Credit score simulators aren’t an exact science. However, they can help you get a good idea of steps you can take to potentially raise your credit score.

They can also help you know what actions you need to avoid to potentially lower your credit score. As such, you can expect a credit score simulator to share advice that could help you manage your credit score, but it’s not a foolproof system.

By the way, in case you were wondering, using a credit score simulator won’t affect your credit score or your credit report at all.

Table of Contents

How Do Credit Score Simulators Work?

To use a credit score simulator, you’ll need to give the company that owns the credit score simulator some personal information. Basically, the company will ask for the same types of information you get asked for when you go to pull your credit report.

For instance, it will ask you for personal information such as your full name, address, and birthdate. In addition, it will ask you to verify some information it finds on your credit report.

It might ask you to verify the amount of your mortgage payment or verify a past or present street you live/lived on.

Gathering this information helps the simulator give you a more accurate estimate of what you can do to raise your personal credit score.

Once the credit score simulator verifies it’s communicating with the right person, it will give you an example of certain actions you can take and how those actions could affect your credit.

Credit score simulators will share how much your credit score might increase or decrease if you take certain steps such as:

- Paying down credit cards

- Making payments on time

- Making payments late

- Taking out a mortgage

The simulators can also tell you how closing a credit card and other steps will affect your score. Credit score simulators have the ability to use your individual credit situation to give you a more accurate estimate of the impact of certain actions. Here’s an example.

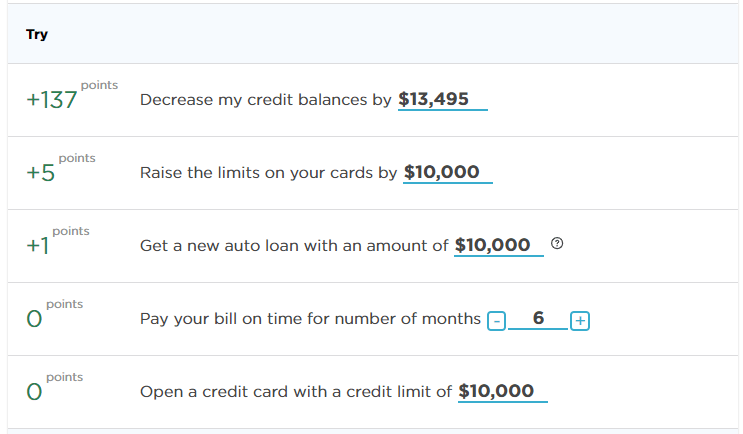

Look at this credit score simulator snapshot. The owner of this credit report currently has about $16,000 in outstanding credit card debt and no other debt.

Here is what the NerdWallet credit score simulator showed they could do to impact their credit score.

Positive Impact Steps

As you can see, paying down those credit card balances would potentially have the biggest effect on raising their credit score. Because they’ve never had a late payment, continuing to pay their bills on time won’t affect their credit at all.

However, if this person did have a history of late payments, they would likely gain some points by creating a six-month history of paying their bills on time.

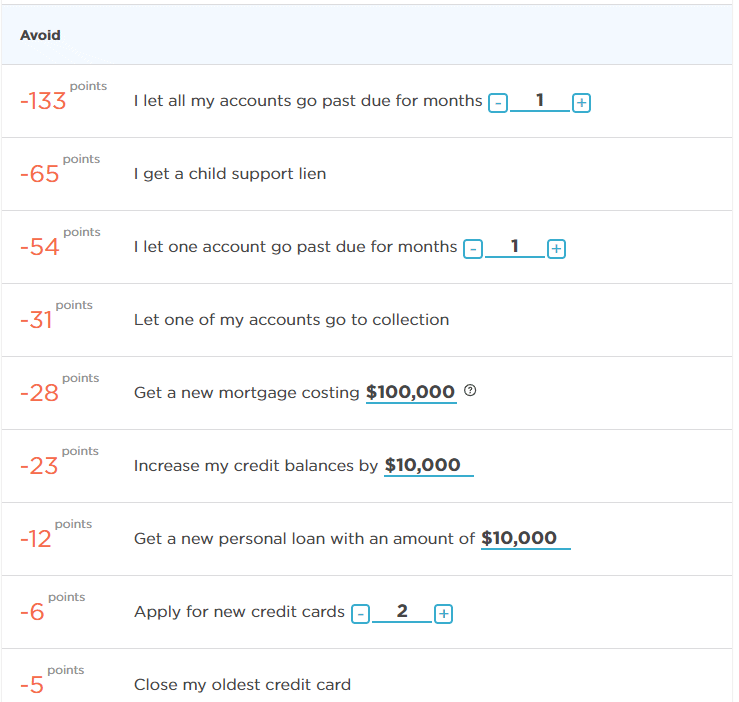

Conversely, here are some steps the credit score simulator showed would impact this person’s credit score negatively.

Negative Impact Steps

Notice how the simulator says that letting all of this person’s credit accounts go past due would have a large impact on their credit score quite quickly.

Even letting one account go past due for a month would cause a steep decrease in points. Although credit score simulators likely aren’t 100 percent accurate, they can help you create a game plan for increasing your credit score.

Likewise, they can show you how to avoid actions that might hurt your score. So, how would you use a credit score to your benefit?

How Can Credit Score Simulators Help Me?

The answer to that question depends on what you want to use a simulator for.

Is your goal to raise your credit score and impact your overall reputation? Or are you working toward a specific numeric increase?

For instance, if you’re looking to buy a house, you’ll often qualify for a lower interest rate if you have a higher credit score. In the case of the person above, let’s say they wanted to increase their credit score a few points to qualify for the best interest rate on a mortgage.

They could have their credit limits raised by $10,000 and potentially gain five points. The reason this could work is because by raising their credit limits, their overall credit utilization ratio (credit available vs. credit used) would drop.

However, they’d likely gain a better impact on their credit score by working hard to pay off some of those credit card balances quickly.

Let’s say you wanted to increase your credit score just for the sake of overall improvement of your personal finances. In that case, you’d probably be better off working on all of the action steps the simulator says will help you do that.

As an example, you’d be sure to make all payments on time. You’d work on paying down any credit balances. And, you’d work to avoid taking on new unsecured debt.

The Type Of Debt Matters

Which brings up a good point. If you look at the screenshots above, you’ll notice two interesting facts:

- Taking on a new car loan will likely increase this person’s credit score

- Getting a new mortgage, personal loan, or credit card will likely decrease this person’s credit score

It’s true that the increase in the credit score for taking out a new auto loan isn’t much. However, it’s still a fact that an auto loan doesn’t have the negative impact that other types of debt can have on one’s credit score.

This is where a credit score simulator can come in really handy.

Credit Score Simulators Can Help You Make Financial Decisions

A credit score simulator can be a great tool for helping you make a final decision on a financial move. For instance, when you’re deciding between a brand new car and a less expensive used car, the amount you borrow will impact your credit score.

You can see from the screenshots above that a $10,000 auto loan would have a positive impact on this person’s credit score. However, when they raised the loan amount to $30,000, the credit score actually dropped by two points.

Granted, the impact on the credit score isn’t life-changing, but it is an impact. And knowing the potential impact might help sway you if you’re on the fence about a decision.

From taking out loans to deciding what the best debt payoff plan is, a credit score simulator can be a great financial tool. Use them to help assist you in making better financial decisions.

Now let’s talk about some of the best credit score simulators.

Four Top Credit Score Stimulators

These credit card simulators are among the most popular available. Three out of the four are free, and all can help you design a plan to monitor and/or improve your credit score.

Credit Karma

The Credit Karma credit simulator is free (it’s also one of our favorite apps to monitor your credit score). You get access to it when you sign up to be a member of Credit Karma.

It’s free to join Credit Karma, and you get access to a wealth of personal finance tools such as:

- Credit scores and reports

- Recommendations for financial products

- Credit Karma’s other financial resources

- Tax filing help

Again, Credit Karma is free. The company makes money when members take advantage of the financial products the site recommends. Check out our full review of Credit Karma for more.

CreditWise

CreditWise is Capital One’s answer to Credit Karma. Like Credit Karma, Creditwise helps you monitor your credit score and credit report.

The company also helps you monitor your credit report for any signs of identity theft. It’s a free service that makes money when you take advantage of financial product recommendations.

CreditWise’s credit score simulator is one of the free tools that’s included with your CreditWise membership.

TransUnion

Credit reporting agency TransUnion, one of the three main credit reporting agencies, also has a credit score simulator. The TransUnion credit score simulator is free when you sign up for TransUnion’s credit monitoring service, which is $24.95 per month.

Although the credit monitoring service with TransUnion is a bit pricey, you might find it worth it if you’re interested in services such as identity theft monitoring, instant emails when your credit report changes, and ID theft insurance of up to $1 million.

NerdWallet

The NerdWallet credit score simulator is free when you sign up for the NerdWallet mailing list. This is the credit score simulator I had our test participant use when I wrote this article.

It’s easy to use and clear to understand.

Conclusion

Using a credit score simulator can be a great way to improve your credit score. It can also help you determine which financial moves will impact your credit score, and how.

Since many credit score simulators are free and don’t affect your credit negatively, it wouldn’t be a bad idea to try one out.