Personal loans have become increasingly popular in recent years. They’re offered by many banks and credit unions, and an entire industry of peer-to-peer lenders has sprung up, specializing in personal loans.

That’s created many more sources for consumers to obtain personal loans. But probably the biggest benefit has been to borrowers with poor or bad credit. Because of the explosion in the number of specialized personal loan lenders, there are more options for consumers with impaired credit than ever before.

Table of Contents

- What are Personal Loans?

- What are the Benefits of Personal Loans for Poor or Bad Credit?

- Your Credit Score May Improve

- 7 Best Personal Loan Options for Poor or Bad Credit

- FAQs

- What’s Considered Bad or Poor Credit?

- How Will I Know if a Lender will use Major Negative Credit Events?

- Why are Dedicated Personal Loan Lenders More Likely to Accept Poor or Bad Credit than a Bank or Credit Union?

- How Does the Application Process Work with Personal Loans for Poor or Bad Credit?

- What Rates and Fees Should I Expect with Personal Loans for Poor and Bad Credit?

- What’s the Difference Between Personal Loans for Poor or Bad Credit and Payday Loans?

- Bottom Line

What are Personal Loans?

“Personal loans” is something of a catchall term for loans that don’t fit neatly in other categories. Personal loans are like car loans or mortgages in that they have a set term with predetermined payments, but they don’t have an asset backing them as car loans and mortgages do. Credit cards could kind of be considered personal loans but, being revolving debt, they are in a different class altogether.

Generally speaking, personal loans are available for just about any purpose. This includes debt consolidation, refinancing of credit card debt, covering large medical expenses, paying for a wedding or vacation, or making major purchases.

Some consumers have even used larger personal loans to purchase autos or for business financing. All those purposes are possible because personal loans typically don’t restrict how the proceeds are used.

Still another defining feature of personal loans is that they are unsecured. This is different from home mortgages and auto loans, which are secured by the underlying collateral.

They’re generally available in terms ranging from 24 months (though it can be less) to 84 months (though it can be more). Both the interest rate and the monthly payment are fixed for the term, after which the loan will be fully paid.

As to credit, personal loans are now available for nearly any credit profile. That includes poor or bad credit. But if that describes your credit profile, you should expect to pay a higher interest rate. These are typically as high as 36%, and may also include payment of an origination fee, that may be as high as 5% or even 10%.

What are the Benefits of Personal Loans for Poor or Bad Credit?

There are multiple advantages to personal loans for poor or bad credit. Below are the most important:

They’re unsecured. You can qualify for a personal loan, even if you have no assets to pledge as collateral. Since this often is the situation for people with poor or bad credit, personal loans can be an excellent choice for financing.

They can be used for just about any purpose. Once your loan is approved, there’s practically no limitation on what the funds can be used for. That will give you the option of either paying off other high interest debt, or covering a major expense, like medical costs.

Approval is quicker than most other loan types. Depending on the lender, personal loans are often approved in just two or three days. That compares with several weeks for home loans and credit cards.

Funding is fast. Once a personal loan is approved, funding can be available as soon as the next business day. This makes it a perfect choice if you have a pressing financial need the financing needs to cover.

They’re available from multiple sources. Personal loans are now available from banks, credit unions, and direct personal loan lenders. You’ll have plenty of source options if you choose to apply for one.

Loan amounts are higher than other loan types. If you have bad or poor credit, you’re probably aware payday loans are generally $1,000 or less, and credit cards for bad credit are typically no more than $500.

Personal loans, even with poor or bad credit, are often available for several thousand dollars.

Interest rates, while high compared to traditional loans, are low compared to most other loans for borrowers with poor or bad credit. Though you should fully expect an interest rate over 20%, or even 30%, if you have bad credit, that’s still a lot lower than other types of financing for bad credit.

For example, effective interest rates on payday loans can easily exceed 300%.

They’re available for specific terms, after which they’re paid in full. Credit cards and payday loans tend to keep you in a debt trap. Once you tap the loan for the first time, it tends to hang around forever. Personal loans are installment loans for a limited amount of time.

For example, a typical term is 36 for 60 months. During that time, both the interest rate and monthly payment will be fixed. And at the end of the term, the loan will be gone forever.

Your Credit Score May Improve

This is a personal loan benefit that rates a discussion all its own. If the reason you’re taking a personal loan is to pay off multiple existing loans, particularly credit cards, your credit score may get an upward bump in a matter of weeks.

There’s a bit of a push-pull involved in this process. Your credit score will take a bit of a dip because you will have obtained a new loan. Since the new loan is unproven, it will cause your credit score to drop.

But if you’re paying off several existing loans, your credit score will improve once they’re paid. The payoff of four or five existing loans or credit cards is likely to result in a bigger increase than the decrease from the new loan. Some personal loan borrowers have reported credit score increases of 20 or 30 points within 30 days.

Personal loans can also help you to improve your credit score if you use them to get out of debt. For example, credit cards are designed to keep you in debt forever. This is why they’re referred to as “revolving debt”. As you pay off previous balances, you add new balances. The net effect is that you always carry a balance and a high rate of interest.

Since personal loans are term loans, they’re completely paid off within a few years. Your credit score is likely to improve as the balance declines, and even more so when the loan is finally paid off.

And it should go without saying, your credit score will improve with a satisfactory payment performance on the loan. This can be especially important for borrowers with bad credit. The reason they have bad credit is often because there’s a long list of negative entries on their credit reports. But by adding a good credit reference, the credit score will improve.

With those advantages in mind, let’s get on to our list of the best personal loan options for poor or bad credit.

7 Best Personal Loan Options for Poor or Bad Credit

Monevo

Monevo is an online personal loan marketplace, enabling you to get loan quotes from multiple lenders by completing a single online form. The platform includes participation by over 30 top lenders & banks.

They offer access to all types of personal loans, not just those for bad credit. However, they do indicate loan programs available for credit scores as low as 450. That would take in the vast majority of applicants who are considered to be in the bad or poor credit category.

Loans are available for as low as $500 to as much as $100,000. And while they advertised rates as low as 2.49% APR, you should expect to pay considerably more if you have poor credit.

OppLoans

OppLoans is not only a good source for loans for applicants with poor or bad credit, but also for those looking to improve their credit. That’s because OppLoans not only grants loans for poor credit, but they also report your payments to the major credit bureaus. This will give you an opportunity to improve your credit score by building a good credit reference.

Best of all, they don’t have a specific minimum credit score requirement. They do investigate your credit history, but they do it using information from alternative credit sources as well as available bank data.

One of the primary benefits for dealing with OppLoans is that the service is designed specifically for applicants who have poor or bad credit. As such, loans will be smaller and interest rates will be higher than what are offered through other personal loan lenders.

For example, loans range from a low of $500 to a high of $4,000. They carry a term of 24 months, but the interest rate charged will be 160% in most states.

That may seem like a higher rate to pay, and it is. But it is an opportunity to get financing when no other sources are available. Just as important, no collateral is required.

Despite the high interest rates and small loan amounts, OppLoans offers a real opportunity for applicants with poor or bad credit to get a loan, as well as a chance to begin rebuilding their credit by making their payments on time.

OneMain

OneMain is one of the better-established lenders for those with impaired credit. The company has been in existence for over 100 years, and even has more than 1,500 brick-and-mortar locations in 44 states.

The company claims to be the largest personal installment loan company in America, with 2.3 million customers.

Both personal loans and auto loans are offered, ranging from $1,500 to as much as $20,000. However, both the minimum and maximum loan amounts will vary based on your state of residence. Like most personal loans, these are term loans with a fixed interest rate and monthly payment. They don’t provide an interest rate range, but they do indicate the average cost of a loan is 27% APR, with a maximum of 36% APR.

Like most personal loan lenders, they also charge origination fees. If it’s based on a flat fee, it can be anywhere from $25 to as much as $400. But if it’s charged on a percentage basis, it can range between 1% and 10%.

To apply, you’ll need to visit a OneMain branch office to complete the application and supply required documentation. Once approved, the funds will either be deposited into your bank account, or you can pick up a check at the branch location.

BadCreditLoans

BadCreditLoans makes all types of loans available to applicants with bad credit. That includes not only personal loans, but also credit cards, business loans, student loans, auto loans, and various types of mortgages.

Personal loans are available at interest rates ranging from 5.99% to a high of 35.99%. Loan terms are from a low of 90 days to as long as 72 months. Because the emphasis is on borrowers with bad credit, loan amounts offered are on the low side. The minimum loan amount is $500, while the maximum is $10,000. Personal loans are unsecured, and feature a fixed interest rate and fixed monthly payments.

Like some of the other lending platforms on this list, BadCreditLoans is an online personal loan marketplace, and not a direct lender. As such, specific loan amounts, terms, and pricing will be determined by the lender that approves your loan.

The company discloses that “our qualification requirements (are) simple enough to allow almost anyone to qualify, even applicants who would most likely not be approved elsewhere.”

Learn more about BadCreditLoans.

Avant

Avant is not specifically a lender for bad credit personal loans. Instead, they offer personal loans to borrowers at most credit levels. The company reports having provided $6.5 billion in loans to more than 1 million customers, making it one of the more popular personal loan sources in the industry.

The company doesn’t indicate a minimum credit score, but they do say the range of a typical borrower is between 600 and 700. 600 is right at the border between fair credit and poor credit. But if you can qualify, they offer unsecured personal loans in amounts from $2,000 to as much as $35,000.

Loan terms are 24 to 60 months with interest rates ranging from 9.95% to as high as 35.99% APR. You should also expect to pay an administration fee as high as 4.75% of the loan amount issued. If approved, you can expect to receive your loan proceeds as early as the next business day.

LendingPoint

LendingPoint bills itself as a loan source for borrowers with fair credit. That’s not necessarily poor or bad credit, but sometimes the difference between the two is just a few points on your credit score. And if your credit has recently improved to the “fair” level, LendingPoint may be an option.

You should also be aware that credit descriptions, like excellent, good, average, fair, and poor, are subjective. That is, they largely depend on the lender’s interpretation. One lender may consider a 620 credit score to be poor, while another will classify 580 as fair. With LendingPoint, the minimum required credit score appears to be 585.

LendingPoint reports that more than 7 million people applied for financing through the company in 2020. You can apply online and get your loan decision in as little as a few seconds. If you’re approved for financing, the loan proceeds will be available as early as the next business day.

Loans are available in amounts ranging between $2,000 and $36,500, with interest rates between 9.99% and 35.99% APR.

Learn more about LendingPoint.

Peerform

Peerform is yet another online personal loan marketplace. Like other online marketplaces on this list, they don’t specifically provide loans for borrowers with bad or poor credit. In fact, Peerform is more of a peer-to-peer lending platform.

You’ll submit your application through the website, and it will then be listed for evaluation by prospective investors. If one or more are available to fund your loan, you will be approved and the proceeds provided to you.

Loans are available in amounts ranging from $4,000 to as much as $25,000, and can be taken for just about any purpose, including debt consolidation and credit card refinancing. And since the loans are for a period of 36 or 60 months, the debt will be fully repaid at the end of that term. Both your monthly payment and your interest rate are fixed, and the rate can range from a low of 5.99% to a high of 29.99%. The loan origination fee will range between 1% and 5% of the loan amount requested. If you have poor credit, you should expect the fee to be 5%.

| Loan Amounts | APR | Origination Fees | Terms | ||

| OppLoans | $500-$4,000 | 160% APR | Varies by state | 24 months | Learn more |

| OneMain | $1,500 – $20,000 Varies by state | max 36% APR | Flat fees are between $25 and $400 Percentage basis between 1% – 10% | Varies | Learn more |

| BadCreditLoans | $500 – $10,000 | 5.99% – 35.99% Depending on credit | Varies by state | 90 days – 72 months | Learn more |

| Avant | $2,000 – $35,000 | 9.99% – 35.99% | 4.75% | 24 -60 months | Learn more |

| Monevo | $500 – $100,000 | as low as 2.49% | Varies by specific lender | Varies by specific lender | Learn more |

| LendingPoint | $2,000 – $36,500 | 9.99% – 35.99% | up to 6% | up to 60 months | Learn more |

| Peerform | $4,000 – $25,000 | 5.99% – 29.99% | 1% – 5% | 36 – 60 months | Learn more |

FAQs

What’s Considered Bad or Poor Credit?

The definition of bad or poor credit – or any other credit classification – is largely subjective. That is, they are a set of terms assigned by each lender to specific credit profiles. Some lenders make this determination based on credit score ranges, while others give more weight to specific credit factors.

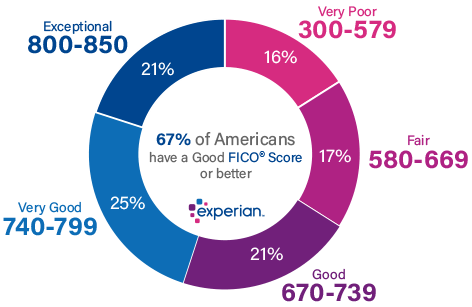

When it comes to credit scores, a more objective set of credit score ranges are published by Experian, which is the largest of the three major credit bureaus.

The credit score ranges provided by Experian are as follows:

However, these are the score ranges assigned by Experian. Each individual lender will have its own score ranges. For example, a lender might determine a credit score of 740 or higher as excellent credit. 700 to 739 may be considered good credit, while 640 to 699 may be considered average.

The lender may also have a cutoff of 640, so that they will not extend credit to borrowers with lower scores. For practical purposes, a score of below 640 will be considered bad credit to that particular lender.

Many lenders also look closely at specific credit events. For example, even if you meet the lender’s minimum credit score requirement, your application may be declined if your credit report reflects certain derogatory information.

It’s common for lenders – particularly banks – to exclude borrowers who have foreclosures or bankruptcies within the past five or seven years. Many will also exclude a borrower if there’s a pattern of late payments, particularly on installment loans. And it’s very common for a lender to reject the applicant if they have an unpaid judgment or tax lien.

The reason is that judgments and tax liens are superior liens. They automatically take precedence over new loans, which increases the likelihood a lender will not be paid on default.

If you are looking to increase your credit score check out Experian Boost. Here’s our full review.

How Will I Know if a Lender will use Major Negative Credit Events?

Some lenders publish this information on their websites. But if it isn’t available, you should contact the lender for clarification.

Some lenders don’t even indicate specific credit score minimums, though they may list negative credit activity that will result in a decline. Pay careful attention to the details. Any one of them can have your application declined, even if you have a satisfactory credit score.

Why are Dedicated Personal Loan Lenders More Likely to Accept Poor or Bad Credit than a Bank or Credit Union?

Banks and credit unions are heavily regulated financial institutions that make loans out of their customer’s deposits. This requires them to minimize the amount of risk they’ll accept with any loan. To mitigate that risk, they may require credit score minimums, as well as credit event restrictions, that exclude borrowers with fair credit, let alone bad or poor credit.

For example, a bank may automatically exclude anyone with a credit score below 650, or a major credit event, like bankruptcy, foreclosure, or recent 60-day late payment.

Dedicated personal loan lenders don’t lend based on customer deposits, nor are they regulated to the degree that banks and credit unions are.

Some lenders are funded by investors and are frequently referred to as “peer-to-peer (P2P) lenders. Borrowers come to the platform to obtain financing, while investors come looking for high-yield loans to invest in. Many investors are willing to fund loans to borrowers with bad or poor credit as a way of increasing their overall yield on their loan portfolio.

P2P personal loan providers also recognize that borrowers frequently improve their financial situations using a personal loan.

For example, by consolidating several high-interest credit cards into a single personal loan, the borrower often benefits from a lower monthly payment than they have with multiple credit cards. Individual investors can make that determination, while a bank or credit union may not be in a position to do the same.

This is why dedicated personal loan lenders are almost always the better choice for borrowers with poor or bad credit.

How Does the Application Process Work with Personal Loans for Poor or Bad Credit?

In most cases, you’ll be able to make application directly on the lender’s website.

That will involve completing a brief application, in which you’ll provide general information. This will include basic information like your name and where you live, as well as your occupation and income. The application will also request you provide a reliable estimate of your credit score, as well as the purpose of the loan.

It’s important to be as accurate as possible with your credit score estimate. It should be based on a recent score available from a financial institution you normally deal with, or a free credit score source.

Here are several ways to get your credit score for free.

The lender will base loan quotes on the score you provide. But if you choose to go forward with a loan offer, a “hard credit pull” will be performed. That means the lender will order your credit report, with an actual credit score. Your loan will be based on that score, not the one you provided.

It’s possible the loan offer will be downgraded if the hard pull reveals a lower credit score than the one you provided.

If you accept the loan offer, and the credit score pulled by the lender is similar to what you provided, you’ll then need to provide specific documentation. That may include details of the loans you want to pay off, including lender names, loan balances, and account numbers. The lender may also require certain income information, like paystubs and your most recent W-2. These are typically uploaded to the lender’s website.

The lender’s final review and approval will generally be completed within two or three business days. They’ll forward the loan documents, which you’ll sign electronically.

Once that’s complete, final details will be made and funds will be electronically deposited into your bank account. However, if it’s a debt consolidation loan, the personal loan lender may forward payment directly to each loan that needs to be paid off.

What Rates and Fees Should I Expect with Personal Loans for Poor and Bad Credit?

Let’s start with interest rates. While many personal loan lenders advertise rates as low as single digits, you should not expect to get those rates. If you have bad credit rates in excess of 20%, and even 30%, will be much more likely. Some lenders charge even higher rates.

The main fee you’ll need to be aware of is the origination fee, sometimes referred to as an administrative fee. This fee represents a percentage of the loan amount you’ll take. Though the range can be anywhere from 1% to 10%, the more common range is between 6% and 8%.

The origination fee will be deducted from your loan proceeds. For example, if you take a $10,000 a personal loan with a 6% origination fee, $600 will be deducted from your loan proceeds. That means you’ll receive $9,400 from the loan, instead of $10,000.

The good news is that the origination fee only needs to be paid if the loan is approved and funded. If your loan application is declined, or if it’s approved and you choose not to proceed with the loan, the origination fee will not be collected.

Another bit of good news is that there are no prepayment penalties with most personal loans, including those for borrowers with bad credit. Personal loans also tend to exclude fees common with other loan types, like application fees, credit report fees and document preparation fees.

Since personal loans are relatively short-term, you’ll want to give serious consideration to the dollar amount of fees you’ll be paying. High fees can even offset the benefit of a slightly lower interest rate with another lender.

What’s the Difference Between Personal Loans for Poor or Bad Credit and Payday Loans?

The two have very little in common other than that both are used by borrowers with impaired credit. Other than that, personal loans may be best described as the antidote to the payday loan treadmill.

Payday loans are quite likely the worst loan situation a borrower can be in. The single advantage is that they will make loans to borrowers with the poorest credit profiles. That includes recent bankruptcies are foreclosures, loan defaults and consistent patterns of late payments. Payday loan lenders are virtually unconcerned with a borrower’s credit profile.

That’s because payday loans are based entirely on your next paycheck – which is exactly where the name comes from.

When you make application for a payday loan, the lender will be most concerned with how much your next paycheck will be, and when it will arrive.

Typically, you’ll only be eligible if your paycheck is direct deposited into your bank account, and there’s an outstanding reason for this. When you complete an application, the lender has you complete an authorization allowing the lender to automatically and immediately withdraw the loan amount from your bank account – plus a loan fee – on the day your paycheck is deposited.

Since the lender will have access to your next paycheck before you will, it’s likely you’ll be short when that payday arrives. That may require you to get yet another payday loan. In theory at least, it’s possible for payday loans to become perpetual debts, even though each must be paid off as of the next payday. This is how borrowers with bad credit often get into a vicious cycle of repeated payday loans.

They’re not cheap either. A typical payday loan will be issued for no more than $500, though some may go as high as $1,000. They’ll charge fees of between 15% and 30% of each loan. If the loan is $500, and the fee is 20%, you’ll repay $600, which will include $100 for the loan fee. That puts the effective APR of payday loans well into the hundreds.

Even though you’ll pay admittedly high-interest rates and fees on personal loans for bad credit, they’re only a fraction of what you’ll pay for payday loans. That’s why personal loans for bad credit are one of the best solutions to the payday loan treadmill.

Bottom Line

Persaonl loans for borrowers with poor or bad credit are certainly not the right choice for everyone. But if your main purpose is to get a consolidation loan to pay off existing debt, or high-interest credit cards, it may be the perfect solution.

Even if the interest rate on the new loan is higher than what you’re paying on the debts you’re paying off, your cash flow will improve if the new payment is lower than the total of the previous payments.

And best of all, at the end of the loan term, you’ll be out of debt. And if you’ve made your payments on time along the way, you should also have a much-improved credit score. That’s a win-win for anyone who is in debt already and has bad credit.