CDs

MySavingsDirect offers CDs with a variety of terms. They offer CDs from 60 months to 120 months. Rates on these certificates are currently set at 2.00% APY, with the exception of their 30-month CD, which is currently paying 1.50% APY.

Shorter term certificates, with terms ranging from six to 30 months, are available at a current rate of 1.50% APY.

CDs require a minimum deposit of $1,000.

You’ll be notified 14 days before a CD matures. There is a ten calendar day grace period after which the CD will automatically renew. During those ten days, you will have the option to close the CD account.

Early withdrawal penalties on CDs are as follows:

- Term of less than one year: 90 days interest, whether earned or not.

- Term of one year or more: 180 days interest, whether earned or not.

Mortgages from Emigrant Bank

MySavingsDirect is not a direct mortgage lender, but the bank’s webpage does mention mortgage loans offered by Emigrant Bank.

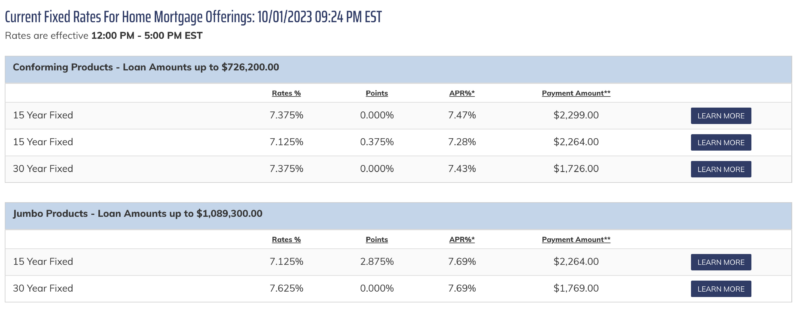

Current mortgage rates offered by Emigrant are as follows:

The website only mentions conventional and jumbo mortgages. There’s no indication Emigrant offers FHA, VA, or USDA mortgage loans.

Though Emigrant Bank is a full-service bank and lender, the MySavingsDirect website lists only mortgage loans. It is unclear if other loan types are available from Emigrant Bank for MySavingsDirect customers.

MySavingsDirect Fees

MySavingsDirect does not charge the usual fees you would expect from a bank. That means no monthly service charges, minimum account balance fees, service charges, or paper statement charges.

Other fees that may apply to your MySavingsDirect account include the following:

- Balance confirmation letter/verification of deposit: $30

- Additional copies: $5

- Legal fee for processing subpoenas, levies, etc.: $100

- Escheatment fee for New York State customers: $10

How to Open a MySavingsDirect Account

You can open an account directly on the MySavingsDirect website by clicking the Open Now button on the home page. To qualify, you must be at least 18 years old, provide a physical address, a valid tax identification number, and have access to a personal checking account at a US-based bank.

When completing the application, you will be asked to provide your full name, date of birth, gender, your mother’s maiden name, any contact phone numbers you have available, and a valid email address. The bank will also require you to provide your occupation, employer name, position title, and total annual income.

As is the case with all financial institutions in the US, you will be required to verify your identity. That will include providing a government-issued form of identification, such as a driver’s license, military ID, state ID, US passport, or alien registration card. The form of identification can be scanned and uploaded with your application.

Funding Your Account

You can fund your account through a direct transfer to MySavingsDirect from your third-party checking account or by writing a check. (Note: the check must be drawn on the same checking account listed when you sign up for a MySavingsDirect account.) But be aware that a check will be accepted only for the initial deposit. After that, all transfers must take place electronically.

You can link a second outside checking account to MySavingsDirect accounts 60 days after account opening.

MySavingsDirect Pros & Cons

Pros:

- Available to depositors nationwide.

- Pays a competitive interest rate on a high-yield savings account.

- There is no minimum account balance for the MySavingsDirect savings account

- No monthly maintenance fees.

Cons:

- No checking accounts, only savings account and CDs.

- CD rates are not competitive with those offered by many online banks.

- No mobile app

- No debit card or ATM access

- No physical branch locations

MySavingsDirect Alternatives

If MySavingsDirect doesn’t interest you, there are other online banks that also provide high-yield accounts. Here are a few alternatives to consider:

CloudBank – 5.26% APY

CloudBank 24/7 is an FDIC insured bank and a division of Third Coast Bank SSB. They offer a variety of deposit products but it’s their savings account that is getting the attention today, currently offering 5.26% APY through the Raisin platform.

Third Coast Bank SSB is based out of Humber, TX and has been in business since 2008. They have 17 locations within the state of Texas but through Raisin, anyone can open an account and earn their high rates.

Blue FCU

Blue FCU is a credit union with a high-interest money market account, currently paying 5.15% APY. The account similarly has a $1 minimum balance requirement. Because Blue FCU is a credit union, your funds on deposit are insured by the NCUA, which is the credit union equivalent of the FDIC. Blue FCU is based in Cheyenne, Wyoming, and has been in operation since 1951.

CIT Bank

CIT Bank is currently paying 4.65% APY on their Savings Connect accounts. You will need a minimum of $100 to open an account, and there are no monthly maintenance fees. CIT Bank is a full-service bank offering checking accounts and mortgage loans, as well as other savings products. Their term CDs currently pay up to 5.00% APY on six-month certificates, with a minimum of $1,000 to open.

Read our CIT Bank review for more.

FAQs

Yes. MySavingsDirect is the online banking platform for Emigrant Bank, a New York City-based bank that’s been around since 1850. It’s becoming increasingly common for brick-and-mortar banks to offer banking services or specific banking products nationwide through a web-based platform.

Yes, when you deposit money with MySavingsDirect, your deposit is protected by the FDIC for up to $250,000 per account, per depositor.

MySavingsDirect is currently paying 4.35% APY on their high-interest savings account and either 1.50% or 2.00% APY on their certificates of deposit, based on the desired term. These rates are available at the time of this review and are subject to change at any time.

MySavingsDirect does not offer a mobile app, and they don’t indicate whether they will offer one in the future. The entire banking process takes place on the MySavingsDirect website.

Learn More About MySavingsDirect

Is MySavingsDirect Worth it?

As an online bank, MySavingsDirect can offer deposit accounts without any monthly fees. With a current savings account yield of 4.35% APY, it’s an OK choice if you’re looking for a place to store your excess savings. Unfortunately, their CD rates are less attractive.

If you’re choosing between it and another bank with higher rates, you may find better options on our list of the best high yield savings accounts.

If you do decide to open an account with MySavingsDirect, keep in mind that they don’t offer checking accounts, so you will need to maintain a banking relationship with your primary bank.

david says

This “bank” offers what they call “non transactional accounts”. By that they mean that you can’t link any accounts other than the original funding account and to change that requires you to go through a lengthy snail mail process. No other AHC transfers, auto debits, or linking is allowed. They won’t send you a check unless you close your account and to top it off they ding you all accrued interest if you close your account before the end of the month – effectively charging you an early withdrawal penalty. Obviously they have decided to make getting your own money back as difficult, inconvenient, and costly as possible. Customer service is rude and unhelpful. They should be ashamed.