🚨 Intuit has announced that Mint.com will be shutting down on March 23, 2024. They’ve pointed users to consider Credit Karma instead but I don’t think that’s the best solution – here are our favorite Mint alternatives.

If you want to get ahead financially, save more than you spend, then budgeting is the key.

But choosing the right budgeting software can be an agonizing process.

How do you know if it’ll work? What tools does it have? Is it easy to use or a pain in the butt?

Today, we’re going to take a look at one of the giants in the industry – Mint.com.

Mint.com offers a full-service budgeting app, but also free credit scores and the ability to find better deals on virtually every financial product that you use, all with no fee. It’s 100% free and ad-supported.

Table of Contents

What is Mint.com?

Mint.com is an online personal budgeting platform that brings your entire financial life into one online application. The app is part of Intuit (makers of TurboTax) and has over 15 million users. There is no software to purchase, and the app is completely free to use.

Best-known for its extensive budgeting capabilities, the app enables you to link your checking and savings accounts, investment and retirement accounts, loans, credit cards, and PayPal account in one platform.

How Mint.com Works

When you set up an account with Mint, you link your various financial accounts to the app. After that, each time you visit the site, your financial information is automatically updated. The app will then provide all of your financial information, complete with graphs and charts for visual presentation.

The app enables you to see your complete financial situation in one place. This makes it easier for you to know exactly what’s going on with your finances, particularly if you have dozens of financial accounts. The app can summarize and sort your accounts into relevant categories, enabling you to know exactly where you stand at any point.

With all of your information summarized, it makes budgeting easy. We’ll get into specifically how that works a little further down.

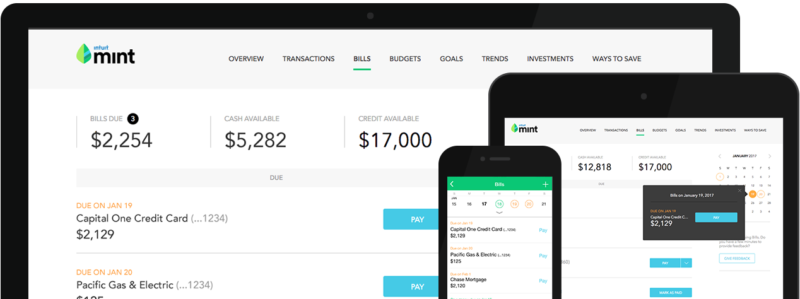

Mint.com access – The app is available through your home computer, as well as mobile devices. This includes iOS, Android, Apple Watch and SMS.

Mint.com Security – Having all of your financial information summarized on one site can seem like a potential security risk, but Mint.com has that covered.

Mint uses multifactor authentication so that only you can access your information. For example, while most sites require just a username and password, the Mint.com also requires special security questions or a code from a text message or email.

They also provide you with your four-digit code so that only you can view your information. You can also set up Touch ID for extra security if you choose to do so. And if your mobile device is lost, you can delete your account information remotely.

Mint.com also uses security screenings with VeriSign to ensure security for the transfer of sensitive data.

Mint presents your information in “read-only” fashion. That gives you the ability to access your financial information at any time you choose, while Mint has no control over any of the accounts displayed in the app.

Finally, Mint connects to your accounts using OAuth when offered by your banks. You no longer have to put in your bank username and password into Mint, you just tell your bank that you want Mint to have access, they send Mint a token, and now you can get your data. This token only permits read-only access too, so there’s no fear that Mint (or someone accessing it) will be able to do anything. This is a recent development so banks are coming online to support it.

Mint.com Features and Benefits

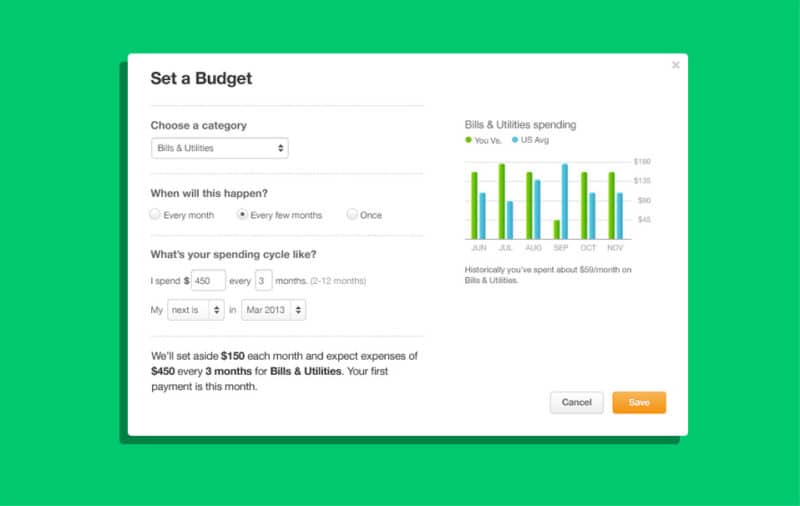

Mint Budgeting

With all of your accounts properly categorized and aggregated, Mint can provide you with a summary of your activity. This will give you the ability to create a simple budget, even though you have multiple accounts.

You can set up predetermined spending targets to help you control your spending. But the app can also compare your spending in each category with national averages. You can adjust your budget as necessary going forward. It’s a perfect application if you have multiple financial accounts and previously weren’t able to assemble them in a way that would allow you to create a workable budget.

Mint Bill Paying

Mint enables you to see all of your bills on the app. That will give you the ability to know what bill is due and when. That will simplify the bill-paying process, and take a lot of stress out of it. For example, rather than logging onto multiple websites to pay bills, you can track and pay all of them on the Mint app.

Mint provides you with bill reminders, ensuring that you pay your bills on time. The reminders can come either by email or to your mobile phone. That by itself will keep you from having to pay late fees.

What’s more, if you access the app from your mobile device, you can pay your bills at any time. You can either schedule payments in advance, or make them immediately – it’s your choice.

Mint will alert you if bills are coming due, and your funds are running low. They will also inform you of any overage charges, late fees, or suspicious activity. The app can even let you know if you’re in danger of going over your credit limits on credit cards or credit lines.

Mint Goals

This tool can help you to set specific financial goals, such as getting out of debt or saving money for the down payment on a house.

Once those goals have been established, Mint will enable you to track your progress. You can then make changes in your financial behavior and activity to help you reach your goals.

Mint Credit Monitoring

Mint will give you access to your credit score, completely free. And in addition to the credit score itself, the app will also provide you with suggestions as to how you can improve it. They will also provide you with credit monitoring alerts, showing any suspicious activity in your accounts. They will let you know anytime Equifax receives new credit information from lenders. That can help you to know if someone might be making a major purchase on one of your accounts or is applying for new credit in your name.

Best of all is that Mint.com’s free credit score is just that – free. They don’t require you to provide credit card information “on file” to access the service, the way so many other “free” credit score services do. The credit score service is part of the overall package with Mint.com.

Mint Investment Tools

Mint.com is not a robo-advisor, nor do they provide any direct investment recommendations. However, the app does enable you to track your investment accounts and to summarize them on the app, just the way you can with other financial accounts. This makes it easier to track and manage multiple retirement accounts and investment brokerage accounts.

This will allow you to see exactly where your money is invested, providing a holistic view of your combined portfolio, and give you the ability to create a better investment diversification plan.

Fee analysis – Mint analyzes your investment and retirement accounts, to show you exactly what you are paying in fees. This includes hidden fees that may not be obvious when you review your investment statements.

For example, Mint will look for advisory fees, transaction fees, and retirement account fees, such as 401(k) fees. They can let you know exactly what you’re paying for an investment service. This will also help you to eliminate any unnecessary fees that you may be paying without realizing it.

It’s a solid suite of tools, especially for free, but it’s not as comprehensive as investing-focused tools that were released later, like Personal Capital. (see our review of Personal Capital)

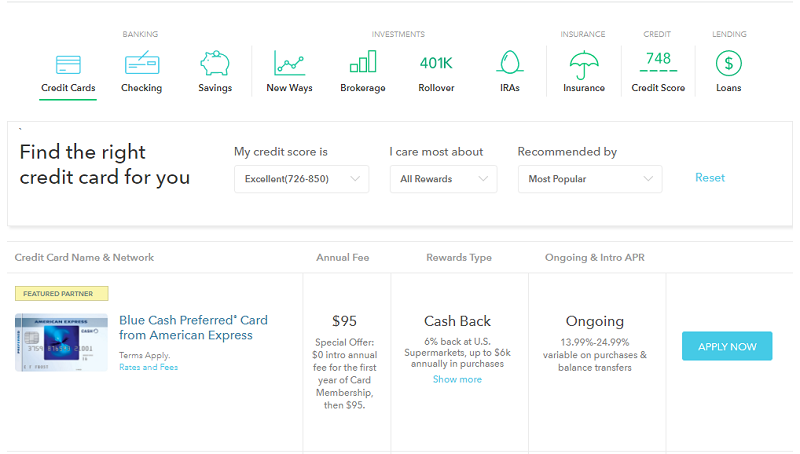

Mint.com Find Savings

This is one of Mint.com’s very best features. It’s one thing to organize and track your finances, but quite another to make improvements. Mint.com does exactly that with its Finding Savings feature.

Mint.com can analyze financial offers, and provide information that may be beneficial to your specific situation. You can then apply for those services directly from the Mint app.

For example, Mint can let you know where you can find higher interest rates on your bank savings, or lower interest rates on credit cards for someone in your credit score range. They can also help you to find investment brokerages that have the lowest fees, as well as where you can get the best insurance policies or the most favorable IRA rollover deals.

They can also make recommendations for personal loans and student loans, suggesting the best opportunities for refinancing and consolidations.

Mint.com Fees

Mint.com bills itself as a free service, and that’s exactly what it is. There’s no software to purchase, no hidden fees, and no requirement to put credit card information on file for any purpose. You simply sign up for the service and use it as you need to.

If Mint is free, how does Mint make money?

If you’re going to assemble your financial life on an application, you certainly want to know that the company behind it is making money and will be able to continue operating.

Mint makes money in two key ways:

Mint.com’s Find Savings feature is really an advertising platform. They recommend ways to save money and if you take advantage of any of the products or services that are offered, Mint earns a referral fee or commission. The referral fee is paid to Mint out of the normal fees that the vendor will charge for their services and there is no additional charge to you (and the vendor usually won’t charge you a higher fee than they would to someone who is not referred by Mint.com)

Next, Mint will aggregate your consumer data with other users and sell it to partners. They pool this information so that their partners won’t know your specific information.

Should You Use Mint.com?

If you’re looking for a good budgeting system, Mint is one of the best. Mint.com is a completely free service to use, which means that you have virtually no risk in using the app. You can pay for budgeting software elsewhere, but it won’t necessarily be better. And let’s not forget the free credit score!

There are a few Mint alternatives that you might want to consider if you don’t think Mint will do everything you need. One of their big competitors is a budgeting tool called You Need a Budget – it’s not free but it provides a great budgeting framework that helps you get on track in a way that Mint doesn’t. We compare YNAB against Mint to show you the differences and which does what better.

(another free alternative is EveryDollar, we compare Mint vs. EveryDollar too)

Not only is Mint free to use, but Mint’s Find Savings feature can help you to either earn more money on your savings or pay less in interest and fees to investment brokerages or lenders. The savings that you achieve by taking advantage of their recommendations can add up to many thousands of dollars over several years.

The combination of the free service and the access that it gives you to better financial services makes Mint.com an easy choice. 15 million people have already made that choice, so what are you waiting for?

Miguel (The Rich Miser) says

I’m tempted to try Mint, but still reluctant because of the need to give it access (even if read-only) to my accounts. But with so many benefits, I may get over that reluctance soon 🙂

A lot of people have saved a ton of money using it, without any (that I’ve heard) reports of problems after giving out their data. Might be worth a look! 🙂

James Doherty says

The way to get mint.com to work for you is to have all of it benefit work for you at the same time. I know it’s very hard to achieve that goal. When you have all of your financial transactions in the right category. That will show you your correct budget. With a proper budget that will be able to show you how much money you will have to save up for your or your family retirement. The way mint.com can save money for you or your family. Most people be able to save money to know where you have the weakest part of your budget.