Most recent high school and college graduates don’t learn about managing money in school. Textbooks can’t teach every money lesson so learning the basics as soon as possible can help you build a rock-solid financial foundation.

Having to balance your income and expenses can feel overwhelming. The best budgeting apps for grads can make “adulting” easier as you can plan and reach your short-term and long-term goals. It’s possible to reduce your stress levels and avoid common money mistakes.

Table of Contents

🔃 Updated February 2023 with new EveryDollar pricing of $79.99 per year after a 14-day trial. This is down from $129.99 per year.

Are Budgeting Apps Worth It?

Spoiler alert: I’m a fan of budgeting apps.

I started using budgeting tools like Quicken during my first year of college after working my first Christmas break to replenish my bank account from the many frivolous purchases – I realized money doesn’t grow on trees.

I was getting serious about money when I only had a part-time job and relatively few bills prepared me for living on my own. While my first job as a college grad boosted my disposable income virtually overnight, I also had to start paying off $50,000 in student loans, saving for a replacement vehicle, and invest for retirement. A budgeting app helped me see what it took to spend less than I earn.

There are several different budgeting strategies you can practice. Finding “the perfect budgeting app” can initially be a process of trial and error to see what works for you. While each app has its unique traits, standard app features include:

- Account balance monitoring

- Monthly spending plans

- Savings goals

- Detailed spending reports

- Bill pay reminders

The Best Budgeting Apps for Grads

The sooner you start budgeting, the quicker you can maximize your paycheck. Once you find one that works for you you’ll likely use the budgeting app long term – think of the impact a decade of smart money management can make.

Mint

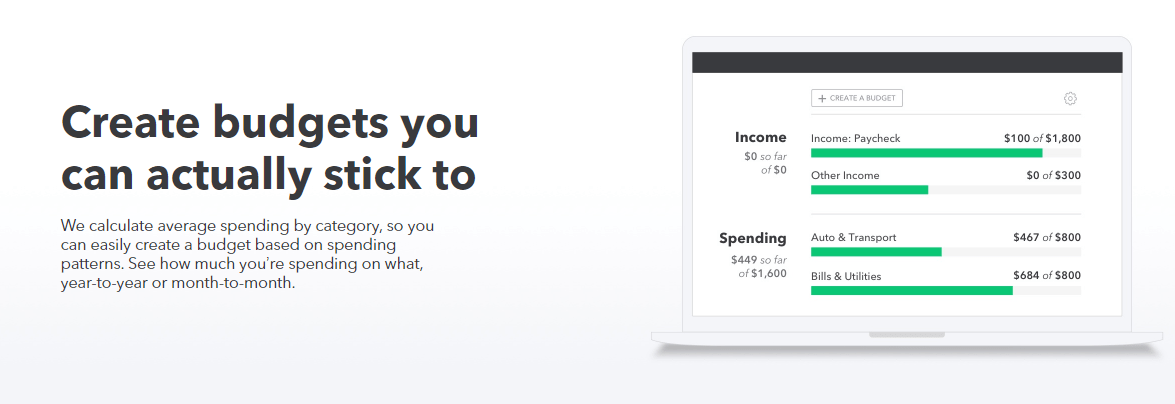

Probably the best-known free budgeting app is Mint. Intuit, Mint’s parent company, powers Quicken and TurboTax too.

Mint’s budgeting and expensing tracking tools are pretty good for a free app. It syncs with most bank accounts so you can see real-time account balances and transactions. To use it’s budgeting features you can categorize your transactions into your budgeting categories so you can see how you spend your money and where you stand in each category.

You can also receive bill payment reminders, low account balance alerts, and personalized tips to help improve your money habits. There is also an investment tracking tool that can be sufficient for beginner investors.

As your money skills increase, you may choose to switch budgeting apps to one that offers more features.

Mint’s largest limitation is that it’s free and lacks the advanced customization tools that premium apps offer. The lack of customization is common with most free budgeting apps and can make planning in-depth spending plans and savings goals frustrating.

Check out our full review of Mint here.

YNAB

Consider You Need a Budget (YNAB) if you don’t even know where to start when it comes to making a budget. YNAB’s goal is to help you pay this month’s bills with last month’s income. In other words, you don’t live paycheck to paycheck and are one surprise bill away from financial ruin.

I discovered YNAB several years ago when my wife and I adapted to living on one income. We loved their step-by-step approach to making a budget and planning for almost any potential expense. The free budgeting apps were not as effective in making a serious budget.

There are also free online workshops to learn budgeting basics and how to navigate YNAB.

YNAB connects to most bank accounts (like many budgeting apps) and you can enter manual transactions too. Manual inputs are handy if you pay with cash or your bank’s security software prevents automatic downloads.

You’ll also have multiple ways to customize your budget and track your progress for your money goals.

The YNAB mobile apps work with most Android and iOS devices. You can also install the app on Apple Watch and Alexa devices. What you do in one app automatically syncs with your other apps. The automatic syncing is helpful as you and your spouse categorize transactions in real-time.

YNAB costs money to use but the plan fees are reasonable. After a 34-day free trial, an annual plan costs $98.99 upfront or $14.99 per month. College students can use YNAB free for one year and get a 10% discount for their second year.

Here’s our full review of YNAB if you’d like to learn more.

Rocket Money

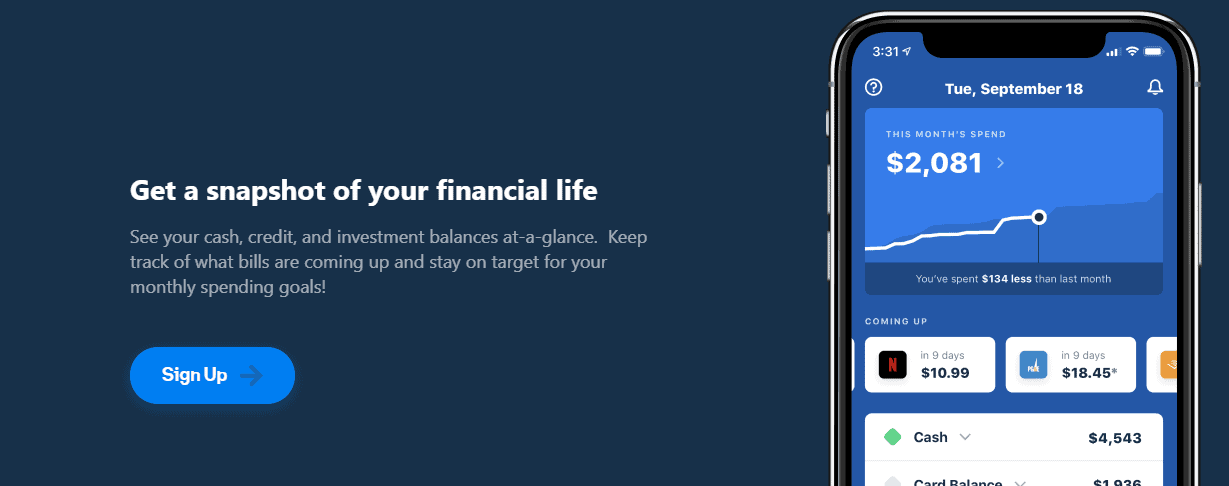

Truebill was acquired by Rocket Companies (most well known for Rocket Mortgage) and renamed Rocket Money in mid-2022.

Rocket Money is a great mobile budgeting app for grads and adults. I have used the free version and was impressed by their mobile app. I liked the interface more than other free budgeting apps I’ve tried.

The free version has basic budgeting tools and links to your bank and credit card accounts. It analyzes your spending habits and suggests ways to reduce your monthly expenses. The free edition of Rocket Money is sufficient if you want a basic budgeting app.

Upgrading to Rocket Money Premium (up to $48 per year) lets you build multiple budgets. You also get upgraded to real-time account updates instead of once-a-day updates. Rocket Money also attempts to negotiate lower bills and will cancel subscriptions for premium members. Free members can read how-to instructions for negotiating bills and canceling services but must call the service provider by themselves.

Like other apps, Rocket Money has a “freemium” pricing plan. I use the free plan and never need to upgrade to remain a member. If you upgrade to Rocket Money Premium, you can decide how much you want to spend. You can pay between $3 and $12 monthly. An annual plan costs $36 or $48.

EveryDollar

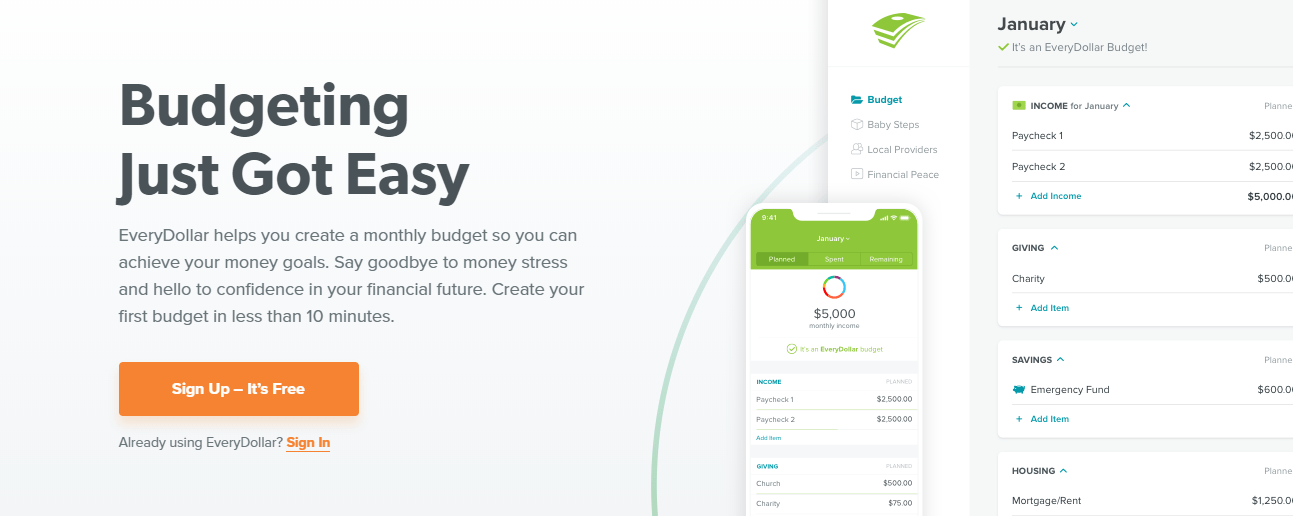

EveryDollar is associated with Dave Ramsey (Lampo Group) who promotes this popular “envelope method” budgeting style.

With the envelope budgeting strategy, you assign a specific dollar amount to each monthly spending category. Once you exhaust your envelope balance for that month, you don’t make any related purchases until next month. This app lets you build digital envelopes that can track your debit card, credit card, or cash purchases.

EveryDollar recommends a model budget you can customize after inputting your monthly income.

On the free plan, you must manually update your income and expenses. Manually logging each transaction can be time-intensive but can increase your awareness of how you manage your money.

Upgrading to EveryDollar Plus costs $79.99 per year after a 14-day free trial, which is more than most premium budgeting apps. One incentive to upgrade is complimentary local or online access to Financial Peace University. A “Plus” membership offers these budgeting features that overlap with other apps:

- Auto-import transactions from bank accounts

- Automatically categorize certain transaction types

- Monitor account balances

- Debt repayment calculators

- Email support with a call back option

Here’s our full review of EveryDollar.

Tiller

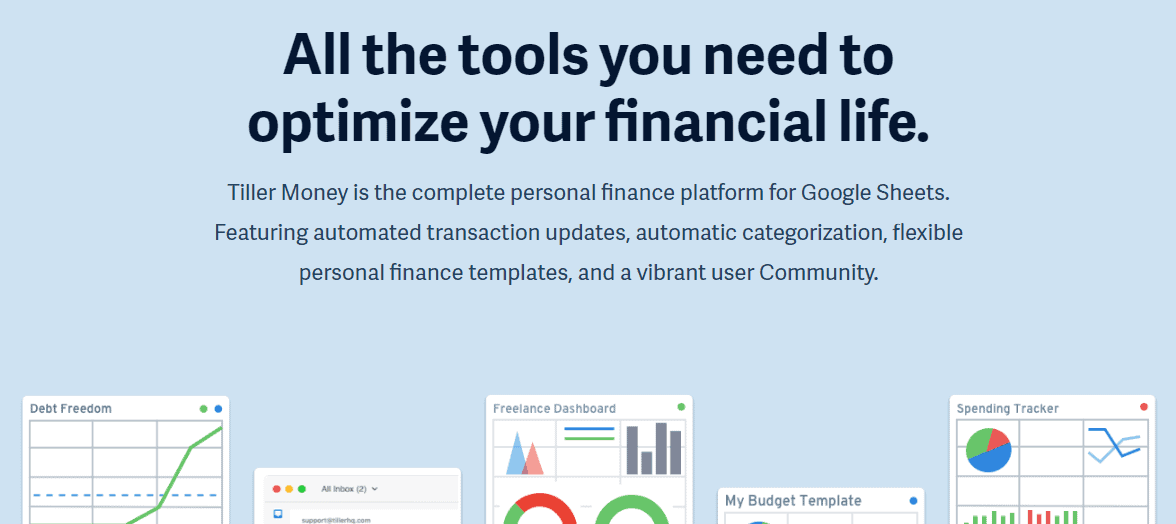

Are you trying the free Google Sheets budget spreadsheet but not pleased with the results? Tiller is a great budgeting app for spreadsheet nerds. Spreadsheets offer plenty of customization options but they can be difficult to build by yourself.

With Tiller, you can create a personalized budgeting spreadsheet template. You can link to over 21,000 banks and Tiller instantly presents the information into a Google spreadsheet or Excel and update in real-time.

You can access these spreadsheets in Google Sheets with the Tiller add-on. It’s possible to auto-categorize transactions to save time when analyzing your spending.

Tiller costs $79 per year after a 30-day free trial. The first year is free for current students.

Check out our full review of Tiller.

Prism

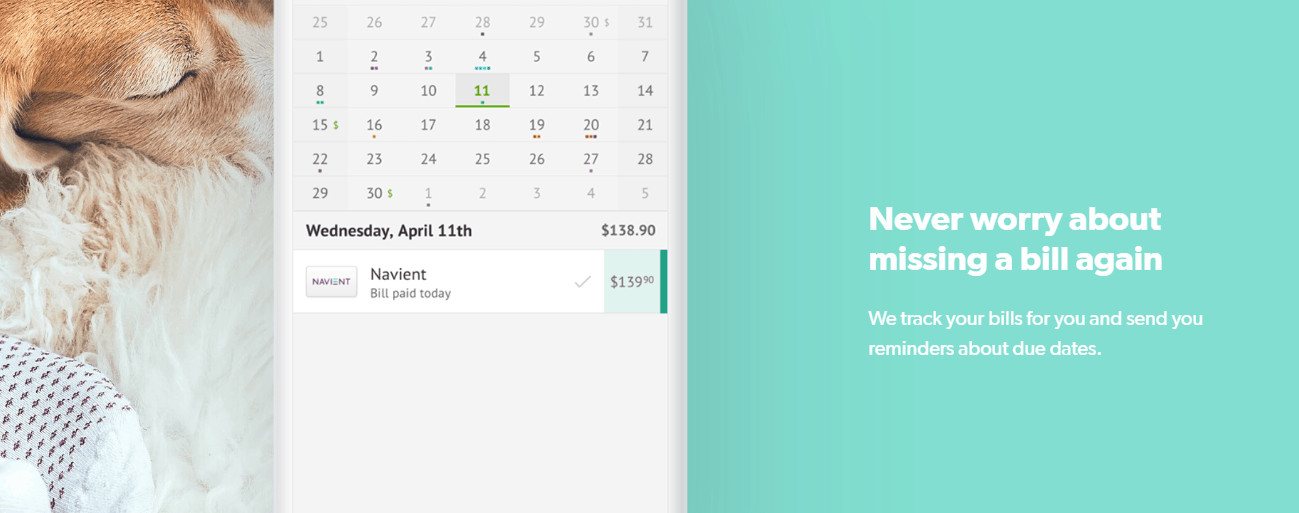

Late bill payments are annoying and a common money mistake. Consider Prism if you’re tired of late fees or you don’t have access to online bill pay.

Prism is free and offers these money tools:

- Bill payment reminders

- Online bill pay

- Budgeting

- Bank account balance monitoring

Most free budgeting apps do not offer a bill pay feature. This tool was once part of Mint but is now a separate app. Many free apps only offer payment reminders but require you to log into your online bank account app to schedule payments.

Bill-tracking and in-app payments are the best reason to consider Prism. However, Prism also lets you track your various bank account activity. You can compare your actual spending to your target spending every month too.

Prism is available for Android, iOS, Windows Phone, Windows 8, and Amazon Kindle devices.

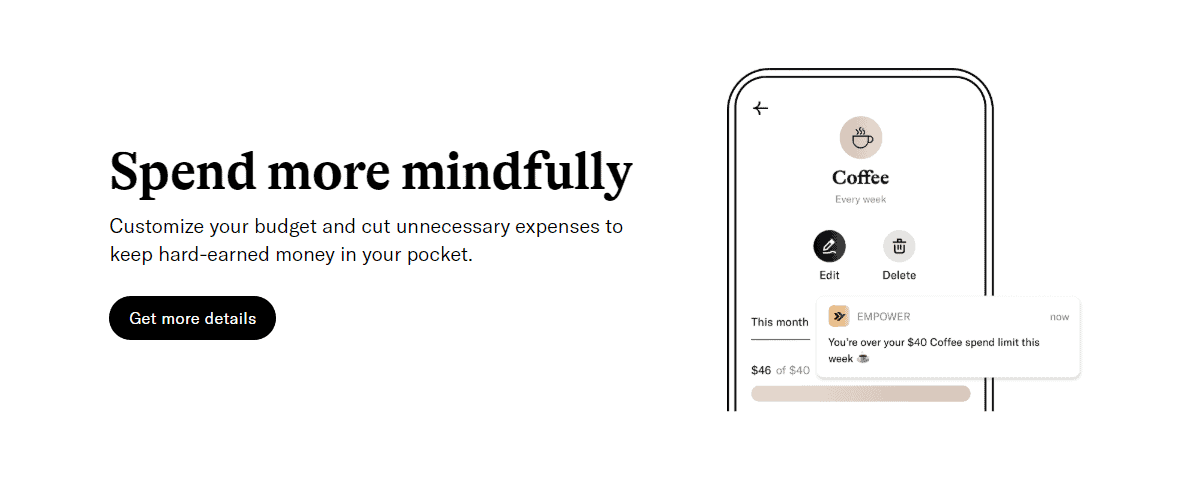

Empower

Empower is perhaps the most progressive budgeting app on this list. You can open an interest-bearing online checking account in addition to getting personalized budgeting advice.

The suite of Empower’s tools include:

- Budgeting app

- Weekly AutoSave automated savings withdrawals

- Interest-bearing checking account

- Up to $250 Cash Advance^

- Fee-free withdrawals at 37,000 MoneyPass ATMs

The checking account has no required minimum balance. You may appreciate the AutoSave feature that withdraws a target savings amount weekly to prevent you from spending your loose change.

Empower’s budgeting tools are not as in-depth as premium apps like YNAB. However, you can easily track your income and expenses similar to free apps such as Mint. The personalized tips can help you find unwanted subscriptions and overlapping expenses you can cancel.

All of the deluxe benefits are nice and cost $8 per month – after your first 14 days. This trial period can be enough time to decide if sacrificing a latte makes Empower the best budgeting app for grads.

* Empower is a financial technology company, not a bank. Banking services provided by nbkc bank, Member FDIC.

^ Eligibility requirements apply.

Summary

These apps can help make budgeting and planning your money goals easier. You may try several different apps to decide which one is the best match for how you handle money. The best time to make a spending plan is now and these apps can motivate you to take the first step to secure your financial future.

Don Milne says

These are all second rate budgeting apps compared to Qube Money. I used the previous version of this before they rebranded and there is nothing else like it. This app has elegantly and ingeniously converted a cash envelope system to a digital version.

All the other budgeting apps are just spending trackers or the money equivalent of calorie counting. Qube Money actually makes your money behave.