When I look at my window, everything looks the same. The grass is growing, the birds are chirping, and the wind blows through the trees. It’s calm and serene.

Inside our home is a different matter, since no one has been outside in months. And that stir-crazy chaos is reflected when I turn on the news, and by that I mean “go on social media or the internet”. For months, there were protests and then various scenes of fights involving face masks. Then, of course, there’s the stock market acting like a child who hasn’t been to school since March – unpredictably and without reason.

We are living in tumultuous times, times that are required for our country to get better and fix the mistakes of the past.

But the process can be a little unnerving. And when it comes to managing your money, good behavior and “unnerving” do not go hand in hand.

It’s times like these that I look to one of my little monthly “rituals” for some solace. At the start of every month, I fire up my net worth Excel spreadsheet and record all the balances from my financial accounts. I still use Personal Capital from time to time but I really enjoy the ritual of logging into each account and giving them a quick peek.

I’ve found that this little ritual helps calm me for five very important reasons:

Table of Contents

1. Helps Maintain a Longer-Term View

We all “know” that investing is about the long term.

But that’s hard to remember when you’re experiencing a volatile period in real-time.

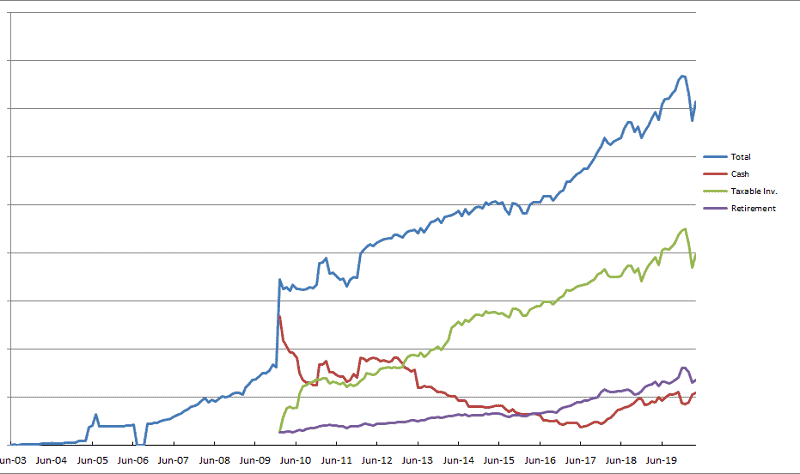

Here is how our net worth has grown from 2003 until earlier this year (2020):

The big spike in the chart (around 2009-2010) was when I sold my first personal finance blog in January 2010 and you can barely see the effects of the Great Recession (December 2007 – June 2009). You can see how the red line slides down as I put some of that cash to work in taxable investments.

I remember living through the Great Recession and it was a scary time. Bear Stearns had collapsed, the Troubled Asset Relief Program (TARP) was underway, and everyone was trying to understand collateralized debt obligations and why all the financial institutions were so intertwined. (did you know TARP had a net profit of $121 billion?)

You can barely see it on my chart. I had a special circumstance (website sale) but I suspect that if you charted out your net worth, you’d barely see it too because the market had an incredible run since.

As I write this, we’re still experiencing the Great Pause in real life but you wouldn’t know it from the market. The S&P 500 just hit new highs. Looking at this chart helps me keep my wits about me when the market goes crazy.

2. Simplify Your Financial Map

If you’re itching for something to do, peek at your net worth and see if there are ways to simplify it.

While I use Personal Capital for a quick snapshot in-between monthly updates, I update the spreadsheet manually. I like the process of logging into my accounts, checking everything, and updating the chart. It’s become a little ritual each month. (if this is you and you want help with automation, consider Tiller as it’s our favorite alternative to Personal Capital for this type of thing)

When I started, I had to log into quite a few accounts and it annoying to log in to an online savings account just to see a few bucks in it. One of the hazards of being a personal finance blogger!

So if you need something to do, make it productive. Simplify your finances and thank yourself later.

3. Volatility is Just Noise

If you look at the stock market, it’s pretty volatile on a day to day basis. If you track your investment portfolio online with a portfolio analyzer, watching it change on a daily basis can be stressful.

But if you only look at it once a month, it’s less stressful. There are times when it’ll go down or up significantly, but when you only see it once then you’re less likely to get too excited or too down.

For example, our net worth fell 4.8% in February and then another 7.6% in March. Ouch.

But then it gained 6% in April and another 5.5% in May.

But in all four instances, I only knew about it after the fact. I knew that the market had fallen and then recovered because I read the news, but I didn’t know how it performed on a monthly basis until I recorded it in my spreadsheet. And when I did, I did it in the morning after waking up while I still had enough mental energy to maintain a level attitude in either case.

There is an analogy about the stock market and the economy being like a dog going for a walk:

My friend Josh Brown likes to use this analogy. Imagine you see a woman walking her dog in the park. The woman generally walks in a straight line. The dog, however, darts around in every direction.

Since the woman has the dog on a leash, they generally go in the same direction; it’s just that one does it following a more chaotic route. Here, the woman is the economy, and our frenetic canine is the stock market. Sure, it will take many more steps, but the dog will get where the woman is going.

I like that analogy a lot. Also, Josh Brown is a financial advisor at Ritholtz Wealth Management and has his own blog, The Reformed Broker.

4. It Helps You Focus on the Journey

When you think about it, your net worth is just a snapshot in time. The number may be an indication of how well you’re doing financially right now but that’s only important as it relates to your goals and your journey.

Let’s say you have a savings goal of $50,000 in 10 years – a challenging but realistic goal. If your money earns 5% per year and you start with $1, you have to save $325 each month. At the end of 10 years, you’ll have a little over $50,000.

Now, throughout that time, you’ll have periods where you earn more than 5% and periods where you earn less than 5%. Like the walking dog, it’ll go side to side sometimes in search of a good new scent.

Tracking your net worth can help you maintain that long term view by keeping your focus on your journey – not your current state. Just as you can look back at your history and take solace there, you can use also use it to chart out the future to know whether you’ll hit your goal. If there is a setback, say the market does what it did in the Spring with the pandemic, you can react by saving more money. Now that the market has come roaring back, you can pull back on your contributions because you’re ahead of schedule.

It keeps your focus on the journey and not where you are in this specific moment.

5. Rituals are Good for the Soul

We have a lot of rituals in our life. Some of them are elaborate but others are simple.

Big or small, they are all important. It’s been shown that rituals work and because I associate tracking my net worth with keeping my mind quieter and calmer, it keeps my mind quieter and calmer.

It’s like making your bed in the morning. I never make my bed… but my wife does because it’s important to her. It sets the stage for her day in a way that is important to her. It’s not that the bed is made (if it were, I’d make my side before I left the room), it’s the act of making the bed.

I don’t have to log into each of my accounts to collect a few numbers. I can set up Tiller to do that if I really wanted it to be automated. But I like doing it because it’s my monthly ritual and I’ve now associated it with remaining calm.

It’s now a self-fulfilling prophecy…

… and that’s a good thing. 🙂

Ed says

Great column. Interested in your thoughts on investing in 2 areas – gold/silver & real estate. Specifically .. is buying ETF’S like GLD, SLV wiser than physical metal? In real estate, is Fundrise a good entry to owning real estate?

Thanks. Ed

I think it depends a lot on what you want to accomplish – physical gold is useful if things get really bad and you have to get out of town. Holding onto a few sheets of paper vs. physical gold is a massive difference.

As an investment, I think ETFs are fine or you can invest with something like Vaulted to get physical gold stored elsewhere. The fees are higher though.

Deb says

Great article again. The dog walking analogy is great. I have been actively managing my finances the last 2-3 years and in recent times have been checking on them frequently, sometimes M-F. I don’t find it stressful and enjoy it, granted the market is going up which helps. I keep some cash handy for when the market goes down which I look forward to as well. In a prolonged downturn that would change and I suppose at that point, I will shift my ritual to something else.

Alien on FI./R.E. says

I absolutely loved this post Jim.

Thanks for sharing these nuggets of wisdom and I look forward to incorporating these five tips – Ahem, I meant rituals – into my routine throughout The Great Lockdown and beyond.

Thanks Alien!

Frances Campbell says

Hi Jim: I enjoy your financial and life style information.. I am a former Pittsburgher– I bet your babies were born at Magee Women’s Hospital. I had my formal training as a Radiologic Technologist at that hospital.. I worked in the Medical center for 30 years and used to X-Ray many students from Carnegie Tech as it was known at that time. During those working years –I worked my way through California University of Pennsylvania with a degree B.S. dual majors in Business Administration. I am now retired and living in Texas . I also give my portfolio a look see each evening just to see how much dividend money that if it isn’t automatically dividend reinvested , I can invest myself even if it is in stock I already own or to buy something new to my portfolio . Charles Schwab makes it so easy to purchase small numbers of stocks with his no fee for purchasing stocks. I also am enjoying some stocks that are splitting and the spin- offs. It keeps my mind active as Iam 86 years old. Keep up the good work.

I love Pittsburgh but we moved to Maryland after college when I took a job at Northrop Grumman. It’s great you have such a solid handle on your finances, there are many people who don’t at any age!

Takele from Ethiopia says

Mr Jim

you posted very much joyful, so, I liked it. please keep it up my bro. thank you so much.

steve nagai says

I track my assets too

I add another couple lines

1 for the SP500 since I try to do at least that well (while having much less invested at any point – don’t want to risk going through a major market pullback at this point that would jeopardize my retirement security)

and another line for my pool of money that I consider “investable” in the market

So, I can tell for example at this point I have 20% of my investable assets in stocks

and I am 3% below the SP500 gain so far in 2021 (SP500 unlikely to keep up that pace for the rest of the year, but anything’s possible)

So, I can easily look back at the end of the year (and during the year) to check my stock trading strategy is succeeding. Most years I have made more than I did as an engineer.

While I don’t have it yet, I think there would be value in another line:

inflation rate

of primary import for early retirees is health ins premiums

which are growing much faster than the 2% infl rate quoted everywhere

Please publish more on health insurance for retirees since it’s probably our biggest expense

thanks

Steve