Do you remember those Free Credit Report commercials? They featured a young man playing a guitar singing a jingle about how his poor credit led to so many problems in his life?

It was catchy, for sure, but it also came with a catch.

When you signed up for your “free” credit report, you also signed up for a monitoring service that billed you every month.

Understandably, people didn't like that.

Back in the day, the companies that tracked your credit score would charge you a lot to see your score. It was a huge profit maker for them. Nowadays, they've realized they can make more by giving you a score for free but then making money when you applied for credit cards, refinanced your loans, or consolidated some debt.

If you fast forward to today, credit card companies realized that offering your score for free could be a differentiator. They already have your information, you gave it to them to get a card in the first place, so why not give it back to you with a score?

One of the best-looking tools out there is from Capital One and it's called CreditWise.

What is Capital One's CreditWise?

CreditWise is Capital One's absolutely free credit score and credit report monitoring tool. They launched it in 2014 and I first learned about it because I have a Capital One credit card. I've been using it for years and so can you.

Anyone can use it. You do not have to have a Capital One credit card. You do not have to have a Capital One bank account. (you do, however, need a Social Security Number and be 18+)

To get access, just sign up on the site. Your inquiry isn't related to an offer of credit, so it's a soft pull, and won't affect your score. If you already have a Capital One account, you can register using your credentials and it populates most of the information for you.

What do you get with CreditWise?

CreditWise uses your TransUnion credit report to generate a TransUnion VantageScore® 3.0. It isn't an “official” FICO score but it's still extremely valuable to know.

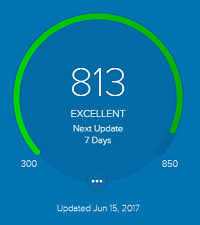

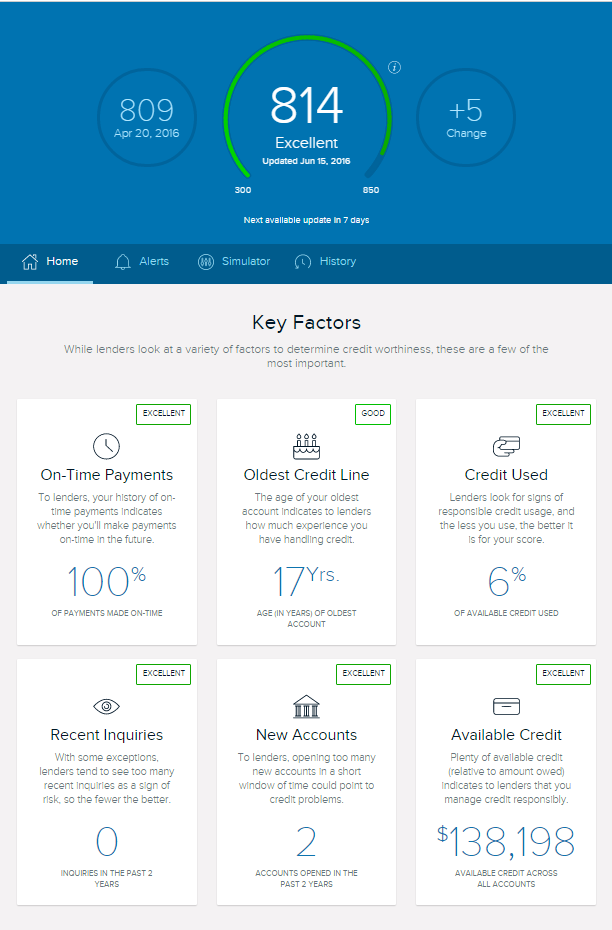

Your Credit Score

CreditWise's Dashboard is beautiful and shows you six of the biggest factors in one screen:

- On-Time Payments

- Oldest Credit Line

- Credit Used – their term for credit utilization

- Recent Inquiries – within the last two years

- New Accounts – within the last 2 years

- Available Credit

They will also tell you where you stand concerning each factor.

Below the factors, they share ideas for what you can improve. I suspect they compare you with others that share your “credit score bucket” and see how you deviate.

Mine were:

- Your oldest account isn't old enough compared to other people with similar credit profiles. How to improve – There isn't a quick fix for this issue. The best thing you can do is continue to manage this account responsibly by paying it on time each month and keeping your balance as low as possible.

- It looks like you haven't paid much of the balance down on your open real estate accounts compared to what you originally borrowed. A real estate account can be a first mortgage, a home equity loan, or home equity line of credit. How to improve – If it's possible, make larger payments on your real estate accounts. If you can't, don't worry, just keep making your payments on time.

- Compared to people with similar credit profiles, the total balance of all your credit accounts is too high. How to improve – If it's possible, try to reduce how much you owe by paying as much as you can each month. Using less than 30% of your available credit is a good goal.

- The balance on your loans is high compared to how much you initially borrowed or the credit limit. How to improve – If it's possible, make larger payments on your loans. If you can't, don't worry, just keep making your payments on time. Don't forget that you can save money long-term by paying more than the minimum each month.

For me, these insights aren't particularly useful because I can't really change them. I can't make time go faster so my oldest account gets older!

There are a lot of other factors so your list may be more actionable.

TransUnion Credit Report

CreditWise gives you a copy of your TransUnion credit report that you can peruse at your leisure. This doesn't count as one of the free copies you get as a result of the Fair Credit Reporting Act (FCRA). You can still get a TransUnion credit report from AnnualCreditReport.com.

Their version of your report is better than what you'd get direct from TransUnion because it is better organized. You can get the full list of everything but they will identify what is new and what has changed. They will also identify any negative items and items under dispute.

If you see an error, there doesn't appear to be a way to dispute the error via CreditWise. You will have to contact TransUnion for that, which makes sense.

Alerts

The alerts system is really fascinating because you get these absolutely free.

My alerts are just a list of times my email address has appeared on the “Dark Web.” This is no surprise because it's the main unsecured email I use and was included in a variety of breaches (Adobe, Linkedin, etc.).

Credit Score Simulator

The CreditWise credit score simulator lets you find out how your score would change if you took certain steps, which include:

- Pay off some of my credit card debt

- Make my payments on-time – for 6 months, 1 year, 18 months, 2 years

- Buy something with my available credit

- Increase the credit limit on one card

- Open a new credit card

- Transfer balances to a new credit card

- Cancel my oldest credit card

- Borrow money to buy a house

- Borrow money to buy a car

- Take out a personal loan

- Apply for a loan

- Allow one account to become delinquent – 30 days, 60 days, 90 days

- Allow all accounts to become delinquent – 30 days, 60 days, 90 days

- Have my property foreclosed on

- Make child support payments

- Have my wages garnished

You can play around and see how different factors impact your score.

For example, if I were to increase the credit limit of one of my cards by $2,000 (one of the easiest things you can do if you have good credit) – it would have no impact on my credit score.

Good to know!

Summary

It's an extremely useful tool for monitoring your credit. If you are already a Capital One customer, I don't see a reason why you wouldn't set this up. A no brainer.

If you aren't a customer, I can understand you not wanting to set up another account with another financial institution but I think it's worth the time.

I use it as part of my DIY identity theft system. So while I'm not in the market for a loan (we live in our forever house and have cars less than 10 years old), my credit score is a canary in the identity theft coal mine. If there is a change in your credit score, and I don't know why, it could be a signal of identity theft.

DNN says

Many people are deceived with the term “free.” Free has secret strings attached most folks have no clue about. I was somewhat iffy back in the day about downloading certain things from sites because even though it said free, I had a feeling they had secret codes or programs inside the download to snoop on what I’m doing online.

Peggy Lee Swift says

I have received a couple of email messages from Capital One indicating that there has been a change to my Experian credit report and I should log in to check it out with Credit Wise. I’m here and I don’t know what to do. Can you assist me?

CreditWise is their free credit service – did you set it up?

Frustrated says

CreditWise reported my credit score as 802. Imagine my embarrassment when during the loan application process, I was told that my score was actually 683. I don’t understand the discrepancy, but it cost me in interest percentage points. Someone smarter than I is going to have to explain why fake news on my credit score helps me. As of right now, I don’t get it. Good thing the service is free; I’d sure hate to pay someone to lie to me. If it doesn’t report the truth, what good is it?

It’s not fake news, the score you get from CreditWise is your VantageScore 3.0 and not your FICO score.