The most important thing about investing is starting early.

I want to show you something… (the image is a bit dated, which explains the dates cited below, but the point still holds)

(This post was originally published in 2016 and then updated in 2021. Everything substantive in this post is accurate as of 2016, now we have four kids! I just checked the account in late 2023 and it's over $500,000 with no additional contributions. It's all market returns!)

That Rollover IRA at Vanguard contains money from every employer-sponsored 401(k) I've contributed into. It's subjected to the same annual contribution limits as any other 401(k) plan, so I have no special advantage outside of just saving a lot. And early.

I don't have my historical contributions handy, those papers have long been shredded and my account access terminated, but if I were to guess my contributions were less than $100,000 total and employer match accounts for probably another $215,000. The last contribution would've been made in 2008, when I quit my job to blog full-time.

What you see is the result of early savings compounded over the last ~12 years.

Since I didn't have my records, I was a little skeptical about how much I put in. But the S&P500 index has gained 97.06% since July 3, 2003 until January 14, 2016. It's plausible that my investment doubled in that short a time period. Vanguard's Total Stock Market Index historical performance is similar, $10,000 at the end of 2005 would be worth over $20,000 just 10 years later, albeit a bumpy ride.

I recognize I've been fortunate that I started a business that generated a nice side income. However, my Rollover IRA only contains contributions from the days when I was an employee. It's subject to the same rules as your 401(k) — which is to say annual contributions are capped at $18,000 (for 2015, it was less when I started working in 2003).

Saving and investing early will trump larger dollar contributions later.

This is a prime case of how smart work beats hard work. Investing early is the smart work.

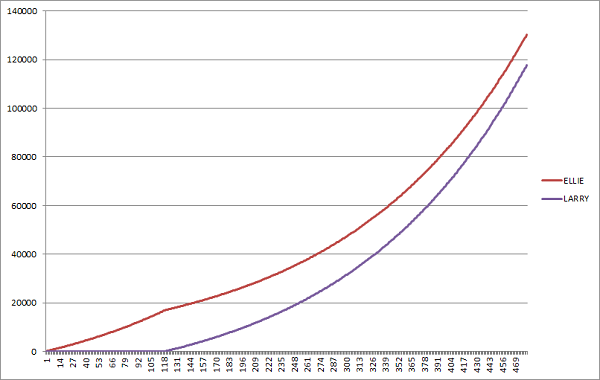

Let's illustrate this with two extreme cases… Early Ellie and Late Larry.

Both start working at 20 and both want to “retire” at 60. The market returns 7% a year, compounded monthly.

- Early Ellie diligently invests $100 a month for ten years. She stops contributing when she turns 30 but leaves the money in the market for the next thirty years until she's 60.

- Late Larry waits ten years before he starts investing $100 a month into the stock market for the next thirty years until he is also 60.

(the average stock market return, Dow Jones Industrial average specifically, from 1965 – 2018 was 6.28%)

Early Ellie invests early, Late Larry waits and is, well, late.

Who ends up with more money? Ellie who has personally contributed $12,000 or Larry who has personally contributed $36,000?

- Ellie – $141,303.76

- Larry – $122,708.75

Ellie has contributed $24,000 LESS than Larry but because time is the friend of compound interest… she wins. By a LOT.

The power of saving and investing early is massive.

In investing, slow and steady is good. Early and often is better.

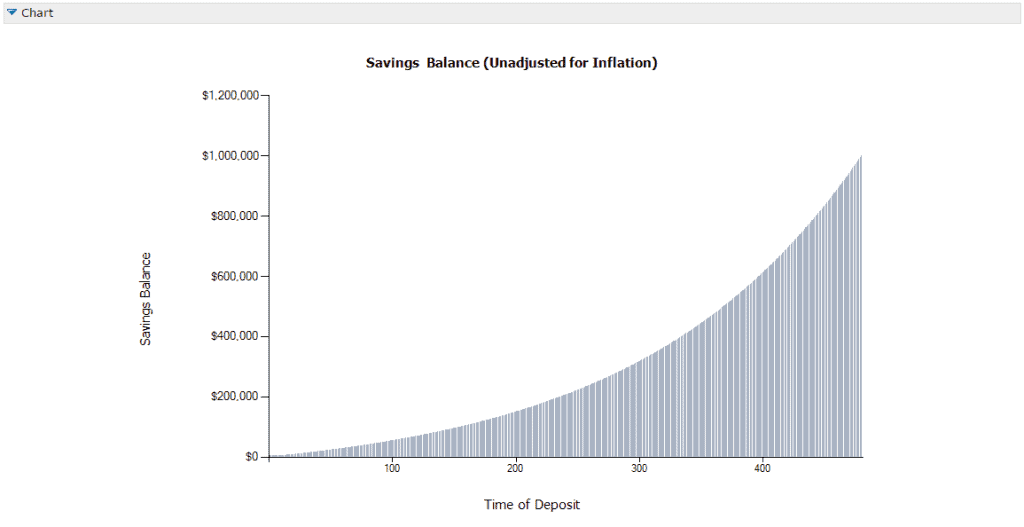

What if you want to retire a millionaire?

The answer is even simpler. If you start saving at 20 and retire by 65 (45 years later), with the same 7% return, you need to save $402.50 a month — $4830 a year. In retirement, you will have a nest egg of $1,000,420.38.

Nearly $5000 a year may seem like a lot, especially if you just entered the work force or you have a lot of loans to pay back. Not to worry, to reach a million dollars you don't have to increase your savings amount (but you should!). The more you're able to save early, the harder it will work for you later on.

As someone who is now married with two kids, there is no better time to save than early in your professional life.

Want to get started? Here's our guide to investing your first $1,000 in the stock market.

Maggie @ Northern Expenditure says

I always love a good compound interest post! It’s so fun to plan with numbers like that and very motivating to make bigger contributions today!

🙂

Brian @DebtDiscipline says

You can’t beat the math. Early and often always wins!

Even though we all intellectually understand it to be true, I still find it amazing to see how powerful compound interest is.

John says

Jim,

Thanks for the reminder that we need to get started early. I was fortunate to get serious about savings in my mid-20’s, but wish I had started sooner! I’ve emphasized to my kids to start as soon as possible and both of my daughters had Roth IRA’s by the time they were 16!

No matter how old you are, today is a great day to start savings. As the old adage goes, the best day to plant a tree was 20 years ago. The second best day is today. Investing is the same way……

John

That old proverb about the best time to plant a tree never fails!

Mrs. Groovy says

The compounding is powerful stuff! Mr. G and I both started late. But I’ve been getting an employer contribution of 8% for the last 10 years and Mr. G gets 4%. We each do the $24K max and $6,500 on the Roths. With additional investing, we’re making up for lost time. I give myself a break about wishing I started earlier, because I was in a profession where the unemployment rate is about 90%. I can only look ahead, not back.

Yikes, 90%?

Mrs. Groovy says

Acting. The years I earned $3K to $5K, with enough covered work to collect unemployment and earn pension credits were good ones.

That makes sense, acting seems like a very challenging line of work to be in. I’m friends with Chip Chinery and heard some of his stories in that world so I have a small sense of what you mean.

fehmeen says

The power of compounded interest rates always amazes me. It works really well in your favor if you are saving money, and it shreds your financial health to pieces if you are on the borrowing end…

Yes indeed!

Valerie says

I started at 19 adding to my company 401k in Feb of 1998. $7.15 an hour at 15% of my wages until 2000. After that my wage increased to $16 or more an hour. I kept adding 15% until 2006. After that, I dropped it down to 5% as I continued to buy more real estate investments. Market collapse in 2009, and I kept my contribution between 0 and 5%. Fortunately, I chose my investment allocation wisely and didn’t touch it. January 31, 2016 balance: $256,328.45. My total contributions: $53,548.97. My employer match: $48,228.05.

Wow! That’s awesome!

Andrew@LivingRichCheaply says

So true! I’m lucky that my father encouraged me to invest at an early age. I opened an IRA and contributed to my 401k at my first job. Many of my peers said they couldn’t “afford” to save anything but somehow still had money to go party, make car payments, and eat out all the time. Slow and steady wins the race and while it didn’t seem much back in the day…compounding really does work magic. The balance sheet isn’t impressive in the early days but give it some time and it is really worth it.

Yes! Long term thinking always wins out and every account starts with a $0 balance. Good on you Andrew!

Norman says

This is exactly the type of information that people need to learn, especially when they are young and have many years left in the market! You’re able to word it so simply and clearly.

Thanks! Help spread the word! 🙂

Mom from AK says

Yes, my husband and I have been guiding our daughter. She has a Roth since age 15. 100% of her summer job gross income went to her Roth. Then we gave her an allowance as her spending money. She has already seen a 27% return and continues to invest her summer income. My husband ran the numbers for her and it got her excited about investing. Hopefully she will graduate from college debt-free and can invest the max into her 401K, Roth and HSA sooner than later.